Back

The Vc Girl

Not a Vc Yet, just O... • 6m

16 VC Terms I’m Learning to Become Sniper . Not a VC (yet), but I’m obsessed with how they think. TAM – Size of the $$ opportunity CAC – Cost to get a user LTV – Money a user brings over time Runway – Months till cash runs out Burn Rate – Monthly spend Moat – What makes the startup defensible Cap Table – Who owns what Dilution – % lost when raising Pre-seed → Series A – Funding stages Exit – How VCs cash out Syndicate – Angels investing together Carry – VC's cut of profits Down Round – Valuation drop 😬 Operator – Built before, not just advised Founder-Market Fit – Right person for the problem Deck – The pitch presentation .

Replies (6)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Shreyash Rajgaria

Founder & CEO at BIP... • 8m

💥 From "Bhai, startup register hogaya!" to "Investor ne deck mein kya bola?" A founder’s journey, brutally honest edition 👇 🚀 Incorporation: Startup registered. Still using personal UPI for business. Founder title: CEO / CMO / Office Boy (All-in-

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

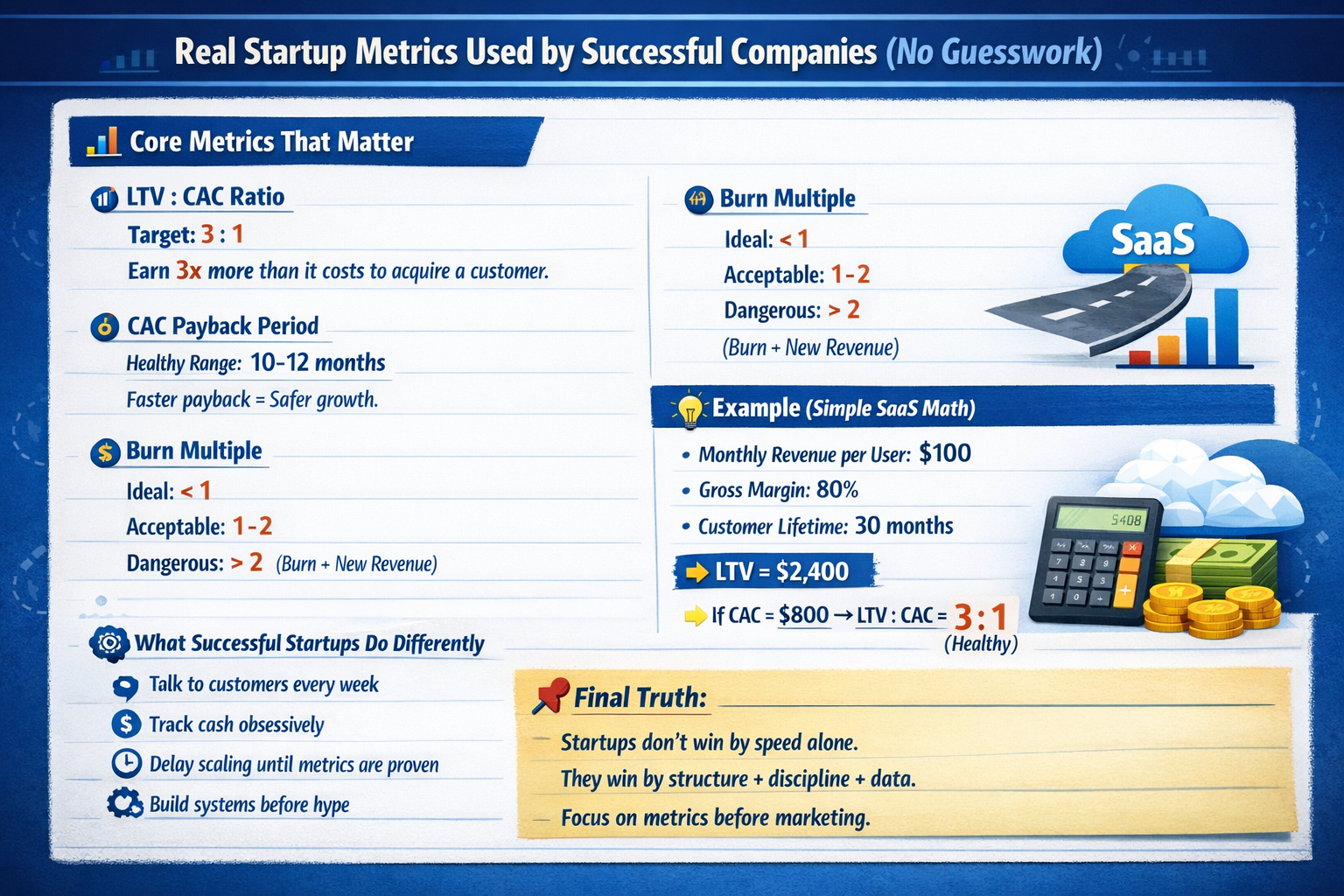

Why Metrics Matter More Than Ideas in VC Funding. 🚀✨️ Be good at your numbers. You’ve got a bold vision and a slick pitch deck. But the moment you step into a VC meeting, the conversation shifts from your idea to your numbers. Why? Because VCs d

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)