Back

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

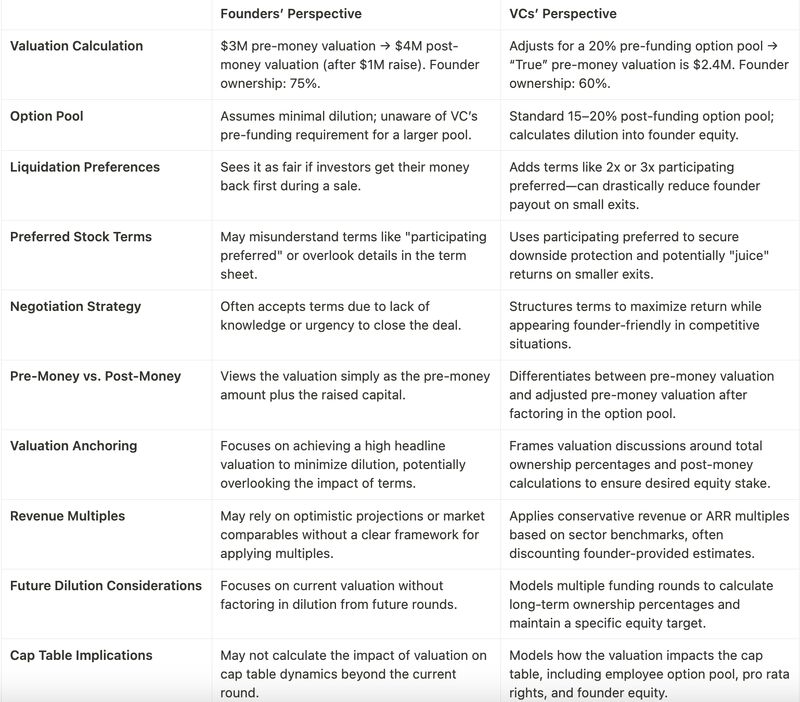

Venture Capital (VC) term sheets often include clauses that can have significant implications for founders and the future of their startups. Below are some critical clauses that founders should carefully evaluate: 1. Valuation and Equity Pre-Money

See More11 Replies

6

9

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)