Back

Adithya Pappala

250Tn Global Impact Ventures • 3m

Insaneeeee! 99% of Indian-founders think VCs are cash-rich In reality, It's not. For those who aren't well aware about- Startups raise from VC VC raises from L.P'S & L.P's do the business 🔁Repeat VCs are not cash-rich. I had a line that struck in mind a long ago in the bar- "VCs don't earn money,They manage money" Hence, Focus wisely between L.P'S & G.P'S P.S-We are hosting 500+ VCs & 260+ L.P'S at 250Tn global L.P Summit in India. Chance to show what you are building in just 72 hours before the massive investors & VCs.Register 👇 below Want early access? Write us at- info@metafundlabs.me

Replies (3)

More like this

Recommendations from Medial

Manik Gruver

•

Macwise Capital • 8m

You spend months understanding your customer's pain, but VCs skip your problem slide in 30 seconds for XYZ reasons. Since VCs rush through problem statements, how can founders ensure that VCs understand the depth of problem? #39 # Started #VC #Fundr

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

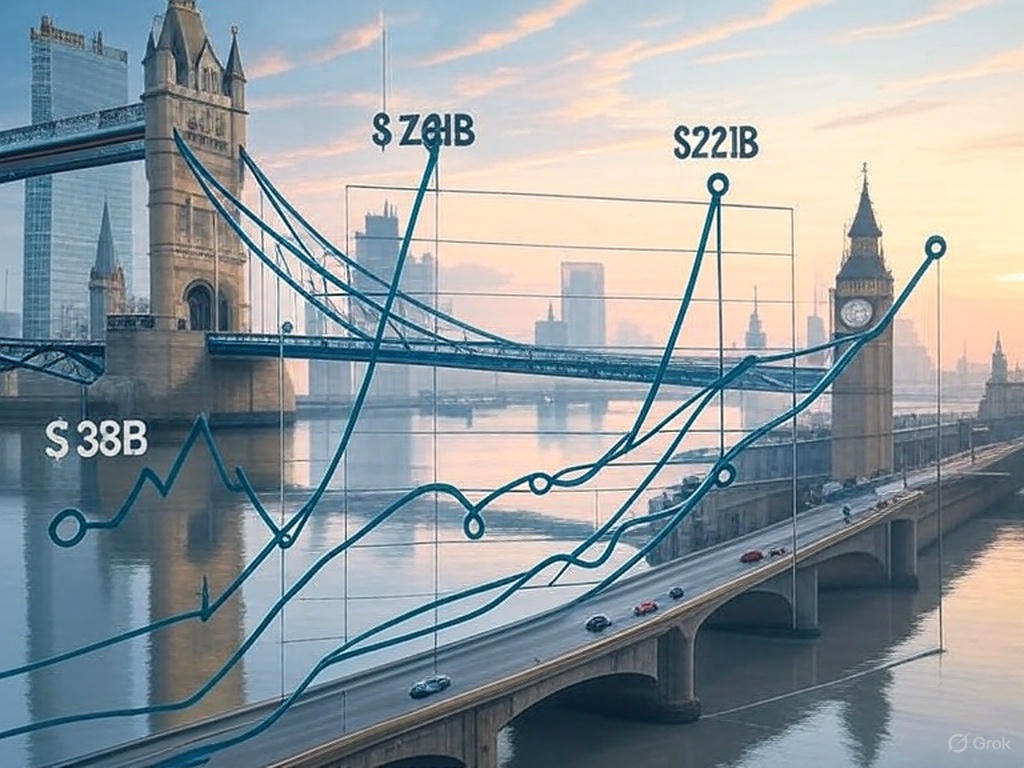

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

Vivek Joshi

Director & CEO @ Exc... • 6m

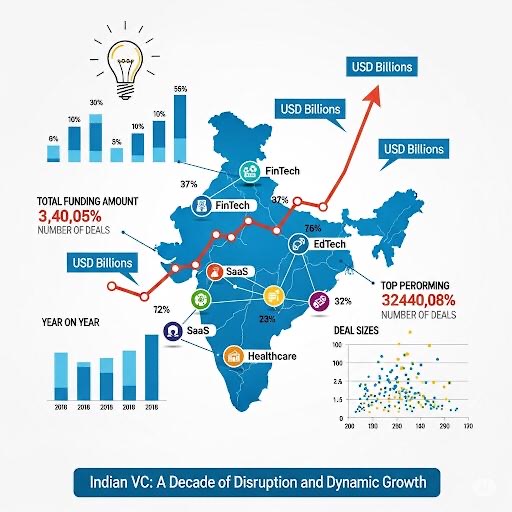

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

NANGBIA TAYO DUI

Business venture • 1y

Hey guys, quick question where to find VC actually and how ? 😭 i belong from a very remote city where people are of the old generation, but these people are rich i mean seriously rich but not interested in ideas, startups nor ventures 😴 despit

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)