Back

Sajin

•

Foundation • 1y

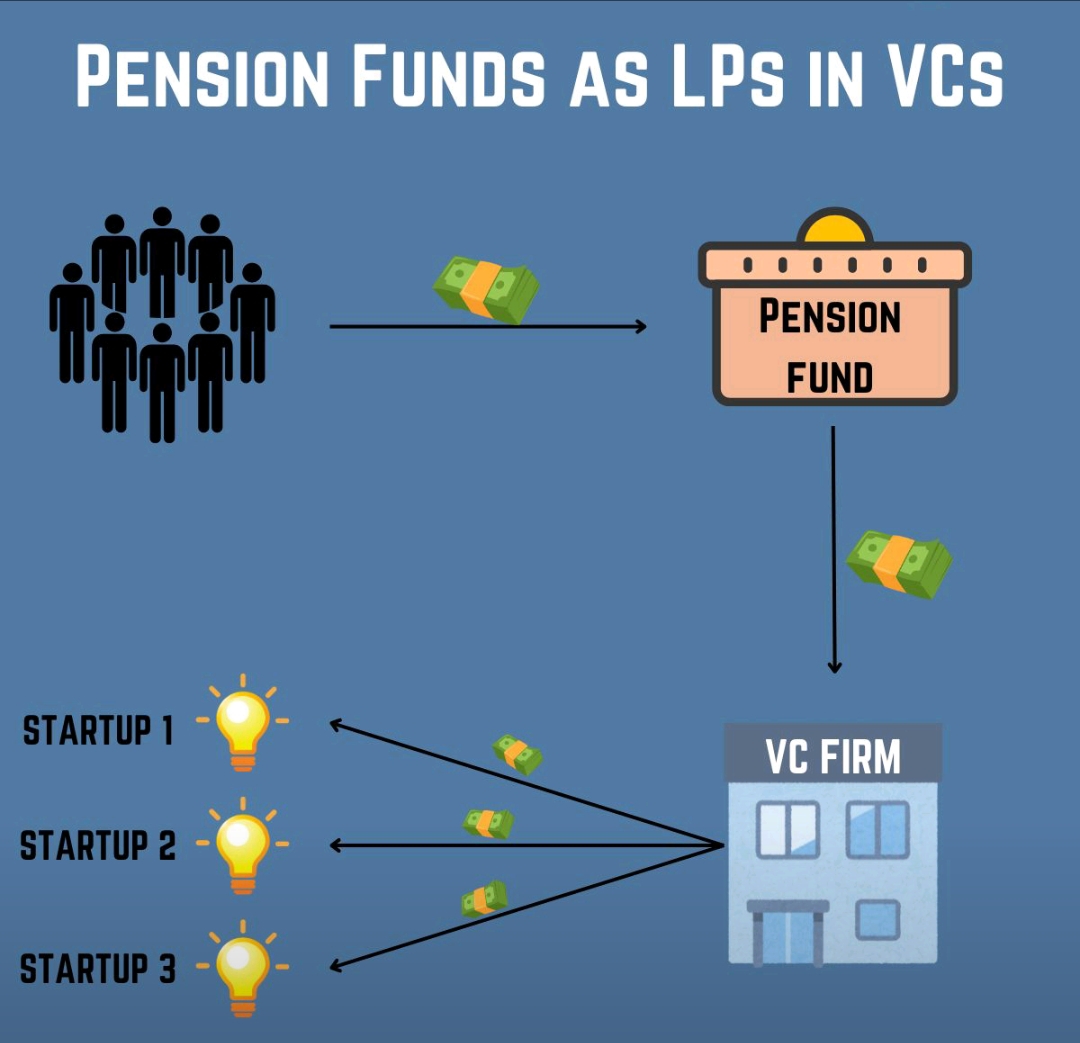

VCs are backbone of startups. How much do you know them? Here are my few insights: 1. VCs invest funds raised from Limited Partners, and accountable to generate them returns in 10 years 2. VCs earn 2% management fee annually from the fund, performance regardless 3. VCs often reserve 50%+ of fund to reinvest winners in later rounds 4. VC model relies on 1-2 unicorns and few late stage exits 5. Expected returns from a startup: 7(+3) years 6. VCs often neglect longterm opportunities due to quicker exits pressure, regardless of profitability or innovation 7. For deal sourcing, VCs rely heavily on networks 8. Branding/PR > consistent returns to attract LP investments for future funds 9. VCs often release funds in tranches 10. VCs push for exits to align fund timelines, regardless of startup maturity For more, Adithya Pappala made an amazing VC series on Medial, check them. As founders, do you find VCs are approachable, or are startups forced to chase clout to win their favor?

Replies (22)

More like this

Recommendations from Medial

Arcane

Hey, I'm on Medial • 1y

Even though 25% of all startups on Carta have just a solo founder, VCs hesitate to fund them. Having 2 to 3 founders seems to be the sweet spot if you were to raise VC money while building a startup. So, Is there a way to make VC funding easier as

See More

VCGuy

Believe me, it’s not... • 1y

Swiggy's upcoming IPO will be a multibagger win for early VC investors. 🎯Detailed insights will be available once their DRHP is public, but if you look at the history - - Elevation Capital: Investment of $5.9 M turned into $61.8 M (~10x returns) -

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-16 🎯What is High Watermark in VC? 🎯What are Distributions/Waterfall? Apart from hurdle rate, Some consider also “high watermark” This is more common practice in hedge funds. This market denotes the highest value recorded by the f

See MoreAdithya Pappala

Busy in creating typ... • 1y

Only 1 Secret that you must know to raise funds from VC'S but sadly no-one is talking about.. It's very often that we show these 👇 to the Investors when raising funds: Problem Solution Product Market Gap Team Customers Revenue Achievements Et

See More

Account Deleted

Hey I am on Medial • 11m

You always hear about startups failing, but no one talks about VC funds going under. It happens more often than you think. Most fail because they chase hype instead of solid businesses, burn through capital without a follow-on strategy, or simply get

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)