Back

financialnews

Founder And CEO Of F... • 1y

Rupee is falling, Foriengs policy is falling, Stock market is falling, FIIs is leaving, Layoff is happening . . . . . What could be the reason behind these economic challenges....🤔🤔

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 2m

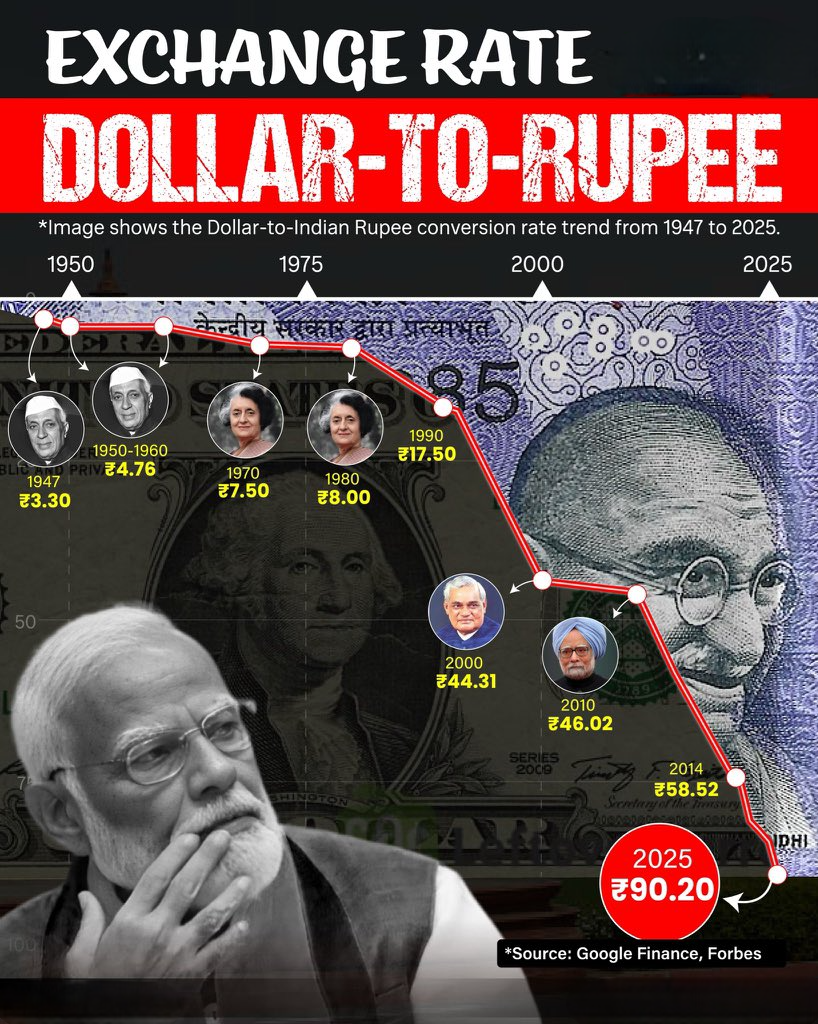

📉💰 DOLLAR vs RUPEE – 78 Years of Change! From ₹3.30 in 1947 to ₹90.20 in 2025, the journey of the Indian Rupee tells a powerful story of our economy, global markets, and policy decisions. 🇮🇳 Leaders changed… 🌍 Global conditions shifted… 📊 But

See More

financialnews

Founder And CEO Of F... • 1y

Why is the Indian Stock Market Falling for Four Straight Sessions? Here Are 5 Key Reasons Stock Market Today: Experts Cite 5 Key Reasons Behind Indian Market Decline 1. US Presidential Elections: Uncertainty surrounding the upcoming US elections is

See More

TREND talks

History always repea... • 1y

🇮🇳 India's Joke of the Day: A calculation error crashed the stock market and the rupee exchange rate! 📉💸 Authorities reported a record trade deficit of $37.8 billion in November, triggering market panic. The rupee plummeted, and a sell-off hit t

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)