Back

Rohan Saha

Founder - Burn Inves... • 8m

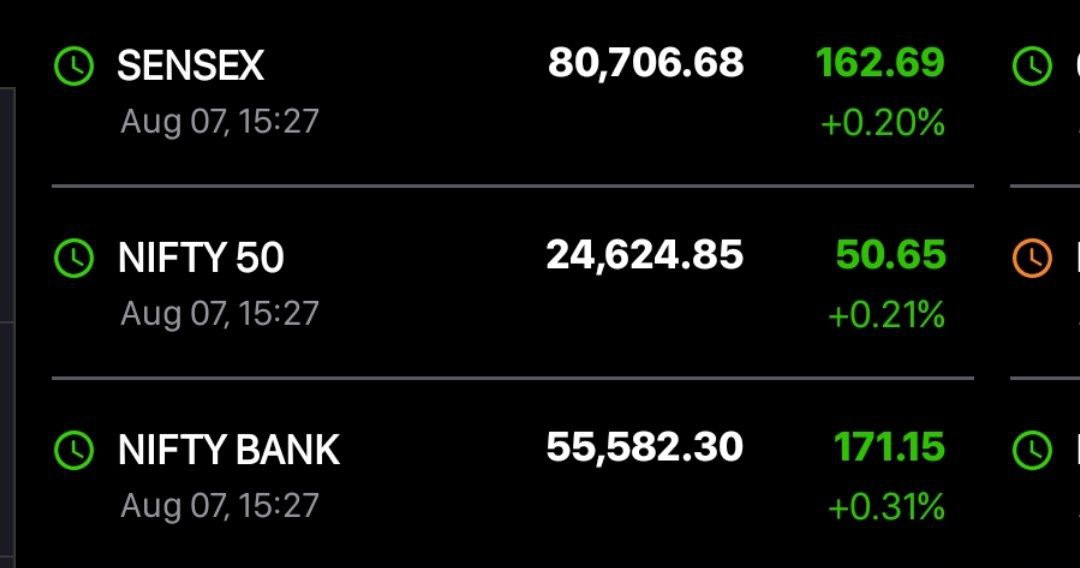

I feel like maybe HNIs and retail investors are selling heavily right now even though FIIs and DIIs made some solid purchases in the Indian market today, the market still ended up falling that’s pretty surprising.

Replies (1)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

As I was saying earlier, and the same thing has happened now DIIs have taken the driver's seat in the Indian market, a position that FIIs had held for the last 22 years. But I don't think this will last for too long, because currently FIIs are making

See MoreRohan Saha

Founder - Burn Inves... • 1y

If the Indian market is rising, it doesn't mean that only Foreign Institutional Investors (FIIs) are buying. This time, it's being observed that even without FIIs, or even after heavy selling by FIIs, the Indian market has held onto its important sup

See MoreRohan Saha

Founder - Burn Inves... • 11m

The Indian market has gone sideways again, and there is no positive news to drive the market forward. SIP flows are also gradually decreasing, and now retail investors are starting to get scared. FIIs are investing their money in China and other unde

See MoreRohan Saha

Founder - Burn Inves... • 11m

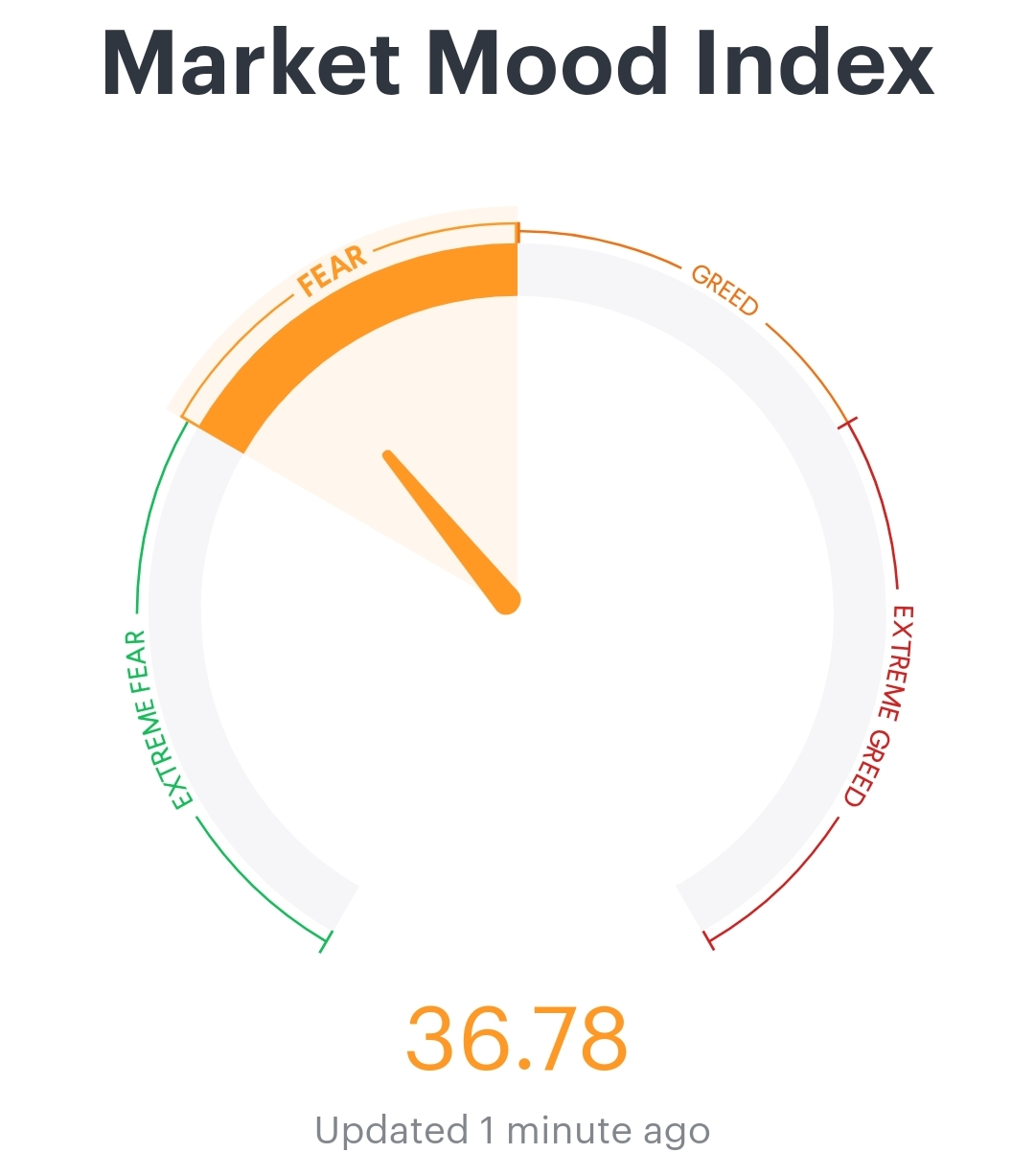

Right now, many articles are writing that the Indian market has become cheap and it can't fall any further, among many other things. Let me make one thing clear along with that: just because the market is cheap, it doesn't mean that economic problems

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)