Back

The next billionaire

Unfiltered and real ... • 1y

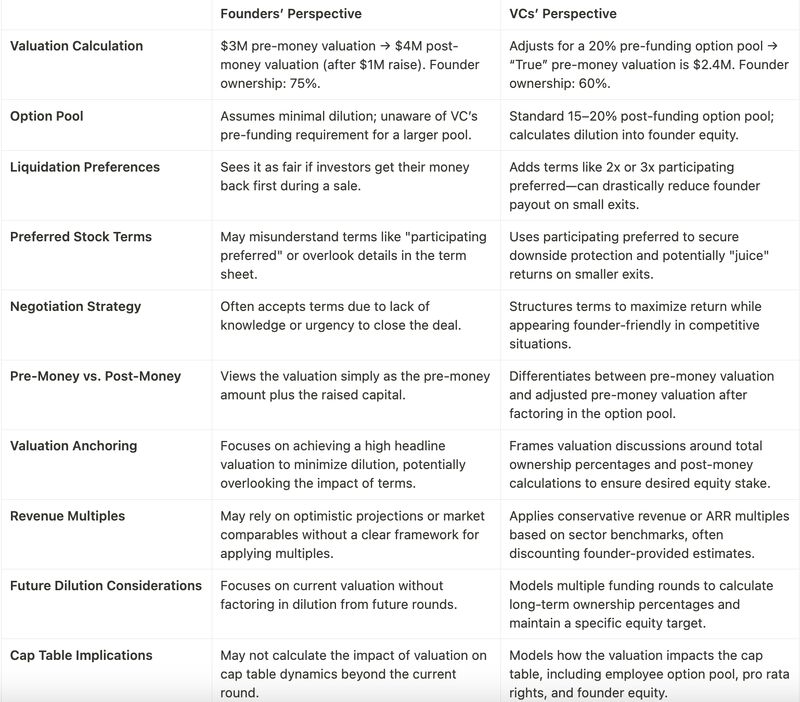

Founders: Protect your equity. VCs have a playbook for valuation that most founders don’t see. Here's a side-by-side look at how they calculate deals differently from you: 𝐕𝐚𝐥𝐮𝐚𝐭𝐢𝐨𝐧 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐨𝐧 Founder: $3M pre-money → $4M post-money, ownership at 75%. VC: Adjusts for 20% pre-funding option pool, "true" pre-money is $2.4M, ownership at 60%. 𝐎𝐩𝐭𝐢𝐨𝐧 𝐏𝐨𝐨𝐥 Founder: Assumes minimal dilution, unaware of VC's pre-funding requirement. VC: Requires a 15–20% option pool pre-funding, lowering founder equity. 𝐋𝐢𝐪𝐮𝐢𝐝𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬 Founder: Expects investors to get their money back first in a sale. VC: Adds 2x–3x participating preferred, reducing founder payout on smaller exits. 𝐏𝐫𝐞𝐟𝐞𝐫𝐫𝐞𝐝 𝐒𝐭𝐨𝐜𝐤 𝐓𝐞𝐫𝐦𝐬 Founder: May misunderstand or overlook participating preferred terms. VC: Uses these terms to protect downside and boost returns on smaller exits. 𝐍𝐞𝐠𝐨𝐭𝐢𝐚𝐭𝐢𝐨𝐧 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 Founder: Accepts terms quickly due to urgency or lack of knowledge. VC: Structures terms to maximize returns while appearing founder-friendly. 𝐏𝐫𝐞-𝐌𝐨𝐧𝐞𝐲 𝐯𝐬. 𝐏𝐨𝐬𝐭-𝐌𝐨𝐧𝐞𝐲 Founder: Sees valuation as pre-money + capital raised. VC: Adjusts pre-money valuation after factoring in option pool. 𝐕𝐚𝐥𝐮𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐜𝐡𝐨𝐫𝐢𝐧𝐠 Founder: Focuses on high headline valuation to minimize dilution. VC: Frames discussions around ownership percentages and post-money equity. 𝐑𝐞𝐯𝐞𝐧𝐮𝐞 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐞𝐬 Founder: Uses optimistic projections or market comparables. VC: Applies conservative revenue multiples based on sector benchmarks. 𝐅𝐮𝐭𝐮𝐫𝐞 𝐃𝐢𝐥𝐮𝐭𝐢𝐨𝐧 𝐂𝐨𝐧𝐬𝐢𝐝𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬 Founder: Overlooks dilution from future funding rounds. VC: Models dilution across rounds to maintain target ownership. 𝐂𝐚𝐩 𝐓𝐚𝐛𝐥𝐞 𝐈𝐦𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬 Founder: Doesn’t assess long-term cap table dynamics beyond the current round. VC: Models impact on employee options, pro rata rights, and founder equity. Learn the math. Master the terms. Protect your stake. credits: Ivelina Dineva/linkedin

Replies (13)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

Venture Capital (VC) term sheets often include clauses that can have significant implications for founders and the future of their startups. Below are some critical clauses that founders should carefully evaluate: 1. Valuation and Equity Pre-Money

See MoreSamCtrlPlusAltMan

•

OpenAI • 7m

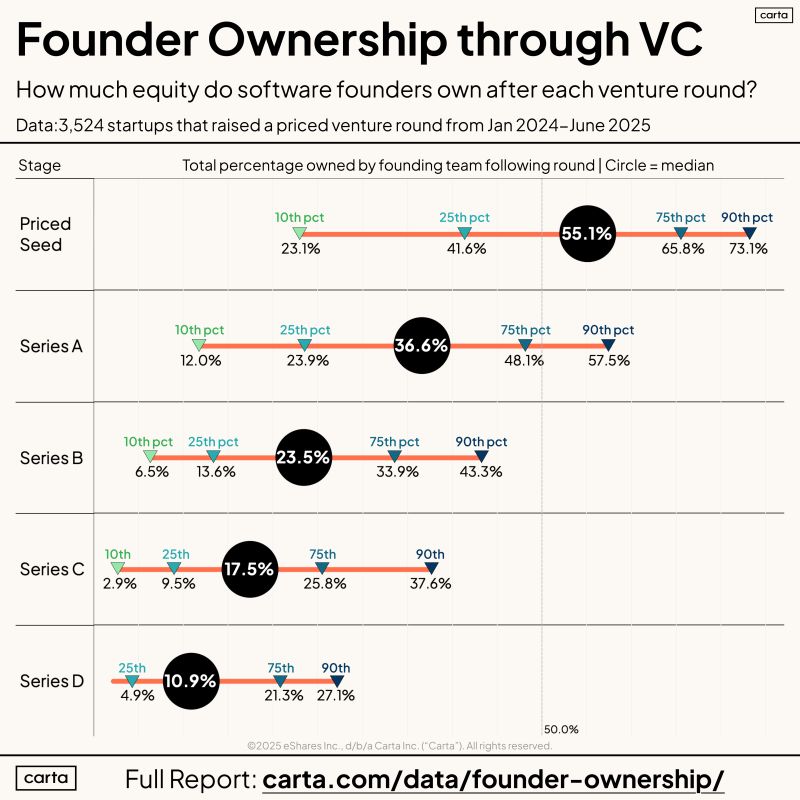

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

The Vc Girl

Not a Vc Yet, just O... • 7m

16 VC Terms I’m Learning to Become Sniper . Not a VC (yet), but I’m obsessed with how they think. TAM – Size of the $$ opportunity CAC – Cost to get a user LTV – Money a user brings over time Runway – Months till cash runs out Burn Rate – Monthly

See MoreAnonymous

Hey I am on Medial • 1y

I am planning to create a large esops pool for my startup of around 20% and give my co-founder (tech) around 35% equity over a three-year vesting period. In this case, if I raised capital at 10% dilution in a pre-seed or seed round, I may end up with

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)