Back

Arya Ketan

curious • 1y

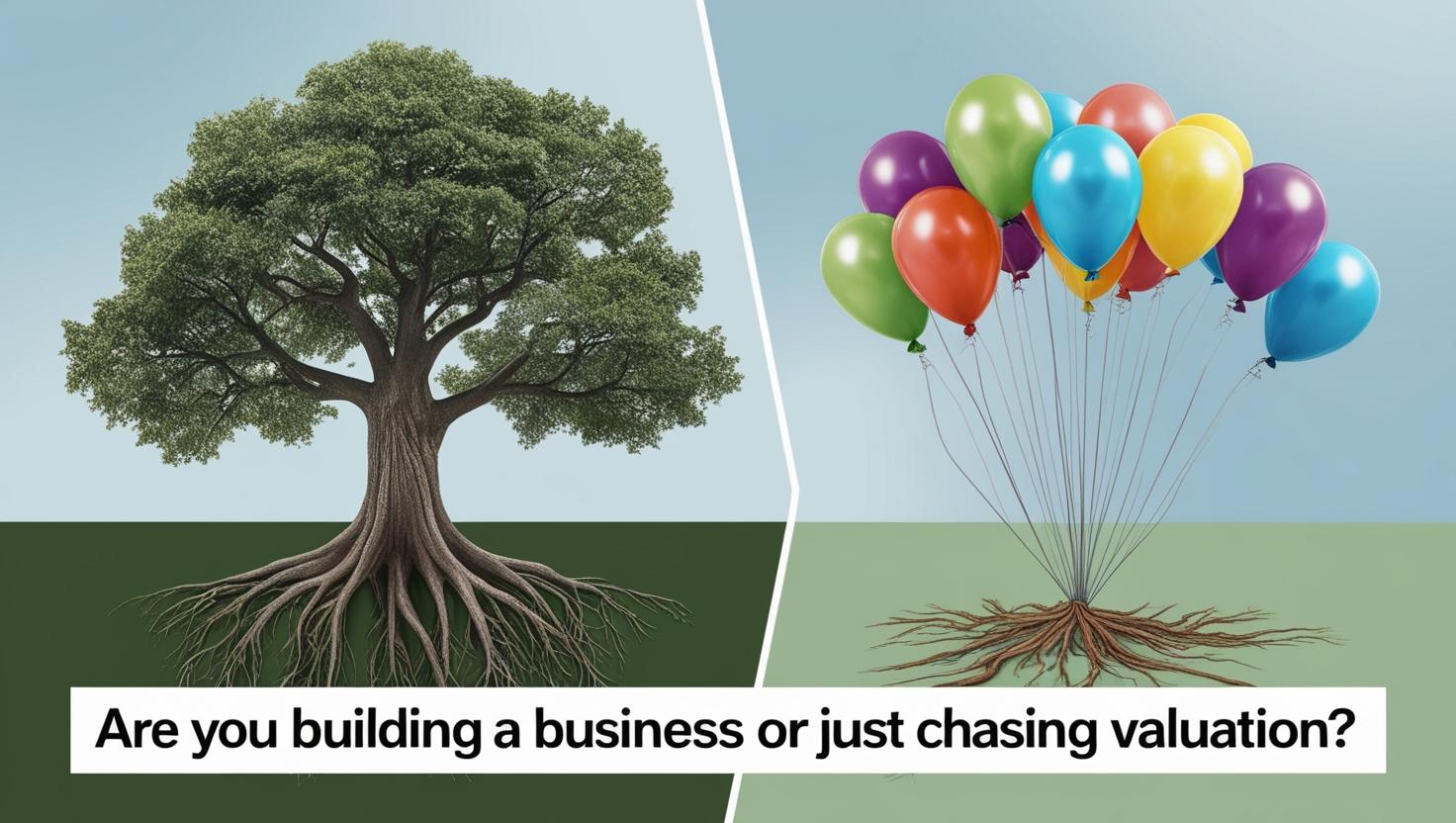

Startups in the US create actual value, while startups in India focus on expanding valuations. Value creates a strong country, and valuation creates the lifestyles of founders and venture capitalists... #startup #funding #vc

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 7m

Current Economic Headwinds for VC Funders The VC landscape in mid-2025 is grappling with significant economic shifts. After a boom, VC funders face a more disciplined environment due to higher interest rates, persistent inflation, and a recalibration

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Discover how VC investment reshapes a company's valuation in our latest video, "VC Investment: Beyond Just Cash!" It's not just about the numbers; it's about transforming potential into promise. Learn how venture capitalists validate visions, attract

See MoreVivek Joshi

Director & CEO @ Exc... • 6m

Discover how VC investment reshapes a company's valuation in our latest video, "VC Investment: Beyond Just Cash!" It's not just about the numbers; it's about transforming potential into promise. Learn how venture capitalists validate visions, attract

See MoreVatan Pandey

Founder & CEO @Zyber... • 10m

🚀 Business Growth or Just Valuation? Many startups chase high valuations but forget the core of business—profitability, sustainability, and real customer value. 🔴 Reality Check: ❌ Valuation without solid revenue ❌ Scaling too fast, weak foundatio

See More

Mayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreAccount Deleted

Hey I am on Medial • 1y

Hello Guys, I am starting one series of content regarding to the Finance, Startups, Venture Capital Firms and Investment Banking etc.📈💭🚀 Let's Discuss with How VC's determine the valuation of startup 🤩🚀💯❓ •TAM : See the Total Addressable Mark

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)