Back

Rohan Saha

Founder - Burn Inves... • 1y

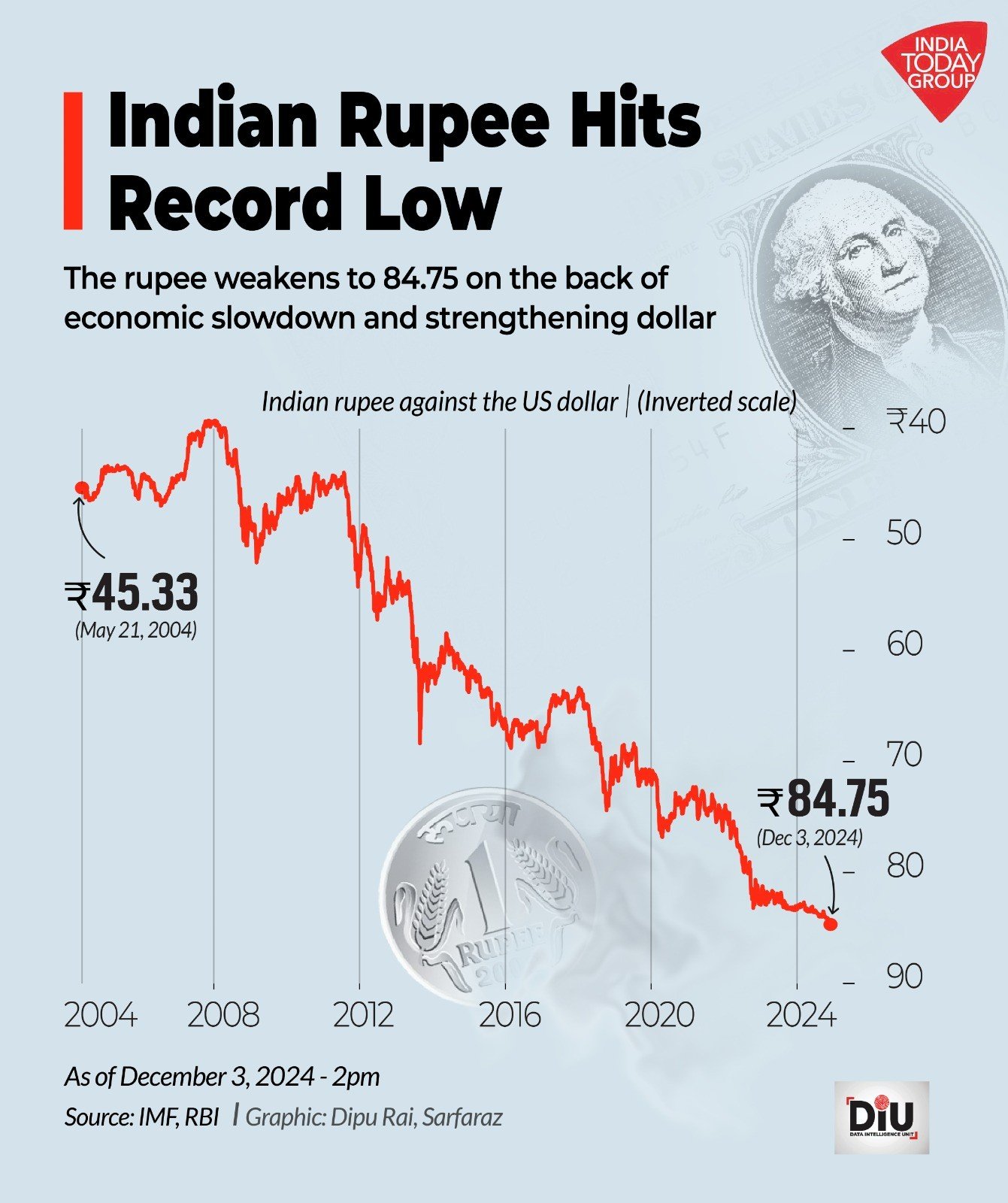

Looking at the current inflation data, it seems that the RBI might consider a rate cut, and the expectation is the same as India's economic growth has slowed down

Replies (4)

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreAnonymous

Hey I am on Medial • 1y

⚠️Big Warning India's retail inflation surged to all time high, breaching the RBI's tolerance limit of 6%. This sharp increase, primarily driven by soaring food prices, has dampened hopes for an early rate cut by the RBI. X Food inflation reached 9.

See Moregray man

I'm just a normal gu... • 11m

The Reserve Bank of India (RBI) is expected to implement a total rate cut of 75 basis points (bps) in the current fiscal year, according to a report by The Economic Times. The cuts are likely to be executed in three phases—25 bps each in April, Jun

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)