Back

Vivek Joshi

Director & CEO @ Exc... • 7m

Got a great product, team, and traction but VCs are still passing?here are 6 common reasons: * Market Size Too Small: Your concept's proven, but is the total addressable market large enough for VC-level returns (10x+)? VCs seek massive scale, not just a solid niche. * No Exponential Growth Path: Traction's good, but VCs need to see how their capital fuels rapid, exponential growth. * Weak Unit Economics: Your business model might be proven, but are your Customer Acquisition Costs (CAC) low, and Lifetime Value (LTV) high? * Lack of Defensibility/Too Much Competition: Even if you're good, do you have a sustainable moat? VCs worry about crowded markets or easily replicated solutions. What makes you truly unique and hard to copy? * Unclear Exit Potential: VCs invest to exit. They need a clear, plausible path to a big acquisition or IPO. * Missing "X-Factor" / Visionary Story: Beyond a good deck, VCs look for audacious vision and compelling storytelling. Is your passion palpable?

More like this

Recommendations from Medial

Thakur Ambuj Singh

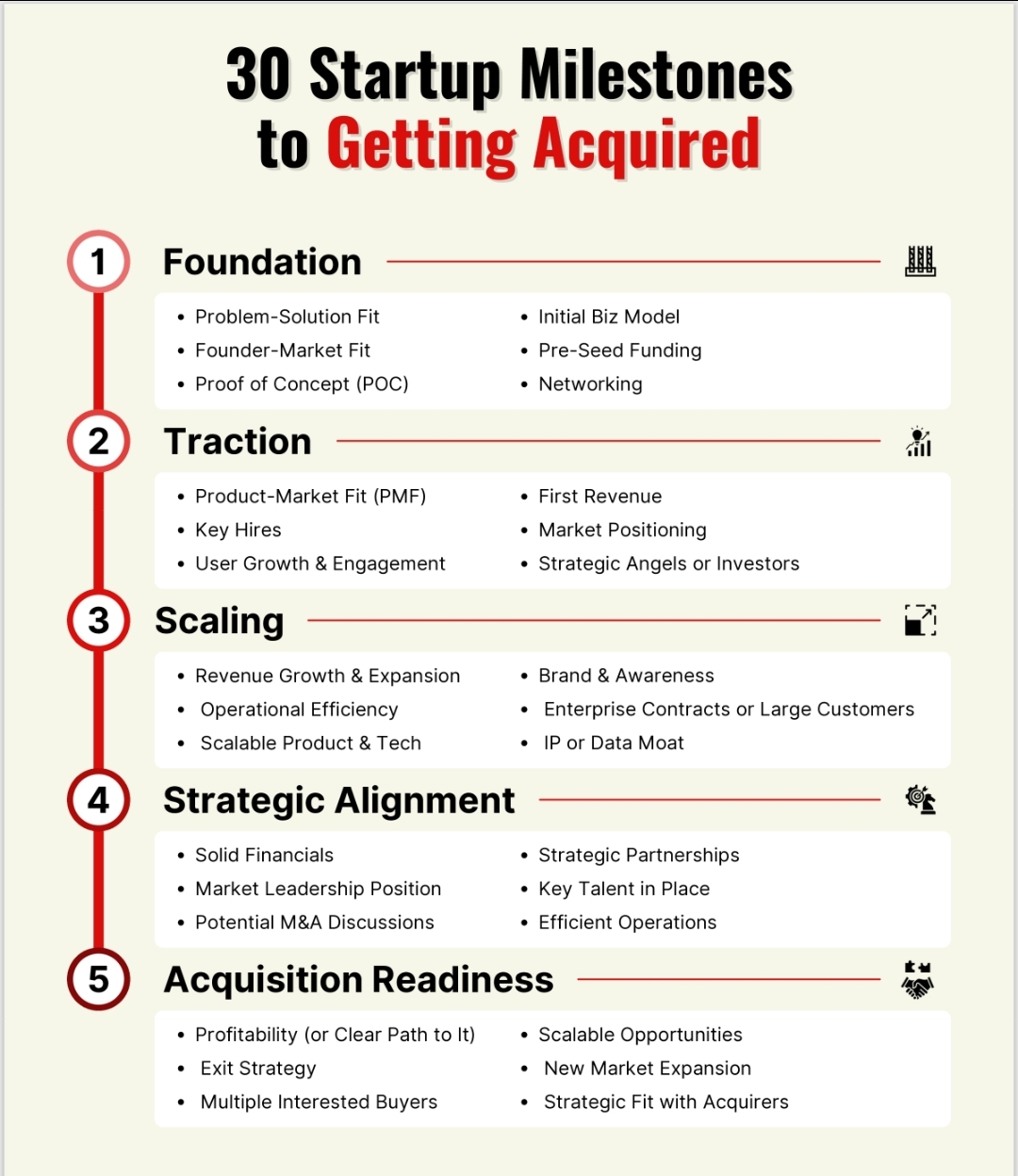

Entrepreneur & Creat... • 10m

Starting from today, be ready to build a high value startup! 🚀 Here are the 30 Startup Milestones to Getting Acquired step by step from foundation to acquisition readiness. Master these stages and you'll be on the path to a successful exit! 💼💰🔥

Sahil Bodare

From Code to Capital... • 2m

🚀 Launching a game-changing urban mobility startup using AI/ML for real-world impact. Proven data analysis expertise, no-code prototypes ready, and a clear path to market. Seeking seed funding from angels/VCs passionate about tech startups. Strong t

See MoreThakur Ambuj Singh

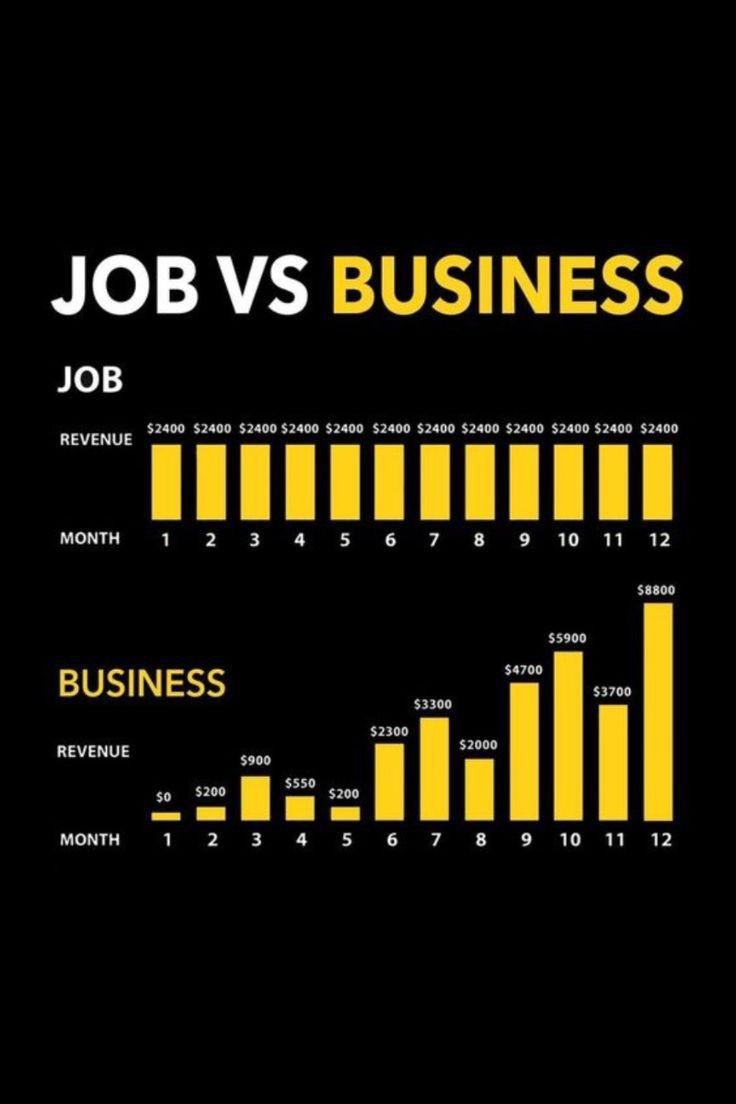

Entrepreneur & Creat... • 11m

Job vs. Business: The Growth Mindset A job offers stability but limits growth. A business starts slow, with ups and downs, but has the potential for exponential returns. The real question is: Do you want predictability or unlimited potential? Entr

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)