Back

Priyank

•

Money • 9m

Pre-Money vs Post-Money | Why It Matters These two terms confuse a lot of first-time founders, but understanding them can save your equity. Here’s the difference (in plain terms): Pre-Money Valuation → What your startup is worth before new money comes in. Post-Money Valuation → What it’s worth after the investment is added. 🧠 Why it matters: Let’s say an investor puts in ₹1Cr. If your pre-money is ₹4Cr → post-money becomes ₹5Cr Investor owns ₹1Cr / ₹5Cr = 20% But if you thought you agreed to a ₹5Cr pre-money - now they own ₹1Cr / ₹6Cr = 16.6% Small mistake here = big dilution later. Always clarify which one you're talking about in your emails and term sheets. If you need help raising funds, DM me.

Replies (6)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

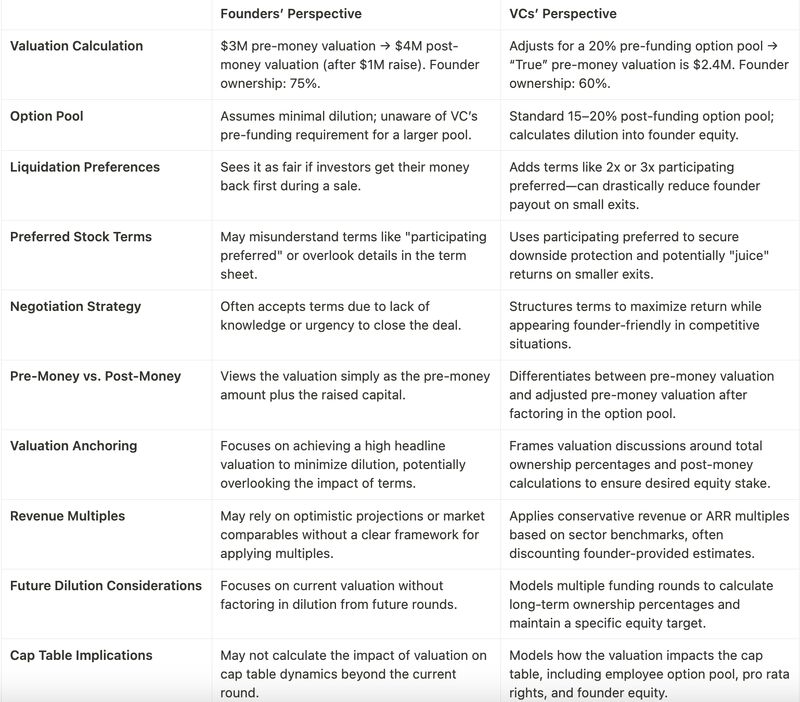

Venture Capital (VC) term sheets often include clauses that can have significant implications for founders and the future of their startups. Below are some critical clauses that founders should carefully evaluate: 1. Valuation and Equity Pre-Money

See MoreShanu Chhetri

CS student | Tech En... • 7m

Pazy secure 6cr funding pazy is a Bengaluru-based fintech startup offering an integrated business-payments platform for finance teams. Founded in 2023, they just raised ₹6 crore in pre-seed funding led by Inuka Capital and Gemba Capital. The funds w

See More

Pulakit Bararia

Founder Snippetz Lab... • 1y

So how do you calculate your company’s valuation? Here’s the simplest way to think about it: 1. Forecast Future Earnings: Start with what your business makes now and apply a growth rate. Example: Year 1: $100K → Year 2: $120K → Year 3: $144K. 2.

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)