Back

Anonymous

Hey I am on Medial • 1y

3. Board Composition Ensure a fair balance between founder representation and investor control on the board. Limit clauses that allow investors to unilaterally appoint directors or have veto rights over key decisions. 4. Founder Vesting/Cliffs Re-vesting of founder equity is often proposed. Understand vesting schedules, cliffs, and any potential risk of losing shares if you exit prematurely. --- 5. Anti-Dilution Protection Full Ratchet vs. Weighted Average: Full ratchet protection can significantly dilute founders in future down rounds. Aim for a "broad-based weighted average" clause to minimize dilution risks.

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

A Term Sheet for company Pre-Seed/Seed/A/B defines: 1) Company 2) Founders 3) Investors 4) Structure of financing 5) Liquidation preference 6) Anti-Dilution 7) Advisory board 8) Material Decisions 9) Pro-rata Right 10) Right to First Refusal 11) Dra

See MoreRajan Paswan

Building for idea gu... • 1y

Last time we discussed dilution in SHAs. Today, we tackle the Board of Directors (BOD)! The BOD: This group oversees your startup's big picture strategy. The SHA defines how many board members there are and how they're chosen. Why it matters: Havin

See More

Akash Bagrecha

Co-Founder at Jorden... • 1y

How much board seat right should you give to an investor in exchange for funding? Yesterday, met an founder who is running a biz with ₹10 Cr rev During our discussion, the founder mentioned an investor who was interested but only on the condition o

See MorePP Associates

Best Law Firms in Ko... • 5m

💡 Startups don’t just fail because of competition or funding—often, the biggest risk comes from within. 👉 Read: Co-founder Betrayal & Legal Lessons Every Startup Founder Must Know Disputes between co-founders have destroyed more startups than marke

See MoreAnonymous

Hey I am on Medial • 1y

I am planning to create a large esops pool for my startup of around 20% and give my co-founder (tech) around 35% equity over a three-year vesting period. In this case, if I raised capital at 10% dilution in a pre-seed or seed round, I may end up with

See MoreAccount Deleted

Hey I am on Medial • 7m

Mira Murati, former OpenAI CTO, has steered her six-month-old venture, Thinking Machines Lab, to a $2 billion seed round at a $10 billion valuation—remarkably achieved without a disclosed product, revenue, or business plan. Led by Andreessen Horowit

See More

Aditya Malur

AI-Powered Product C... • 11m

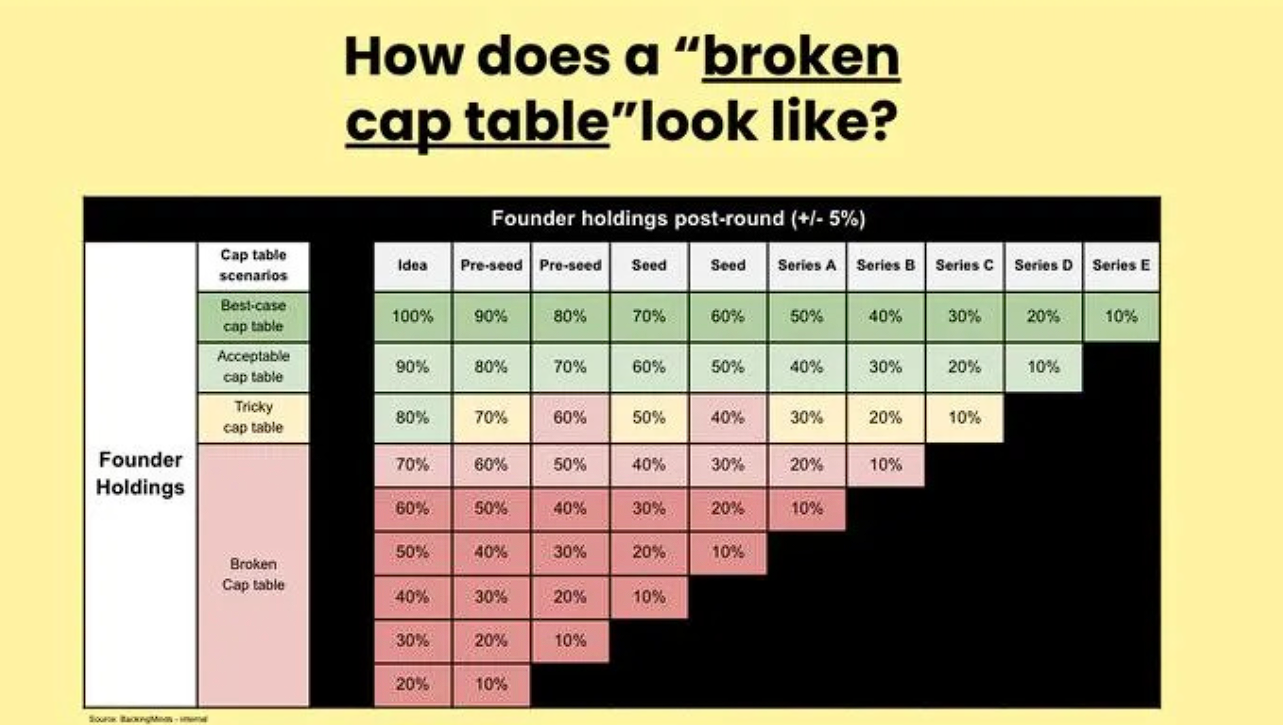

How a Broken Cap Table Turns Founders Into Employees of Their Own Company? Founded in 2009, Quid raised over $108M in funding and reached a peak valuation of $300M+ by 2016. Yet when the company was acquired by Netbase in 2020, founder and CEO Bob G

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)