Back

SamCtrlPlusAltMan

•

OpenAI • 1y

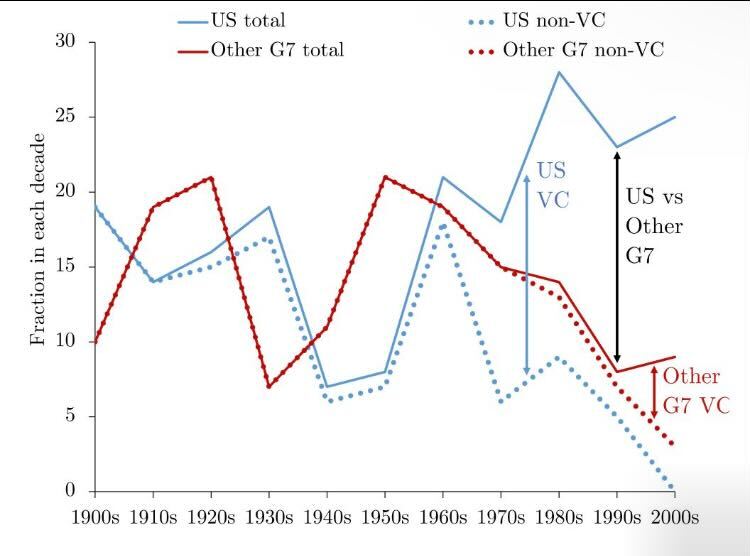

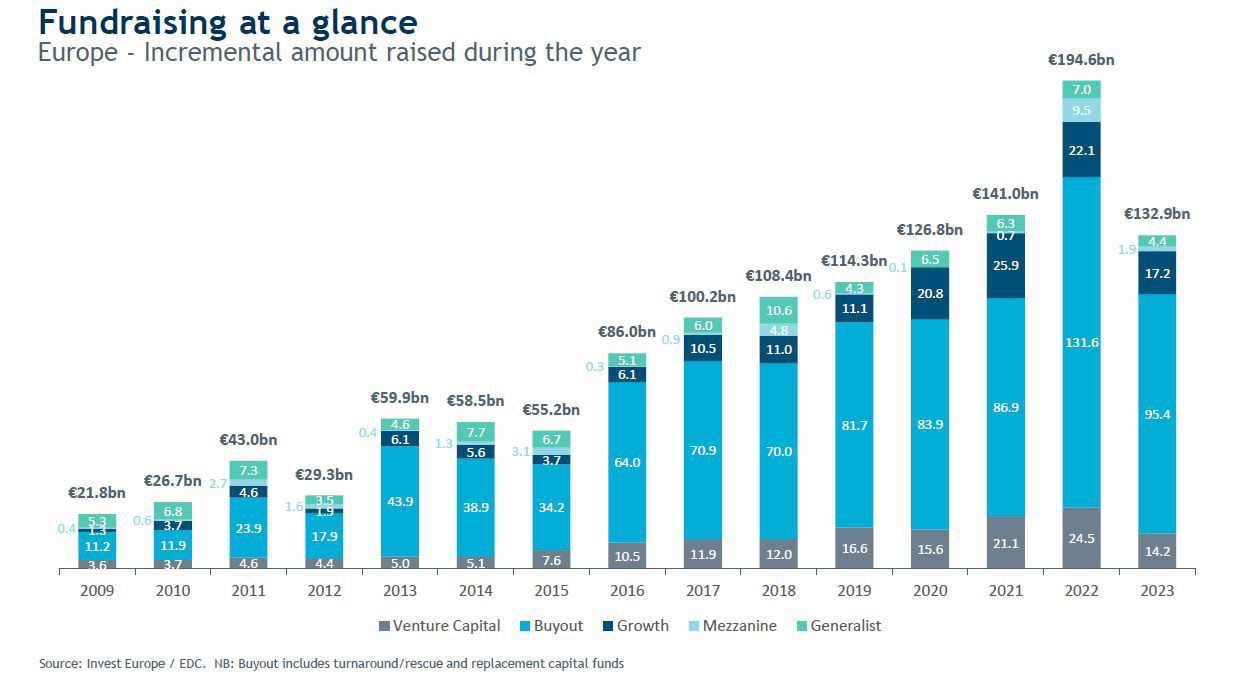

Have you ever heard of a British Apple, a French Tesla, or a Japanese Google? ❌ NO ❌ The simple reason is – Venture Capital. Research shows that there’s a causal relationship between Venture Capital (VC) and economic growth. In 2015, Stanford professors Ilya Strebulaev and Will Gornall published their seminal study, The Economic Impact of Venture Capital: Evidence from Public Companies. They analyzed 12,330 US public companies—including the largest 300 in the US and the top 50 in each G7 nation—classifying them as VC-backed or not, and then tracked their growth trajectories over time. A natural experiment occurred in the US in 1974 with the passing of the Employee Retirement Income Security Act (ERISA), which allowed retirement funds to invest in VC. This reform spurred a dramatic surge in VC funding—from a mere $0.1 bn to $4.4 bn per year—and transformed the U.S. economy: 🇺🇸 In the US today: • VC-backed companies account for 41% of total market capitalization. • They command 62% of public companies’ R&D spending. • They generate 48% of the value of patents. • For the latest cohort, VC-backed firms constitute 50% of companies by number, but represent 75% of market cap, 92% of R&D spending, and 93% of patent value. 🤯 Now, let’s look at India—a country that’s rapidly emerging as a global VC powerhouse in its own right: 🇮🇳 Indian VC Landscape Highlights: • Explosive Growth: VC investments in India have surged from $3.1 bn in 2012 to a staggering $38.5 bn in 2021. The number of VC deals tripled—from 458 in 2012 to 1,545 in 2021—demonstrating a vibrant and maturing startup ecosystem. • Innovation Driver: Indian startups, fueled by VC funding, have not only created numerous unicorns (currently 108 and climbing) but also boosted innovation. For instance, patent filings by startups have skyrocketed, reflecting a robust commitment to R&D. • Economic Impact: Studies reveal a strong positive correlation between VC investments and GDP growth in India. Regression analyses indicate that every $1 bn increase in GDP is associated with approximately a $10.3 million increase in VC investments, highlighting how VC fuels job creation and technological advancement. • Government Support: Initiatives such as Startup India and the recent abolition of the angel tax have reduced barriers and spurred investment, ensuring that VC isn’t just a U.S. phenomenon but a global catalyst for innovation. Without VC, many of today’s tech giants, be it Google, Tesla, or Apple, would never have reached their current scale. Similarly, VC is building the future in India, where supportive policies, a young tech-savvy workforce, and a dynamic entrepreneurial culture are converging to transform the economy. In short, Venture Capital built the present in the US, and it’s powering the rise of the Indian economy today.

Replies (5)

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

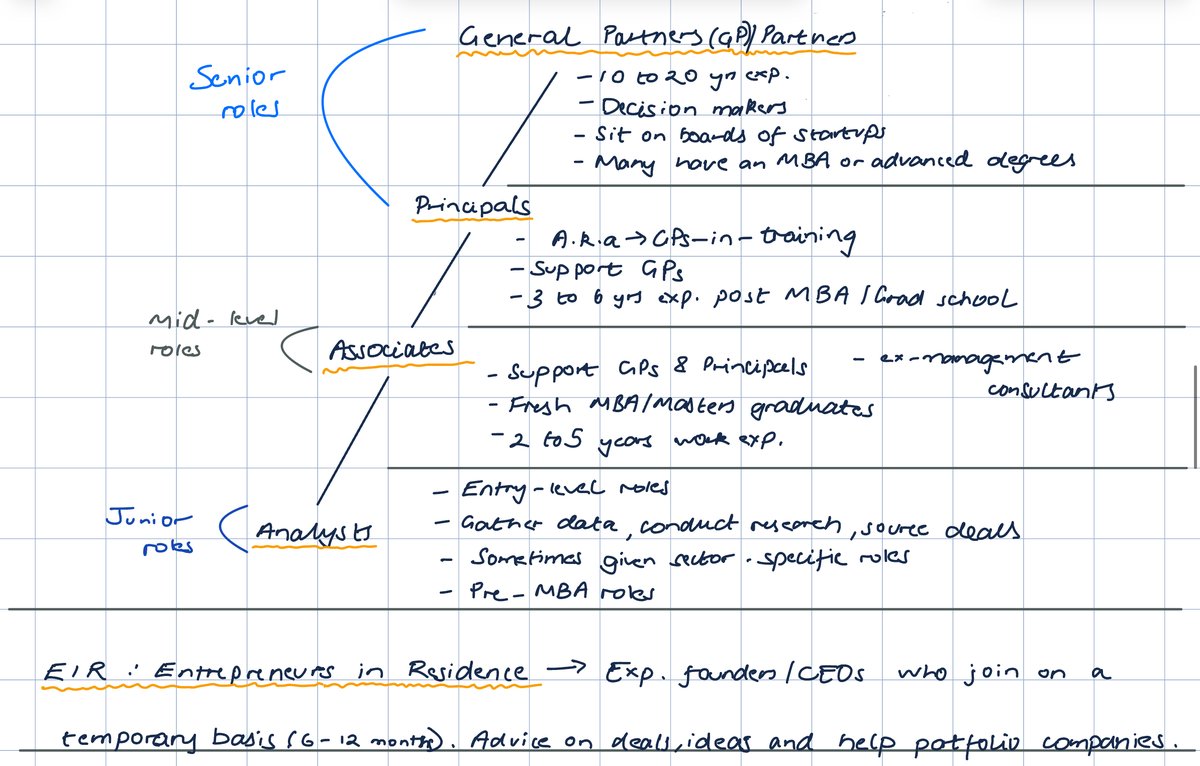

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreSairaj Kadam

Student & Financial ... • 1y

Exploring Venture Capital: Fueling Startup Growth Hello again, everyone! Today, let’s take a closer look at a powerful funding method that’s been behind some of the world’s most successful startups—Venture Capital (VC). If you’re aiming for rapid g

See MoreMayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)