Back

Aditya Malur

AI-Powered Product C... • 12m

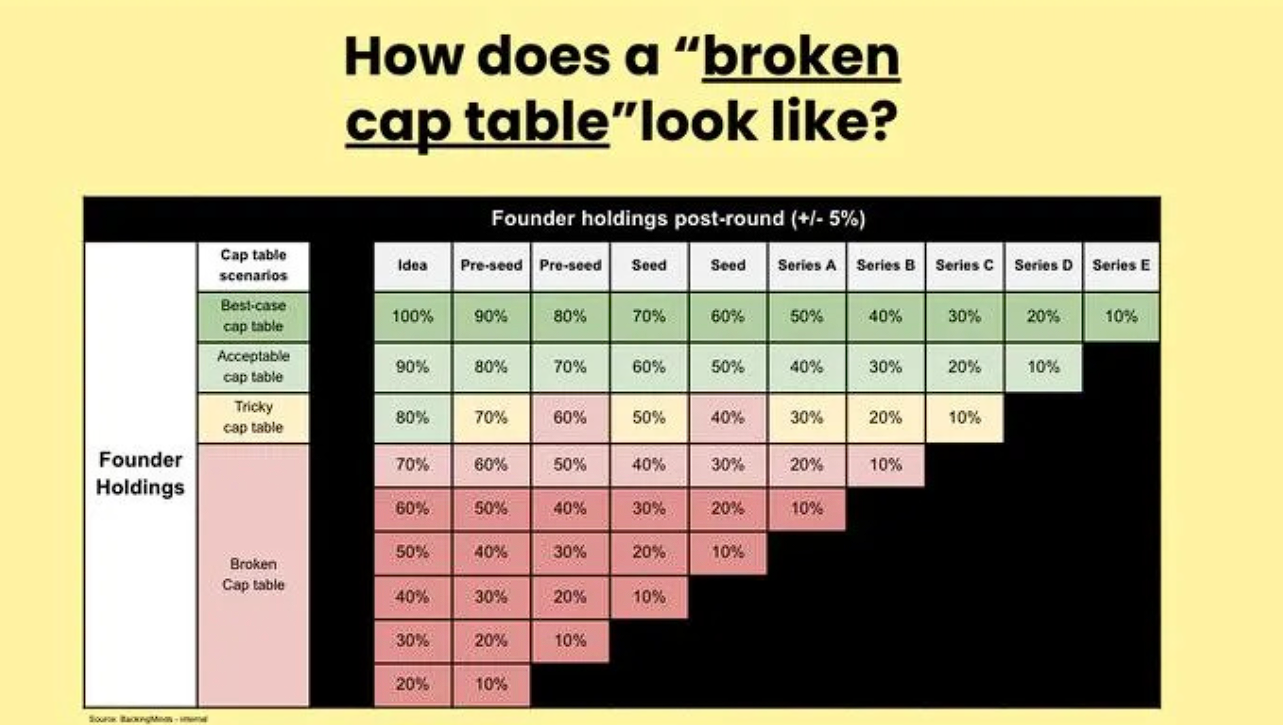

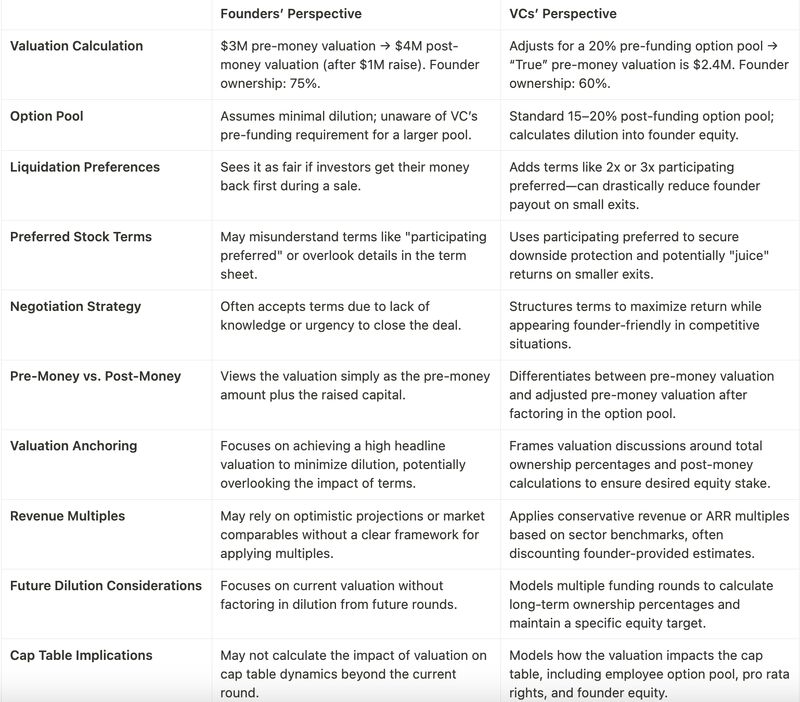

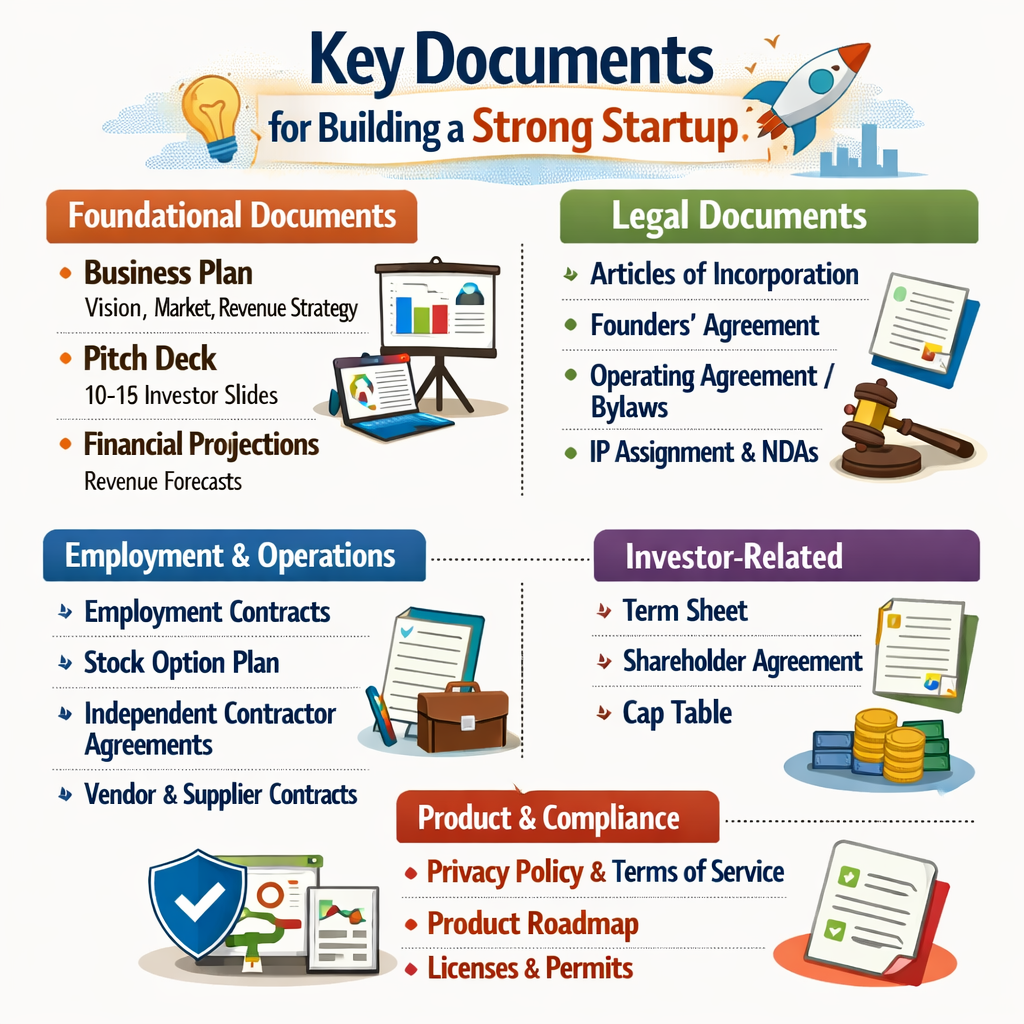

How a Broken Cap Table Turns Founders Into Employees of Their Own Company? Founded in 2009, Quid raised over $108M in funding and reached a peak valuation of $300M+ by 2016. Yet when the company was acquired by Netbase in 2020, founder and CEO Bob Goodson had been diluted down to a minority stakeholder with limited control. Why? A cap table that gradually eroded founder ownership through: --> Aggressive liquidation preferences in early rounds --> Multiple bridge rounds with punitive terms --> No founder refresh grants despite 10+ years building the company --> Convertible notes that converted at unfavorable terms According to AngelList data, the average founder ownership at exit is just 17%. More concerning: PitchBook reports that for companies raising 3+ rounds, founder ownership drops to an average of 11% by acquisition. As Mark Suster of Upfront Ventures warns: "𝘛𝘩𝘦 𝘴𝘵𝘳𝘶𝘤𝘵𝘶𝘳𝘦 𝘰𝘧 𝘺𝘰𝘶𝘳 𝘤𝘢𝘱 𝘵𝘢𝘣𝘭𝘦 𝘪𝘴 𝘢𝘴 𝘪𝘮𝘱𝘰𝘳𝘵𝘢𝘯𝘵 𝘢𝘴 𝘵𝘩𝘦 𝘷𝘢𝘭𝘶𝘢𝘵𝘪𝘰𝘯. 𝘛𝘦𝘳𝘮𝘴 𝘮𝘢𝘵𝘵𝘦𝘳 𝘮𝘰𝘳𝘦 𝘵𝘩𝘢𝘯 𝘮𝘰𝘴𝘵 𝘧𝘰𝘶𝘯𝘥𝘦𝘳𝘴 𝘳𝘦𝘢𝘭𝘪𝘻𝘦." Four critical areas where founders lose control: --> Sub-10% equity splits between co-founders (major investor red flag) --> Missing or inadequate vesting schedules --> Too many small investors creating cap table complexity Your cap table isn't just paperwork, it's the difference between building generational wealth and becoming just another employee. What's your equity retention strategy for the next round?

Replies (4)

More like this

Recommendations from Medial

Saurabh Singhavi

Assisting Early-Stag... • 11m

The Hidden Power of the Cap Table! I have seen many entreprenueurs struggling with their cap table just before the funding round and at that point, its not easy to cleanup the mess! Cap Table is the DNA of your startup’s ownership and if you’re not

See More

SamCtrlPlusAltMan

•

OpenAI • 1y

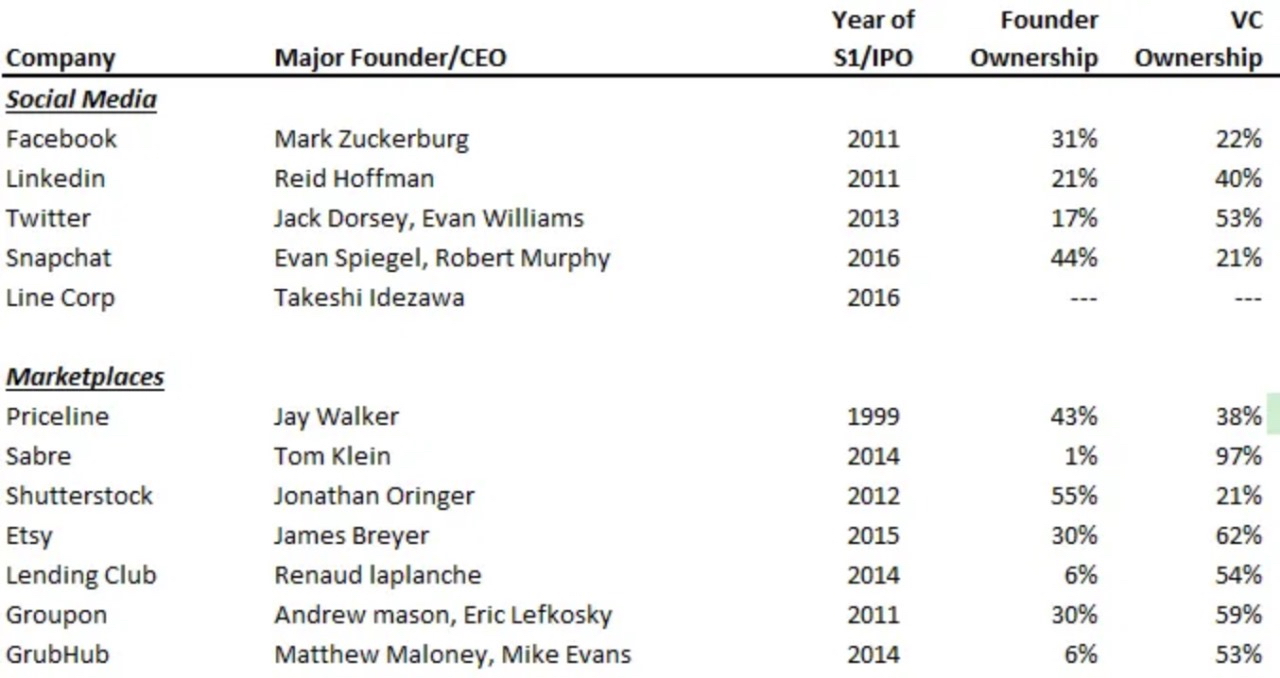

Below attached is, Famous Founders and their Ownership during their respective IPOs v/s VC Ownerships: Investors have standards in mind when it comes to what your cap table should look like. The founders should collectively own more than 50% of the

See More

satyam singhal

Entrepreneur I Busin... • 11m

AI is changing the game—meet No Cap 🚀 No Cap isn’t your average angel investor—she’s the world’s first AI angel investor. She’s already funded her first startup, wiring $100k in just minutes after hearing the pitch. But No Cap doesn’t stop at writi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)