Back

Rohan Saha

Founder - Burn Inves... • 1y

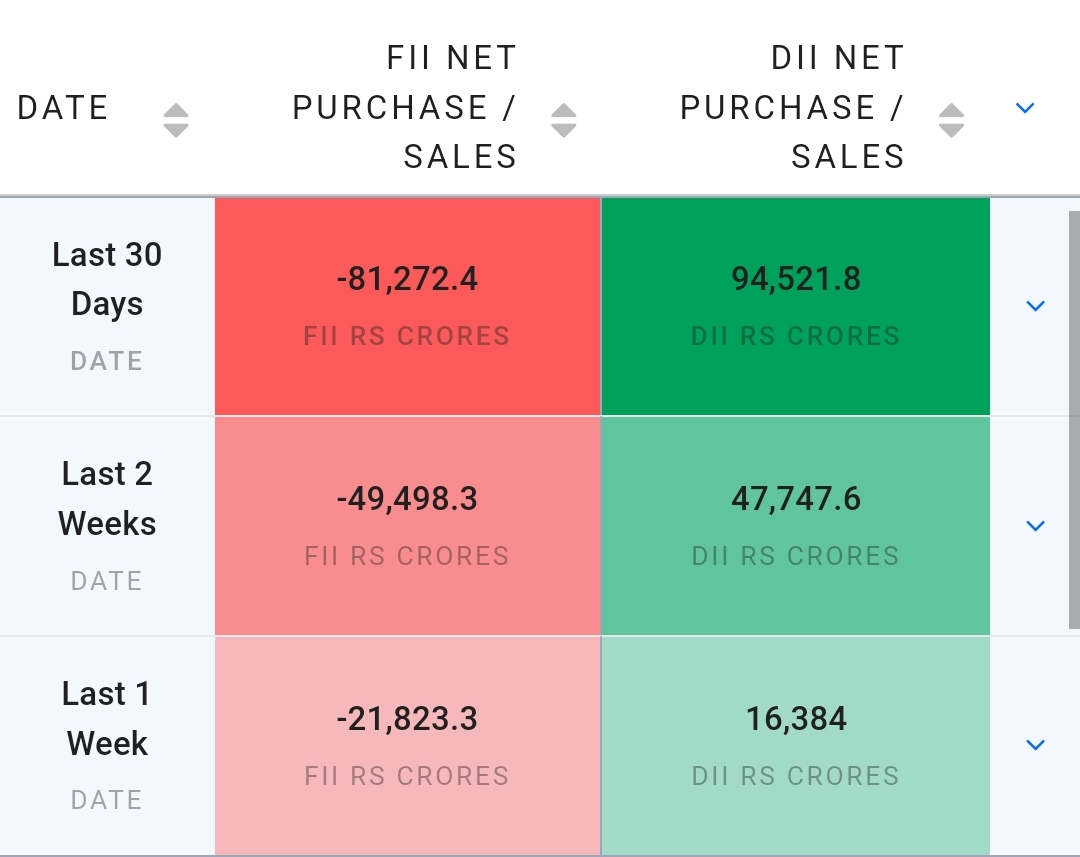

As I mentioned earlier, Foreign Institutional Investors (FIIs) are significantly withdrawing their money from the Indian market. Many factors are working together, such as China’s economy, the US election, poor results from Indian companies, and the war in the Middle East. A lot is happening.

Replies (4)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

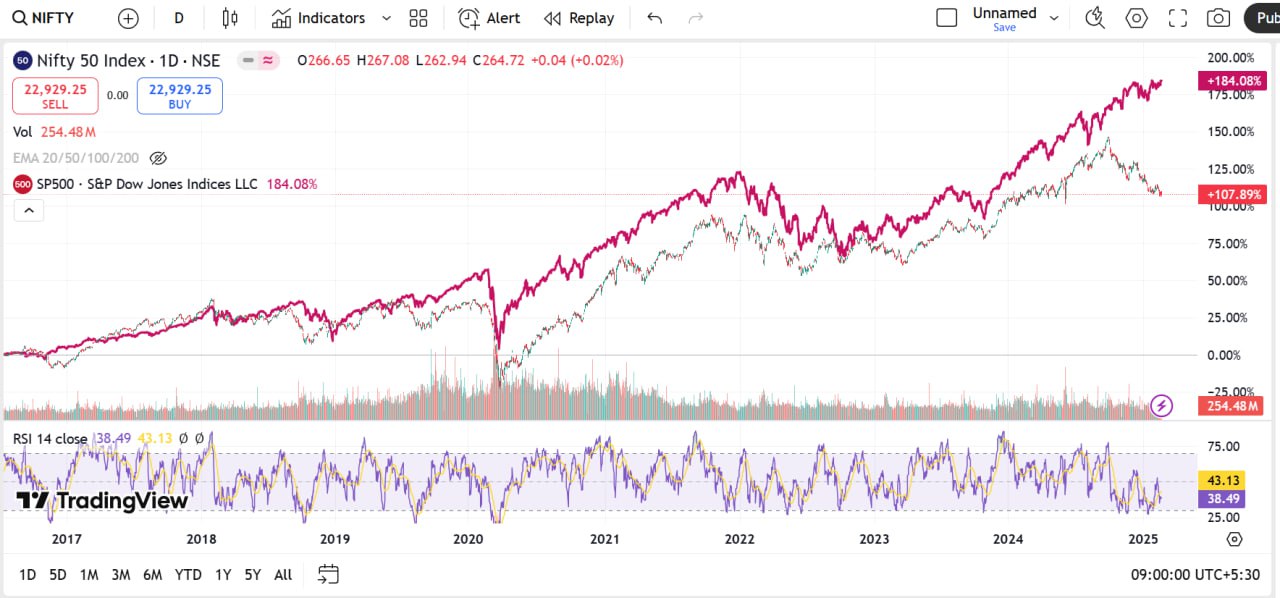

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See MoreRohan Saha

Founder - Burn Inves... • 1y

Indian companies are reporting good earnings this time, but for the market to see a significant rally, Foreign Institutional Investors (FIIs) need to invest in India. Domestic Institutional Investors (DIIs) or retailers alone cannot achieve this. Ano

See MoreRohan Saha

Founder - Burn Inves... • 1y

From September 27th until now, FIIs (Foreign Institutional Investors) have only been selling in the Indian market, and this trend is continuing. Looking at the current data, it also seems that Indian investors might be parking their money back into d

See Morefinancialnews

Founder And CEO Of F... • 1y

"FIIs Return, Invest ₹11,100 Crore in Indian Equities Over Two Sessions" ### FIIs Reverse Selling Streak, Invest ₹11,100 Crore in Indian Equities Foreign Institutional Investors (FIIs) have made a dramatic turnaround in the Indian stock market, pur

See MoreMohammed Zaid

building hatchup.ai • 1y

Bitcoin has reached a record high of $75,395, driven by a mix of factors including anticipated U.S. fiscal policies under Trump's administration, China's significant fiscal stimulus, easing Middle East tensions, and increased institutional adoption,

See MoreRohan Saha

Founder - Burn Inves... • 10m

As I was saying earlier, and the same thing has happened now DIIs have taken the driver's seat in the Indian market, a position that FIIs had held for the last 22 years. But I don't think this will last for too long, because currently FIIs are making

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)