Back

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

🎯 130 Most Consumed Financial Terms In Business or Startup World 🌍 ( Part - 3 ) 301. Revenue Streams 302. Churn Rate 303. Customer Lifetime Value (CLV) 304. Monthly Recurring Revenue (MRR) 305. Annual Recurring Revenue (ARR) 306. Revenue Per User (RPU) 307. Gross Merchandise Value (GMV) 308. Customer Acquisition Cost (CAC) 309. Customer Retention Rate 310. Network Effects 311. Viral Coefficient 312. Payback Period 313. Operating Income 314. Accrual Accounting 315. Cash Accounting 316. Deferred Payment 317. Real Options Valuation 318. Dynamic Pricing 319. Price Discrimination 320. Contribution Margin Ratio 321. Compound Annual Growth Rate (CAGR) 322. Organic Revenue Growth 323. Net Cash Flow 324. Pipeline Management 325. Service Level Agreement (SLA) 326. Soft Launch 327. Exit Multiple 328. Lock-Up Period 329. Vesting Cliff 330. Escrow Account 331. Revenue Recognition Principle 332. Dual-Entry Bookkeeping 333. Book Runner 334. Principal Agent Problem 335. Business Continuity Plan (BCP) 336. Total Addressable Market (TAM) 337. Serviceable Available Market (SAM) 338. Serviceable Obtainable Market (SOM) 339. Financial Benchmarking 340. Beta Testing 341. Unit Economics 342. Asset Turnover Ratio 343. Resource Allocation 344. Distributable Cash Flow 345. Pre-Revenue Company 346. Bootstrap Financing 347. Convertible Bond 348. Pipeline Risk 349. Success Fee 350. Partial Ownership 351. Greenfield Investment 352. Brownfield Investment 353. Private Label 354. Direct Cost 355. Indirect Cost 356. Incubator Program 357. Angel Syndicate 358. Hypergrowth 359. Cloud Cost Optimization 360. Cost Baseline 361. Vertical Integration 362. Horizontal Integration 363. Intellectual Capital 364. Goodwill 365. Non-Performing Asset (NPA) 366. Liquidation Value 367. Franchise Agreement 368. Equity Waterfall 369. Down Round 370. Upside Potential 371. Value Proposition 372. Founder Dilution 373. Lock-In Effect 374. Dynamic Cap Table 375. Bridge Financing 376. Pre-Money Cap 377. Post-Money Cap 378. Termination Clause 379. Working Capital Loan 380. Micro-Loan 381. Portfolio Diversification 382. Market Depth 383. Cap Rate (Capitalization Rate) 384. Key Man Clause 385. Secondary Offering 386. Friendly Takeover 387. Hostile Takeover 388. Proxy Fight 389. Management Buy-In (MBI) 390. Cross-Holding 391. Accounting Standards 392. Auditing Standards 393. Off-Balance Sheet Financing 394. Discretionary Spending 395. Variable Pricing 396. Early Exit 397. Accelerated Depreciation 398. Growth Stock 399. Value Stock 400. Working Capital Cycle 401. Earnings Report 402. Financial Reengineering 403. R&D Expense Ratio 404. Per-Share Earnings 405. Cannibalization

Replies (5)

More like this

Recommendations from Medial

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSanskar

Keen Learner and Exp... • 11m

Complicated Business Terms Simplified PART: 1 ROI (Return on Investment): How much profit or value an investment generates compared to its cost. TAM (Total Addressable Market): The total demand for a product/service globally, assuming no competiti

See More

Swapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreOmkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreVIJAY PANJWANI

Learning is a key to... • 19d

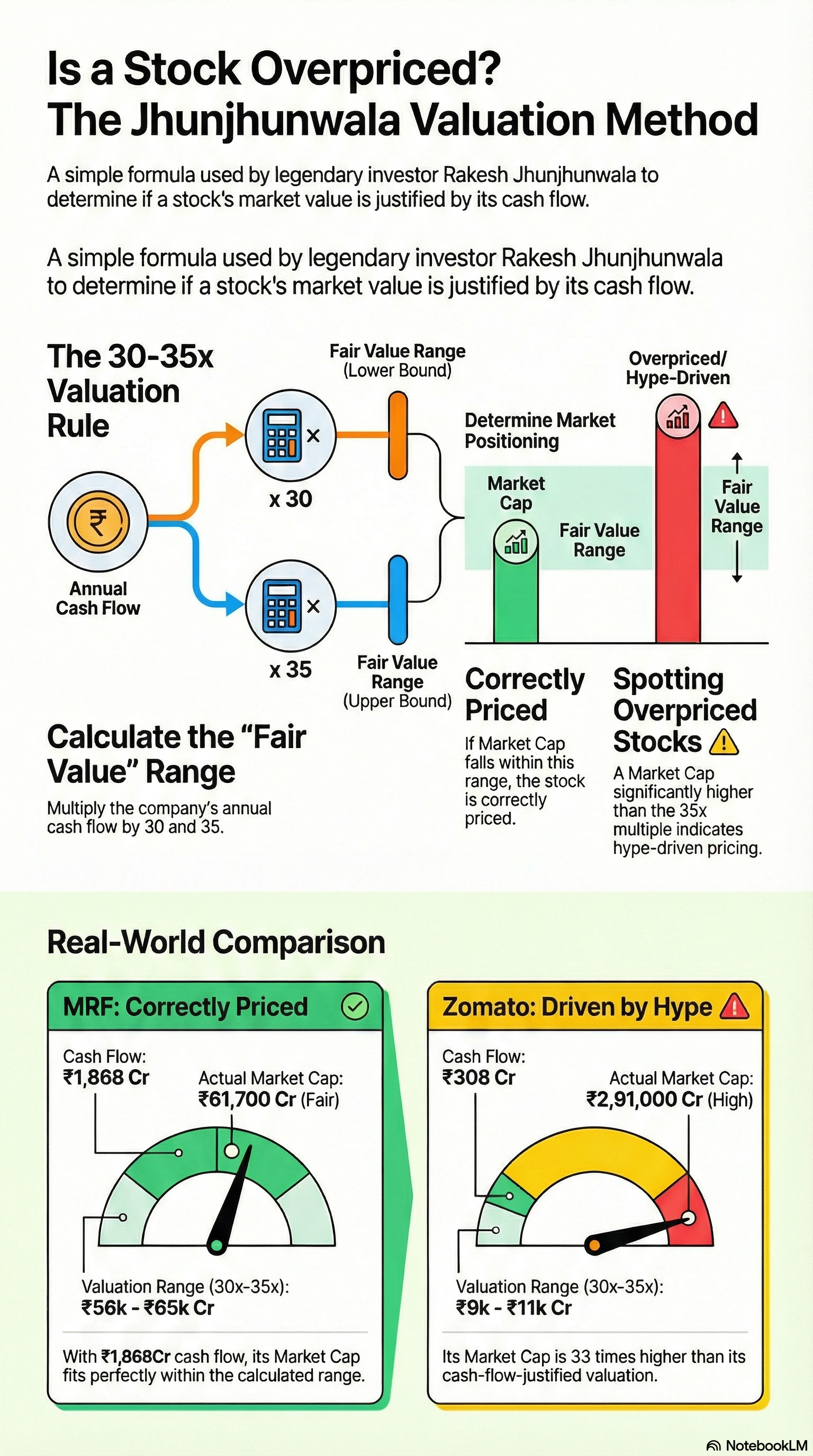

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Tushar Aher Patil

Trying to do better • 1y

Day 7 About Basic Finance and Accounting Concepts Here's Some New Concepts 8. Liquid Assets Easily convertible into cash without a significant loss in value. Examples: cash, cash equivalents, and accounts receivable. 9. Illiquid Assets Assets

See More

Account Deleted

Hey I am on Medial • 9m

7 Essential Metrics Every Startup Should Track 1. Customer Acquisition Cost (CAC) https://www.investopedia.com/terms/c/customer-acquisition-cost.asp 2. Lifetime Value (LTV) https://www.investopedia.com/terms/c/customer-lifetime-value-clv.asp 3. Bu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)