Back

Rohan Saha

Founder - Burn Inves... • 10m

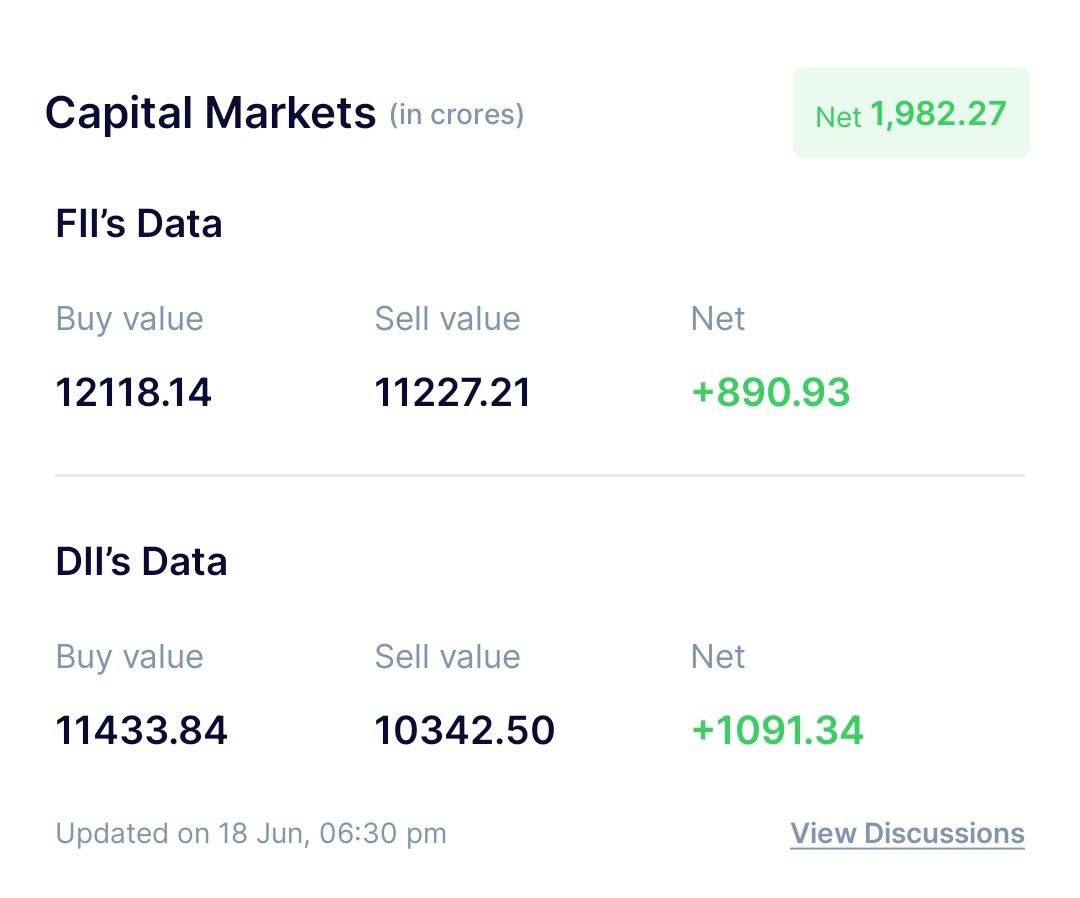

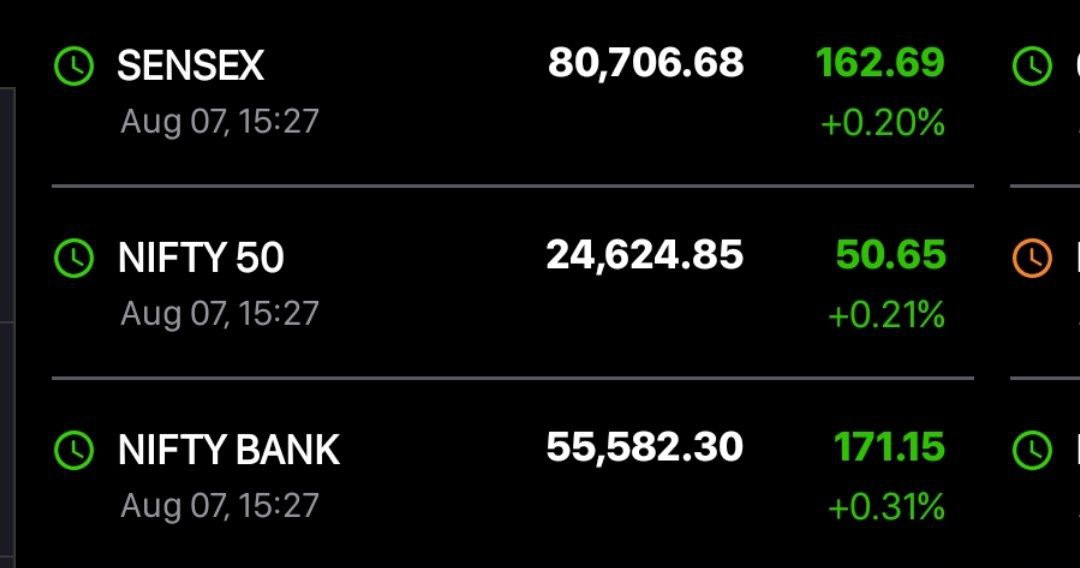

As I was saying earlier, and the same thing has happened now DIIs have taken the driver's seat in the Indian market, a position that FIIs had held for the last 22 years. But I don't think this will last for too long, because currently FIIs are making heavy investments in the Indian market. In a few days, everything might return to how it was before. However, the clear message is that India's DIIs, HNIs, and Retail investors together can manage the Indian market to a certain extent.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See MoreRohan Saha

Founder - Burn Inves... • 1y

The Indian market has gone sideways again, and there is no positive news to drive the market forward. SIP flows are also gradually decreasing, and now retail investors are starting to get scared. FIIs are investing their money in China and other unde

See MoreRohan Saha

Founder - Burn Inves... • 1y

Indian companies are reporting good earnings this time, but for the market to see a significant rally, Foreign Institutional Investors (FIIs) need to invest in India. Domestic Institutional Investors (DIIs) or retailers alone cannot achieve this. Ano

See MoreRohan Saha

Founder - Burn Inves... • 10m

It's only May 11, and within less than half a month, FIIs have already invested ₹14,167 crore in the Indian market. This amount also includes the net selling from the last trading day. Now, the key thing to watch is whether these numbers remain the s

See MoreRohan Saha

Founder - Burn Inves... • 10m

Last week, FIIs poured ₹8,500 crore into the Indian market. One of the main reasons could be the ongoing trade tensions between China and the US. Plus, Indian market valuations have become quite attractive lately, and the overall economic indicators

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)