Back

Aryan patil

•

Monkey Ads • 1y

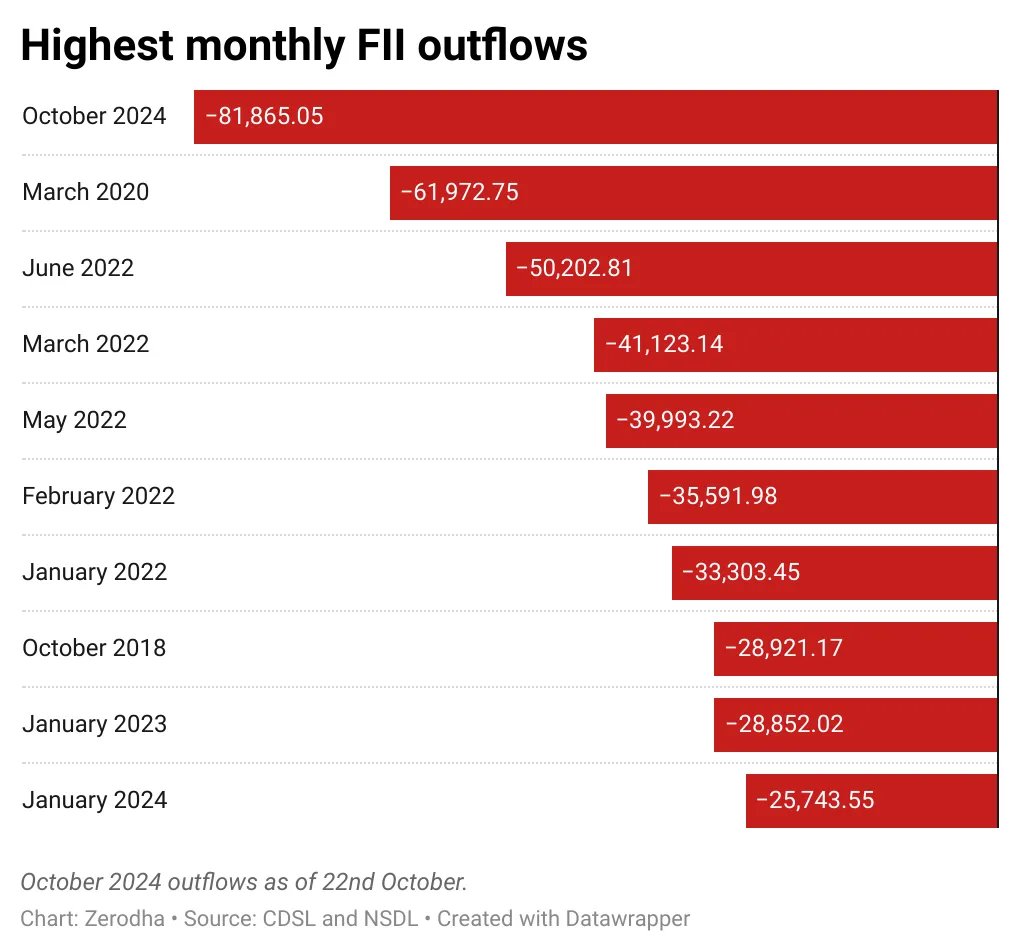

In October 2024, the Indian stock market saw one of the largest sell-offs by foreign institutional investors (FIIs) in recent history. FIIs sold a massive ₹82,000 Cr in just a single month. What are the reasons? No one can say for sure why FIIs are selling or why the markets are falling, but we can make a reasonable guess. There are 4 main reasons! 1. High Valuation of Indian Market: Indian stocks have become quite expensive compared to other markets. For example, the Nifty 50 has a price-to-earnings PE ratio of 23x 2. Shift towards China: China has introduced significant stimulus measures to boost its economy, making it an appealing option for global investors. 3. Weak Corporate Earnings: Some key sectors in India, like consumer finance and energy, have reported weaker-than-expected earnings this time. 4. US Fed Policies: Despite the recent 0.5% rate cut by the Federal Reserve and expectations of more cuts, the yield on the 10-year US Treasury bond has increased from about 3.6

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

Last week, FIIs poured ₹8,500 crore into the Indian market. One of the main reasons could be the ongoing trade tensions between China and the US. Plus, Indian market valuations have become quite attractive lately, and the overall economic indicators

See MoreRohan Saha

Founder - Burn Inves... • 1y

Indian companies are reporting good earnings this time, but for the market to see a significant rally, Foreign Institutional Investors (FIIs) need to invest in India. Domestic Institutional Investors (DIIs) or retailers alone cannot achieve this. Ano

See MoreRohan Saha

Founder - Burn Inves... • 1y

Today, the Indian market was expected to fall. Until now, our government was focusing on CAPEX (capital expenditure), but now this responsibility has been given to private players, so it will be interesting to see. The USA has imposed tariffs on Chin

See MoreRohan Saha

Founder - Burn Inves... • 11m

The Indian market has gone sideways again, and there is no positive news to drive the market forward. SIP flows are also gradually decreasing, and now retail investors are starting to get scared. FIIs are investing their money in China and other unde

See MoreRohan Saha

Founder - Burn Inves... • 1y

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See Morefinancialnews

Founder And CEO Of F... • 1y

"FIIs Return, Invest ₹11,100 Crore in Indian Equities Over Two Sessions" ### FIIs Reverse Selling Streak, Invest ₹11,100 Crore in Indian Equities Foreign Institutional Investors (FIIs) have made a dramatic turnaround in the Indian stock market, pur

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)