Back

financialnews

Founder And CEO Of F... • 11m

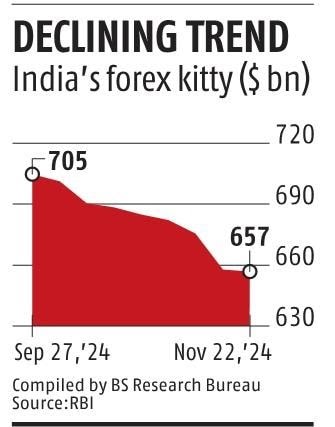

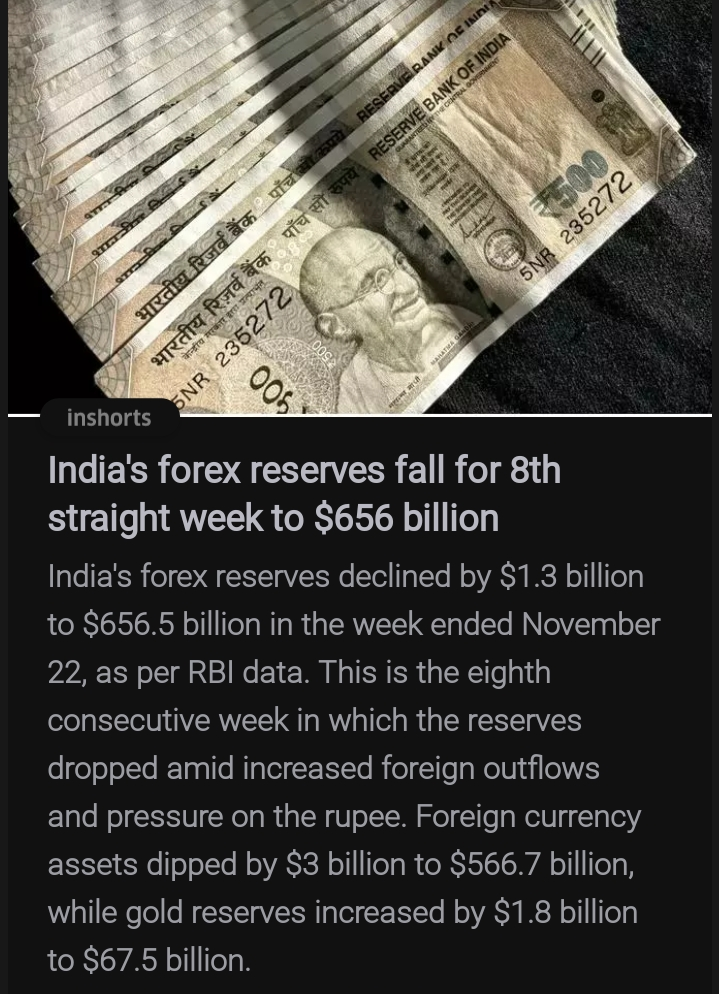

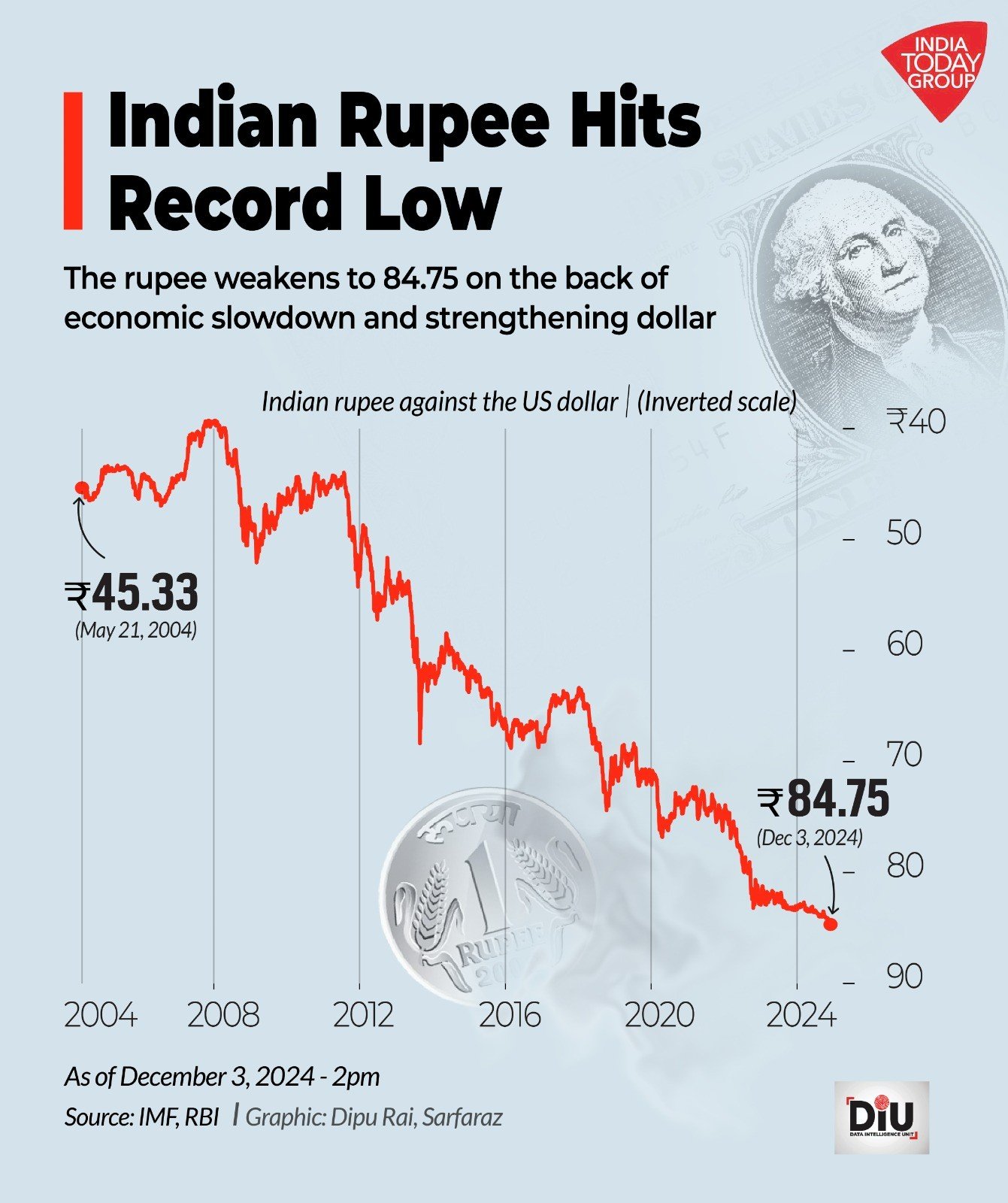

RBI’s Record $77.5 Billion Short Positions: Impact on Rupee Liquidity and Forex Reserves The Reserve Bank of India (RBI) currently holds a record $77.5 billion in net short dollar positions, which could influence rupee liquidity and foreign exchange reserves. To prevent market disruptions, the RBI may need to roll over these positions, ensuring stability in the financial system. Managing these forward contracts is critical, as any sudden unwinding could impact India's forex reserves, which currently stand at $640 billion, down from a peak of $704 billion in September 2024. RBI’s Dollar Short Positions at Record High As of January 31, 2025, the RBI's net short positions in the dollar forward book reached an all-time high. The central bank holds $30.6 billion in positions with maturities ranging from three months to one year. In February, the RBI conducted two major dollar-rupee.. if you want to know more click 👇 below the link

More like this

Recommendations from Medial

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

RBI Increases Gold Purchases The Reserve Bank of India has significantly increased its gold purchases, buying 50 tonnes so far in FY25. This move aims to diversify its foreign exchange reserves and mitigate revaluation risks, as part of efforts to m

See MoreSairaj Kadam

Student & Financial ... • 1y

What Happens When Forex Reserves Decline? We should understand it, Because India is going through that. Let’s break it down step by step. Let’s Understand What Forex Reserve Is Forex reserves are a country’s savings in foreign currencies, gol

See More

Ansh Kadam

Founder & CEO at Bui... • 1y

How does RBI earn money ? & why the RBI is more of a banker than a regulator. Last year, the RBI transferred over ₹87,000 Crore to the government, and it's expected to surpass ₹1,00,000 Crore in FY 2025. But how does the RBI generate this enormous

See More

Gireendra

The world runs on hu... • 1y

Who is the real richest man in the world? Warren Buffett – $149 Billion in Liquid Assets Bill Gates – $20 to $30 Billion in Cash Reserves Larry Ellison – $10 to 15 Billion in Liquidity Jeff Bezos – $5 to $10 Billion in Liquid Net Worth Elon Musk –

See MoreRohan Saha

Founder - Burn Inves... • 1y

why the RBI isn't taking any action against P2P platforms for accepting lenders' money on their own balance sheets. According to RBI guidelines, P2P platforms cannot accept money on their own balance sheet or provide rapid liquidity to any lender, ye

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)