Back

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

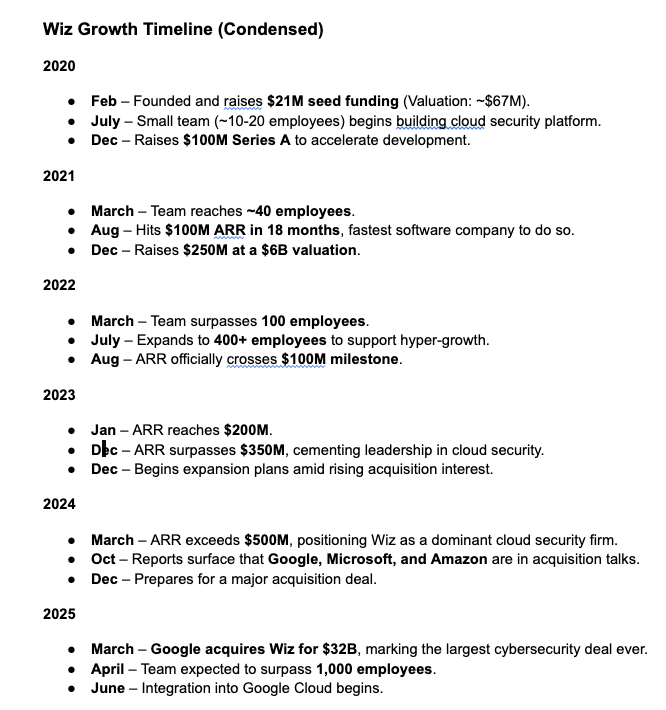

💥 A VC turned $6.4m into $1.3b in 5 yrs — there’s a lesson here for founders💥 Cyberstarts just turned a $6.4M seed investment in Wiz into $1.3 BILLION after Google’s $32B acquisition—a mind-blowing 222x return in just 5 years! 🚀🔥 This is why VCs chase unicorns. Most investments either fail or barely return capital. But one breakout success, like Wiz, can return the entire fund and some more. 🔑 How VCs Play the Power Law Game ⚡ Hunt for market-dominating startups ⚡ Prioritise exponential growth over steady returns ⚡ Accept high failure rates to capture the 100x-1000x outliers There’s A Lesson Here for Founders: Go Big or Go Home! If you’re building a VC-backed company, don't optimise for early profitability—optimise for scale and dominance. Profitability should be a by-product of capturing a massive market. So before raising VC, ask yourself: 💡 Can this idea realistically become a billion-dollar business? 💡 Can I grow fast enough to justify VC economics? 💡 Am I ready to take big swings and play for exponential outcomes? VC funding is a powerful tool—but it’s not for every startup idea. Are you thinking about Power Law dynamics before deciding to raise venture capital? 👇 ----------------------------------- https://www.reuters.com/technology/cybersecurity/alphabets-32-billion-wiz-deal-promises-windfall-vc-backers-2025-03-18

More like this

Recommendations from Medial

Siddharth K Nair

Thatmoonemojiguy 🌝 • 11m

Google in Talks to Acquire Cybersecurity Startup Wiz for $30 Billion Google (Alphabet) is reportedly in advanced discussions to acquire Wiz, a cybersecurity startup, for a whopping $30 billion—potentially making it Google’s largest acquisition ever.

See More

Akash Rajage

"Creating Wellness B... • 1y

Good to know that.... 💯✨. The Ayush market has seen exponential growth, increasing from $2.85 billion in 2014 to $ 43.4 billion in 2023, according to Shripad Yesso Naik, Minister of State for New and Renewable Energy. know more though following lin

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)