Back

Vivek Joshi

Director & CEO @ Exc... • 7m

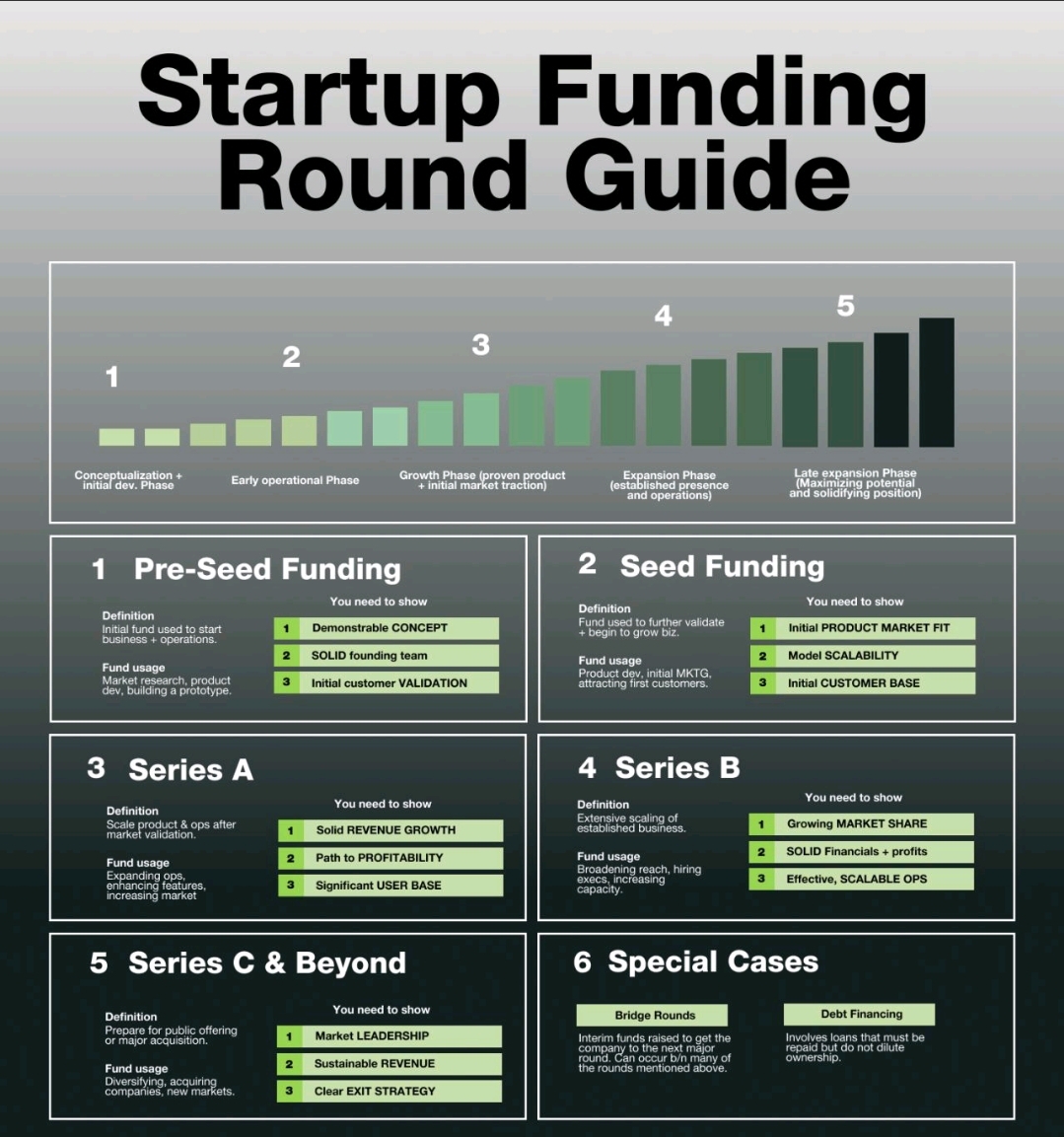

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potential. In exchange, they receive equity, aiming for substantial returns through an "exit" (IPO or acquisition). Startup funding progresses through distinct stages: Pre-Seed/Seed: Initial capital from founders, friends & family, or angel investors to validate ideas and build a Minimum Viable Product (MVP) Series A: The first major VC round, focusing on refining product-market fit and user acquisition Series B, C, and Beyond: Subsequent rounds for scaling operations, market expansion, and preparing for an exit Benefits of VC: Beyond capital, VCs offer invaluable mentorship, strategic guidance, industry networks, and credibility, accelerating growth Risks for Founders: Dilution of ownership, pressure for rapid growth, potential loss of control

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Got a great product, team, and traction but VCs are still passing?here are 6 common reasons: * Market Size Too Small: Your concept's proven, but is the total addressable market large enough for VC-level returns (10x+)? VCs seek massive scale, not ju

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Crucial KPIs for founders, from inception to exit: Pre-Seed: Validate your idea! Focus on Problem-Solution Fit (qualitative user interviews, early sign-ups). Seed: Prove initial traction. Track Customer Acquisition Cost (CAC), Conversion Rates, and

See More

Download the medial app to read full posts, comements and news.