Back

Abhay Kumar

on the hunt for oppo... • 1y

With VC 2.0 emerging in india i.e., boutique firms operated by former founders - do you see a growing culture of founder friendly VCs or is this an opportunity to tap into?

Replies (3)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

Last week, news broke that India's former Defence Secretary launched his VC fund, Mount Tech Growth Fund. The first fund, named Kavachh, is expected to be ~₹500 Cr, supporting Defence Tech startups. ⏭️Demand for Defence Technology seems to be on t

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

Sweet short summary: Bain 2024 Indian VC insights. • India's VC scene in 2023 was a rollercoaster. Funding dropped from $25.7 billion to $9.6 billion year-over-year. Despite this, India held onto its spot as the second-biggest VC destination in Asia

See MoreTouhid Ahmed Razavi

CEO at Cawlab • 1y

Hi Everyone we are Building an AI Architecture software for the Architects that can generate the building plan with some parameters like Site dimensions, facing and Number of bedrooms the plan will generate with the principle of vastu floor configu

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

I sometimes worry, about what’s happening in the Indian VC ecosystem 😅😅 Based on a recent chart shared by seasoned VC Vinit Bhansali, in the last 10 years, the number of VC firms in India has grown by almost 25x. And based on an assertion by Peak

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

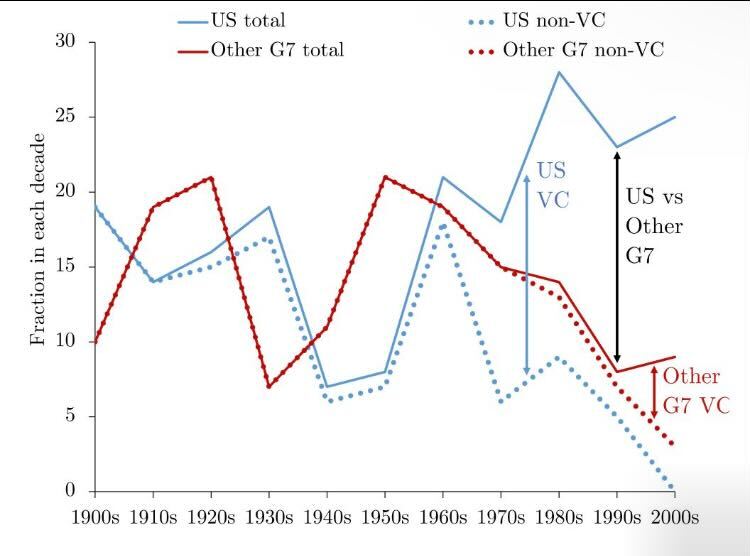

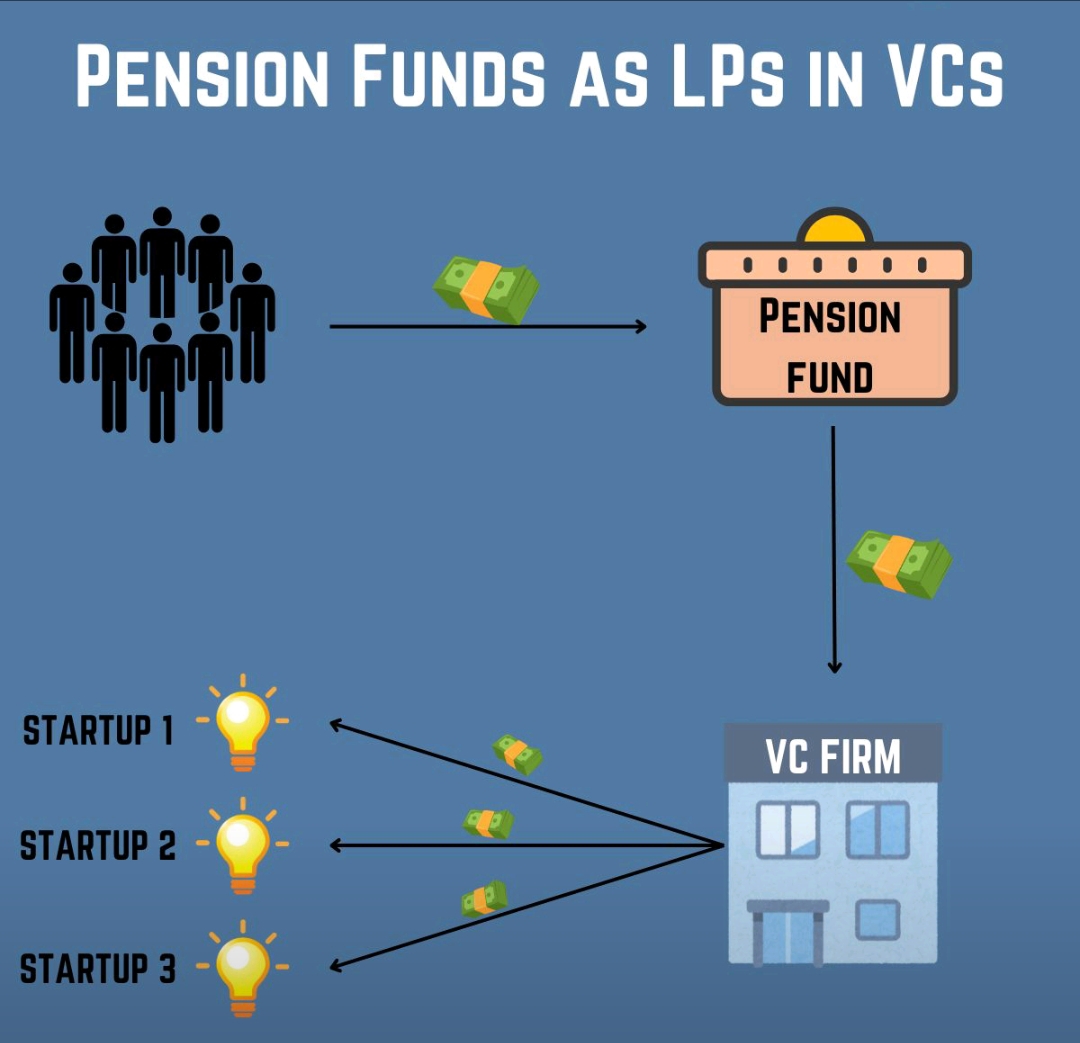

Have you ever heard of a British Apple, a French Tesla, or a Japanese Google? ❌ NO ❌ The simple reason is – Venture Capital. Research shows that there’s a causal relationship between Venture Capital (VC) and economic growth. In 2015, Stanford profes

See More

Vivek Joshi

Director & CEO @ Exc... • 10m

The Next 6 Months of Disruption: 5 Emerging Technologies Transforming Business Tech innovation is accelerating—and these five trends are set to reshape how businesses operate: 1. Generative AI 2.0 – Moving beyond content to driving entire workflows

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)