Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

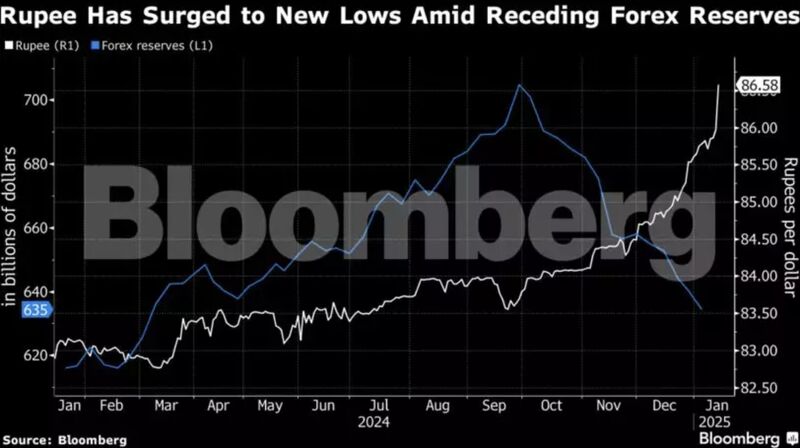

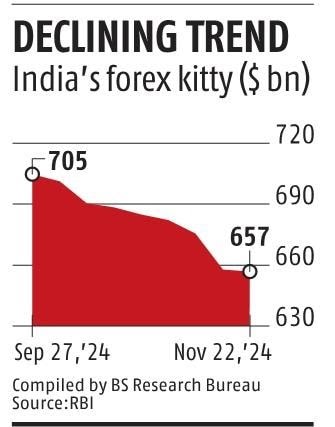

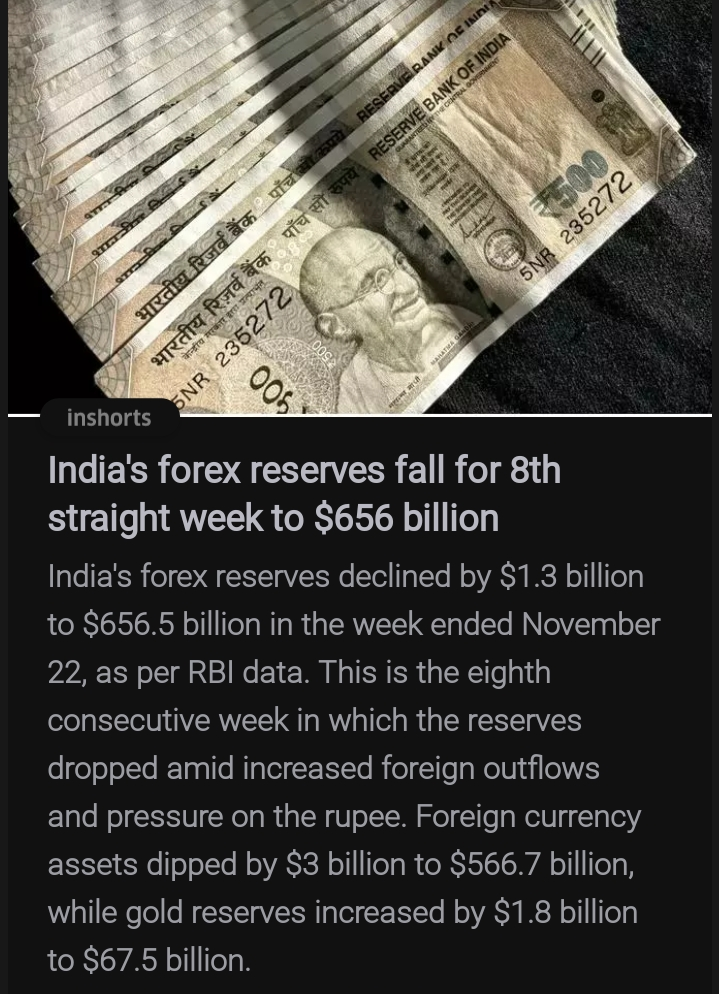

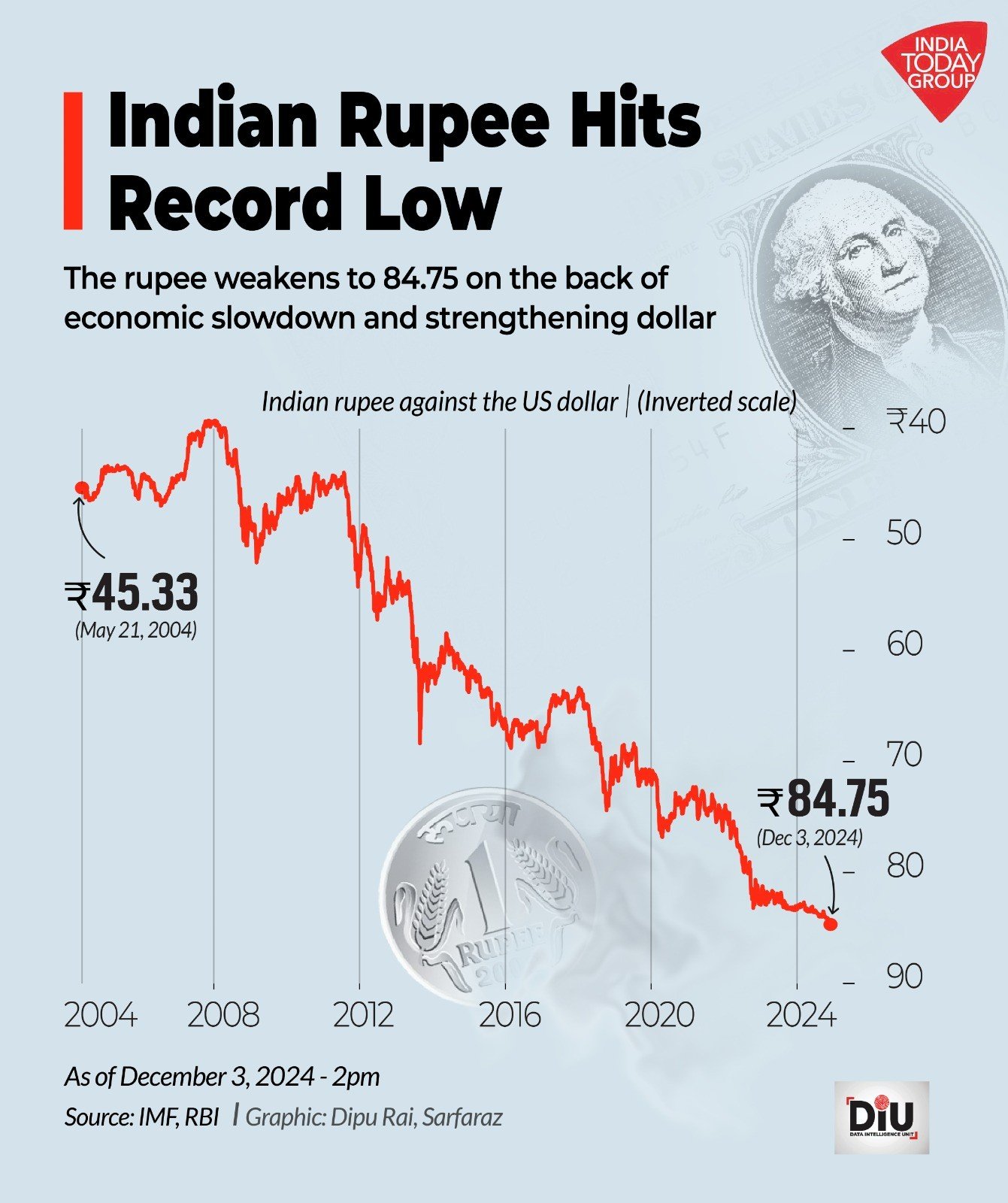

’m a bit surprised by how everyone’s in a tizzy over Indian Rupee's slide against the Dollar, and how Govt and RBI are being bashed over it. It makes it amply clear that much of people don’t understand how & why currency markets move 🙏🙏 And, the knee-jerk reaction of seeing this as a sign of economic weakness is not just simplistic, it's downright ignorant of global economic dynamics. The truth is, that currency valuation is not an indicator of economic health but rather a complex dance of that and international trade, policy, and investor sentiment. Let me explain in full depth, in as layman a language as possible. .. See, over the last 3 months, every major currency (Yen, Euro, Pound, Renminbi) has depreciated against the Dollar. It’s driven by capital flowing back to the US, particularly with Trump's return and his aggressive tariff plans, which promise to disrupt global trade dynamics. And, when you compare, the INR has actually depreciated much less than the Yen, Euro, Pound, or Renminbi against the Dollar 🙏🙏 .. Also, the criticism that the RBI and the Govt have failed to manage the INR’s value is a misreading of the situation. Since Oct, India's forex reserves have dropped by 10%, with about 60% of that used by the RBI in Nov alone to temper the INR’s fall. This intervention has certainly slowed the INR’s decline, else it too would have fallen as much as the other currencies. And this has come at a steep cost 📛📛 .. See, the RBI's forex reserves are a buffer for economic shocks. -> And with Trump's return looming, potentially bringing with it a storm of global economic instability, how much more can we afford to drain these reserves? -> The reality is, if the RBI had tried to peg the INR at its previous level, we'd be looking at a far more significant depletion of reserves, leaving us vulnerable when we might need that cushion most Moreover, while the RBI has been propping up the INR, it's inadvertently made our exports less competitive compared to those from countries where currencies have fallen more sharply. .. The argument for letting the INR depreciate further isn't about throwing in the towel - it's about strategic economic positioning. It's about understanding that currency value isn't just about strength or weakness but about strategic flexibility in a world where economic policies are in flux 🙏🙏 This is why, rather than knee-jerk reactions, we need a nuanced discussion on how currency policy can serve India's long-term economic interests. Let the INR find its level - It might just be the smart move in this unpredictable global chess game. ..

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

What Happens When Forex Reserves Decline? We should understand it, Because India is going through that. Let’s break it down step by step. Let’s Understand What Forex Reserve Is Forex reserves are a country’s savings in foreign currencies, gol

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

RBI Increases Gold Purchases The Reserve Bank of India has significantly increased its gold purchases, buying 50 tonnes so far in FY25. This move aims to diversify its foreign exchange reserves and mitigate revaluation risks, as part of efforts to m

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Brief History of RBI The Reserve Bank of India (RBI) was established on April 1, 1935, based on the Hilton Young Commission's recommendations and the Reserve Bank of India Act, 1934. Initially, the RBI took over the functions of the Controller of

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)