Back

Anonymous

Hey I am on Medial • 1y

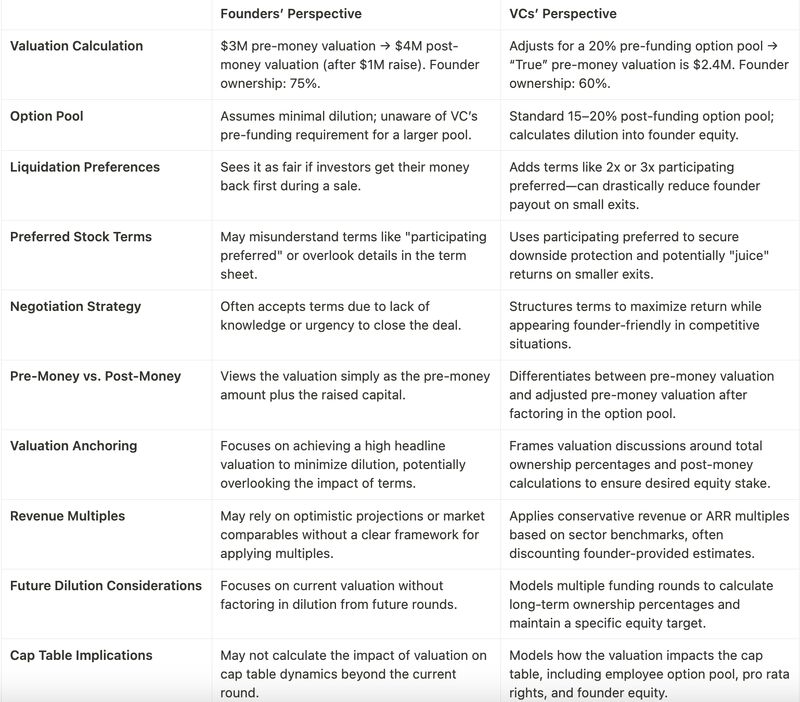

Venture Capital (VC) term sheets often include clauses that can have significant implications for founders and the future of their startups. Below are some critical clauses that founders should carefully evaluate: 1. Valuation and Equity Pre-Money vs. Post-Money Valuation: Understand the difference and how it impacts your ownership stake. Option Pool: Pay attention to whether the option pool is created pre-money or post-money, as this affects your equity dilution. 2. Liquidation Preferences Single vs. Multiple Preferences: Ensure you know how much the investors get paid before founders and employees during a liquidation event (e.g., acquisition or IPO). Participating Preferred Stock: Watch out for "double-dipping," where investors get their preferred payout and share in common stock proceeds. Read comments for more

Replies (11)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

A Term Sheet for company Pre-Seed/Seed/A/B defines: 1) Company 2) Founders 3) Investors 4) Structure of financing 5) Liquidation preference 6) Anti-Dilution 7) Advisory board 8) Material Decisions 9) Pro-rata Right 10) Right to First Refusal 11) Dra

See MoreVamshi Yadav

•

SucSEED Ventures • 9m

The Falsehood of Distributions of Founders at Distress Exits: A Lesson for BluSmart Worth ₹850Cr Let's dispel one myth: "Founders make money in acquisitions. Reality Check of BluSmart Raised: ~₹1,300Cr | Last Val: ₹2,700Cr | Exit Val: ~₹850Cr Outs

See MoreCA Vamshi

Practicing Chartered... • 9m

90% of startup founders overestimate their valuation. The other 10%? They raise smart, retain more equity, and stay investor-ready at every stage. Valuation isn’t just about numbers — it’s about narrative, traction, and timing. It reflects how well

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)