Back

Adithya Pappala

Busy in creating typ... • 1y

Only 1 Secret that you must know to raise funds from VC'S but sadly no-one is talking about.. It's very often that we show these 👇 to the Investors when raising funds: Problem Solution Product Market Gap Team Customers Revenue Achievements Etc... Even though, Many Startups show these but only 1-2% of Startups get funded by VC. Do you know why?? It's because the Startup Founders who are raising funds from VC are well aware about their Venture Capital Firm & L.P'S Not only by-hearting the Startup Metrics but also they had a good research on V.C firm they are reaching out such as; G.P/L.P'S VC Fund Thesis Fund Cheque Size Fund Target Location Fund Milestones Fund Categories Fund Cycle of that Specific Firm etc.. When founders talk about these, The VC'S will get that "Aaahhh Point" Remember, Either Investors or VC'S Sits for the Business but not for your Stories ultimately The one who masters these VC Metrics is the one who raises more & more funding from VC'S🚀🚀

Replies (8)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

🤫Only 1 Secret to raise funds from VC'S but sadly no-one is talking about It's very often that we show these 👇 to the Investors when raising funds: Problem Solution Product Market Gap Team Customers Revenue Achievements Etc... Even tho

See More

Adithya Pappala

Busy in creating typ... • 1y

The Raising VC Fund is Scary, Fearful & Thrilling Journey rather than Raising Funds for a Startup. Believe me, Rasing 1 Crore & Raising 1000 Crores makes a lot of differences in : Metting People Making Quality Connections Habits & Personal Networ

See More

Adithya Pappala

•

Hustle Fund • 4m

You don’t need this to be a VC! -IIT or Ivy degree -MAANG Resume -Nor Altman or Elon Musk's brother At 19,I broke into VC.Was part of VC Lab & after evaluating 80+fund decks globally Here’s the truth:it boils down to three core skills. 1.Abilit

See MoreAdithya Pappala

250Tn Global Impact Ventures • 3m

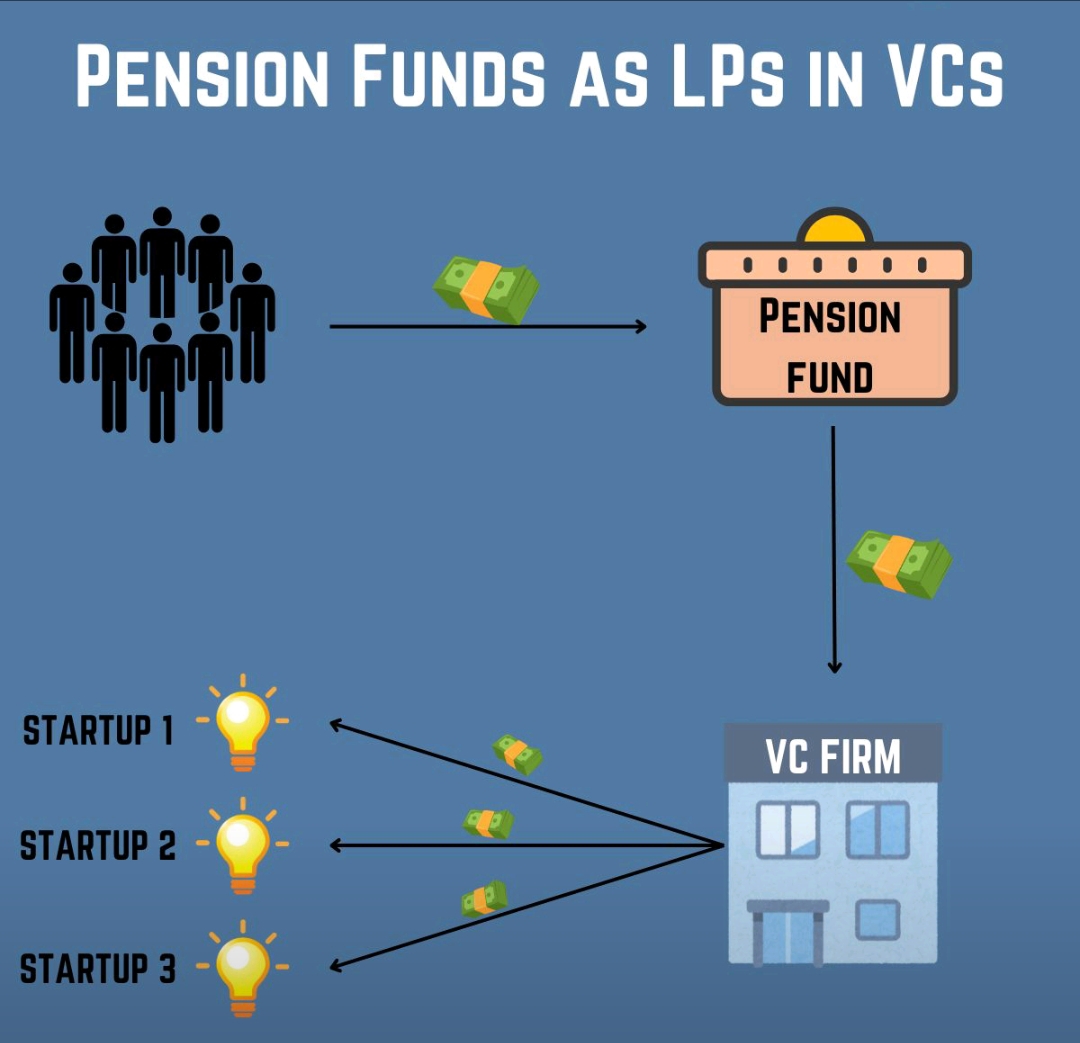

Insaneeeee! 99% of Indian-founders think VCs are cash-rich In reality, It's not. For those who aren't well aware about- Startups raise from VC VC raises from L.P'S & L.P's do the business 🔁Repeat VCs are not cash-rich. I had a line that struck

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-12 🎯Types of Expenses for VC? 🎯What is a Self-Managed Fund? 🎯Organisational Expenses: These are costs for VC Funds which includes such as Incorporation Costs, Statutory Compliance Cost of the Funds, Placement Commissions, Distri

See MoreNithin Augustine k

DAY ONE • 1y

Burning through funds to capture Market share is TRENDING. For that startup sacrifice the control they have on the business. To what extent should we raise funds and what all things should we consider about the VC from which we are raising funds. OR

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)