Back

Jaydev Parmar

Be curious. • 1y

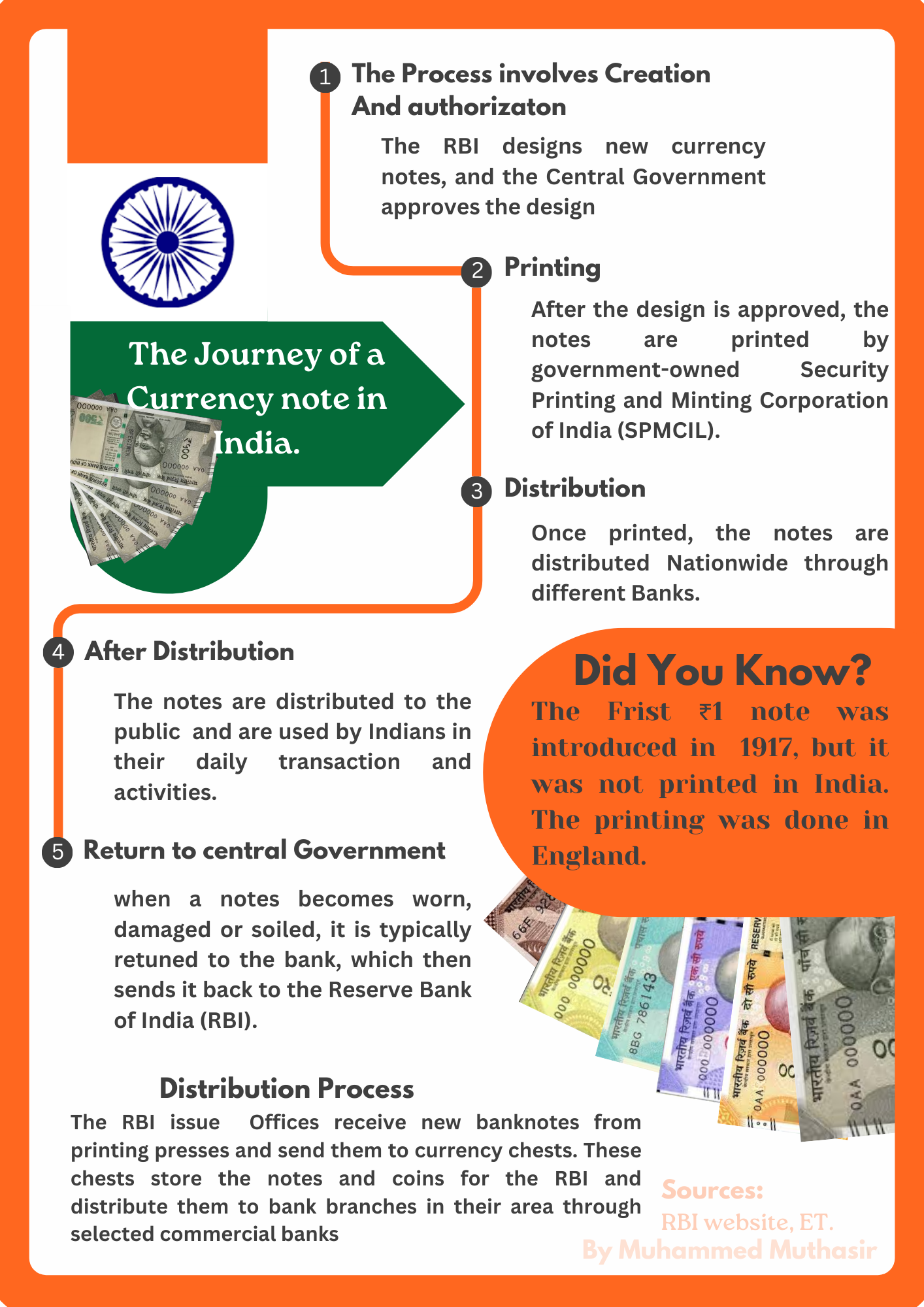

Are all currency notes just a pieces of paper.why dollar and INR don't have same value.why inflation are control by RBI.

Replies (2)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 1m

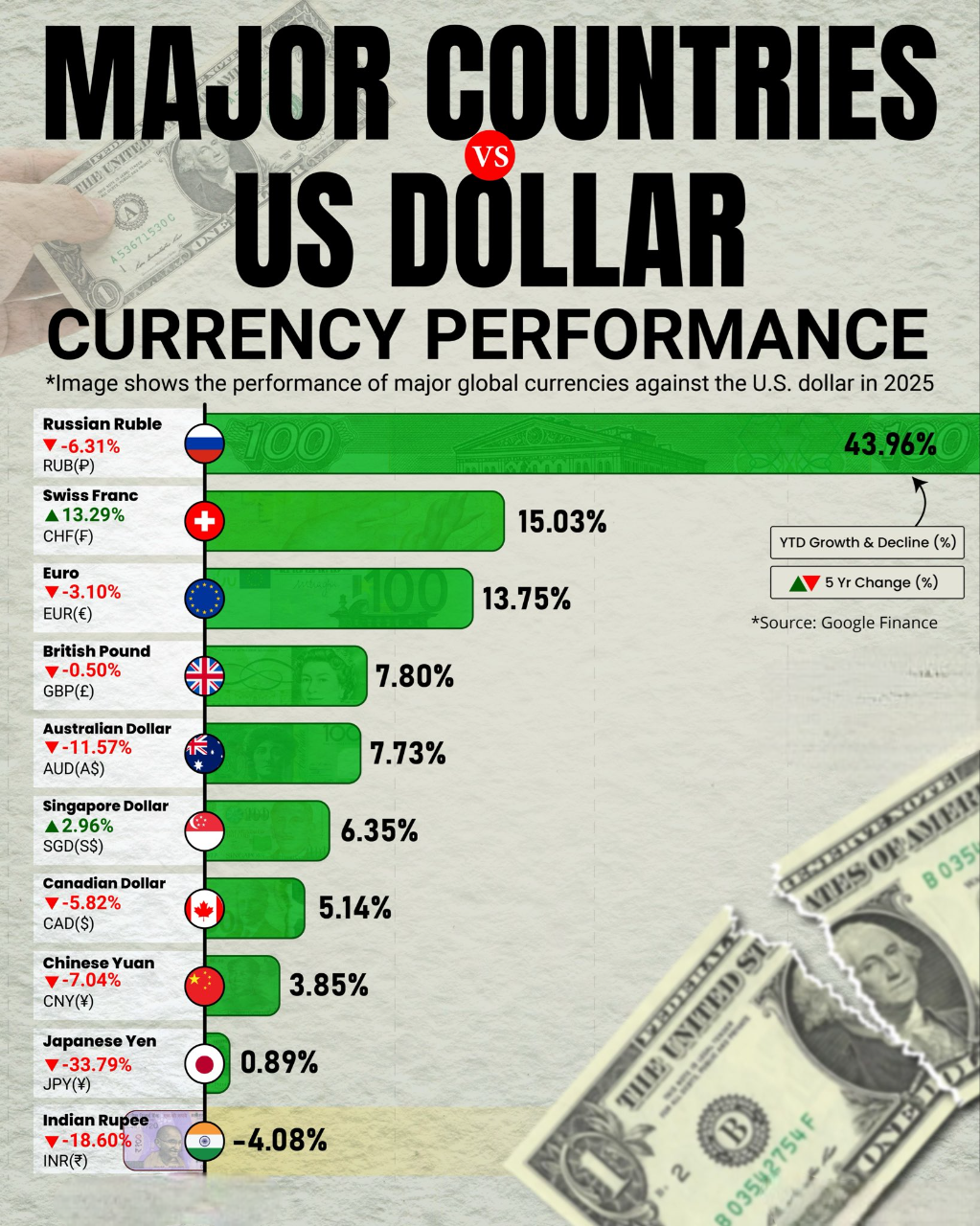

Major Countries vs US Dollar Currency Performance 2025 📊 The U.S. Dollar continues to dominate global markets in 2025. While some currencies like the Swiss Franc and Euro show resilience, others—including the Indian Rupee (₹) and Japanese Yen (¥)

See More

Rohan Saha

Founder - Burn Inves... • 5m

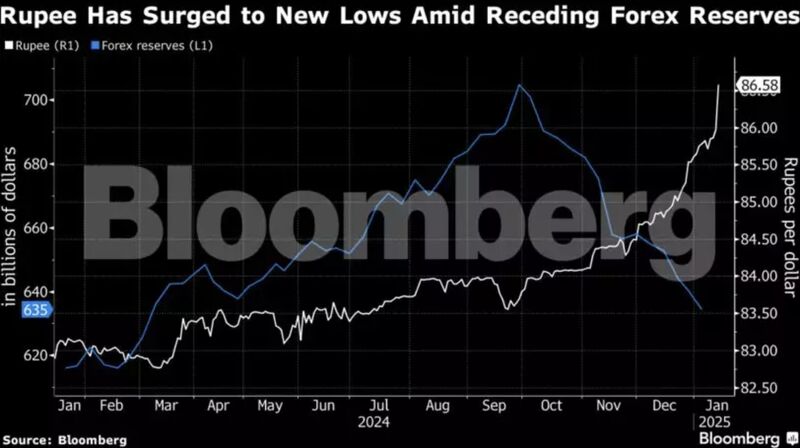

Rupee Losing to Dollar – What’s Happening Lately the rupee has been slipping against the dollar and you can feel it in daily life Fuel gets pricier, overseas trips or studies cost more and even gadgets that rely on imports see a rise in price on the

See MoreSairaj Kadam

Student & Financial ... • 1y

This Thing Will Actually Blow Your Mind. Click on This. "Inflation is taxation without legislation." - Milton Friedman Inflation: A Major Concern in India Inflation remains a pressing issue in India, with the state of Odisha facing the highest r

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

RBI Increases Gold Purchases The Reserve Bank of India has significantly increased its gold purchases, buying 50 tonnes so far in FY25. This move aims to diversify its foreign exchange reserves and mitigate revaluation risks, as part of efforts to m

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

’m a bit surprised by how everyone’s in a tizzy over Indian Rupee's slide against the Dollar, and how Govt and RBI are being bashed over it. It makes it amply clear that much of people don’t understand how & why currency markets move 🙏🙏 And, the

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)