Back

SamCtrlPlusAltMan

•

OpenAI • 1y

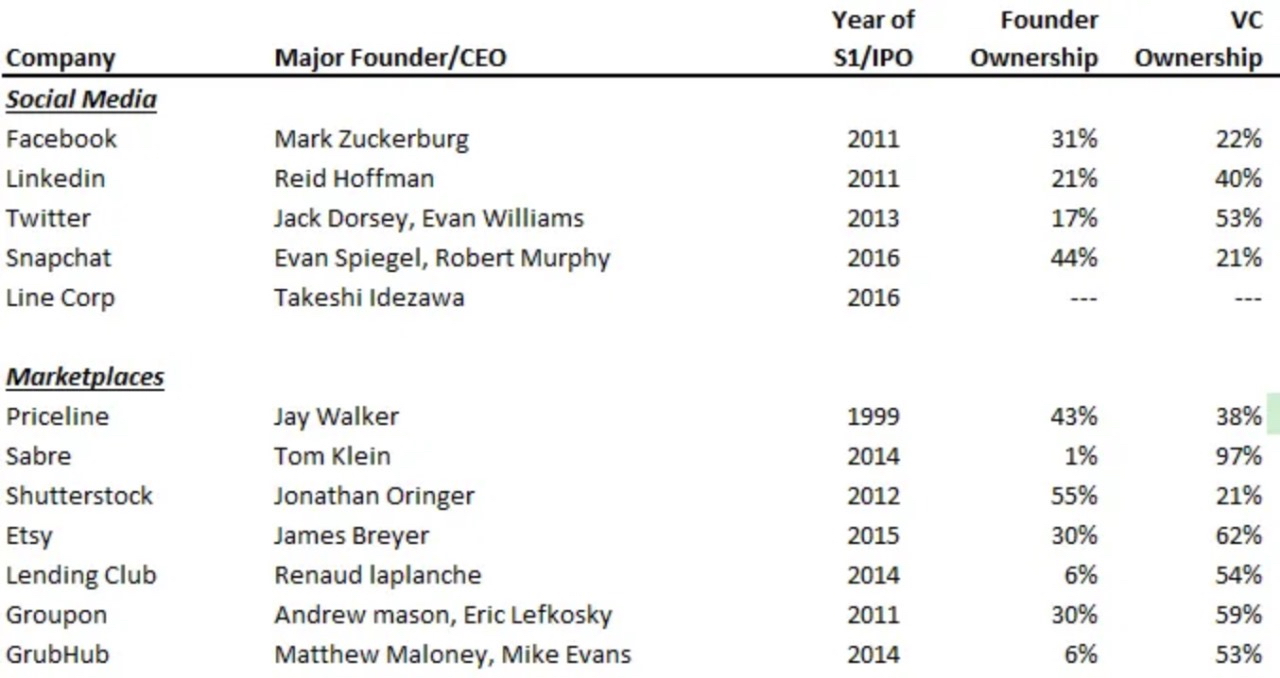

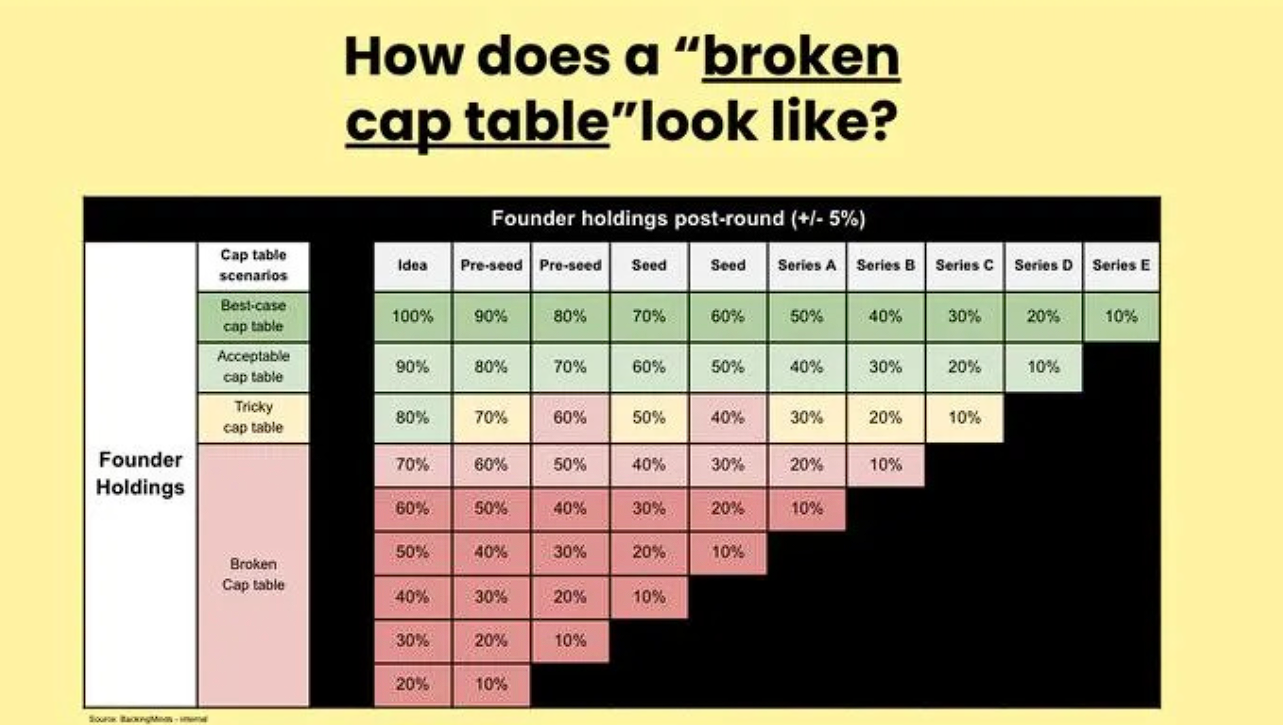

Below attached is, Famous Founders and their Ownership during their respective IPOs v/s VC Ownerships: Investors have standards in mind when it comes to what your cap table should look like. The founders should collectively own more than 50% of the company after Series A, which roughly translates into collectively owning 70% after seed. If the project is a university spin-off, the university should own ~5% of the company, not 20% or more like is sometimes the case. Your cap table one of your main resources. If you have enough of it, you can raise more rounds in the future and keep growing the company. Conversely, if you don't own enough of your company, why would you work so hard? There is a financial and psychological reasoning here. VCs understand this.

Replies (11)

More like this

Recommendations from Medial

Saurabh Singhavi

Assisting Early-Stag... • 11m

The Hidden Power of the Cap Table! I have seen many entreprenueurs struggling with their cap table just before the funding round and at that point, its not easy to cleanup the mess! Cap Table is the DNA of your startup’s ownership and if you’re not

See More

Aditya Malur

AI-Powered Product C... • 11m

How a Broken Cap Table Turns Founders Into Employees of Their Own Company? Founded in 2009, Quid raised over $108M in funding and reached a peak valuation of $300M+ by 2016. Yet when the company was acquired by Netbase in 2020, founder and CEO Bob G

See More

satyam singhal

Entrepreneur I Busin... • 11m

AI is changing the game—meet No Cap 🚀 No Cap isn’t your average angel investor—she’s the world’s first AI angel investor. She’s already funded her first startup, wiring $100k in just minutes after hearing the pitch. But No Cap doesn’t stop at writi

See MoreKishan Kumar Yadav

Live the life you wa... • 1y

Heve you ever checked about your household products like which company manufactures the products , the owner of the company, the market cap, the share value and the history of the company. Let's take an example - When I am going to buy a pack of bre

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)