Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

I sometimes worry, about what’s happening in the Indian VC ecosystem 😅😅 Based on a recent chart shared by seasoned VC Vinit Bhansali, in the last 10 years, the number of VC firms in India has grown by almost 25x. And based on an assertion by Peak XV Partners’ Rajan Anandan, India-centric VCs are sitting on top of over $20bn of dry powder. .. This is good for startups. -> With time passing, the pressure is only going to grow for the VCs to deploy that capital -> After all, they have a defined fund life of 7-10 years and have to deliver returns to their investors, for which deployment is the only first step -> And the more the delay, the more will be pressure to invest in early-stage startups, because they will promise prospects of better returns in a smaller time frame So, sounds good for the startups in the medium to longer term. .. But, think about it. -> If you talk to seasoned VCs, it’s a common grouse that many who have turned VCs are simply not made to be in this business -> They tell you, the space has seen an influx of so many operators when most have never been much about investing even in their personal lives -> And they add that a bad VC does more damage to the founders, than excess money .. And the biggest fact is- If you look at mature ecosystems like the US, most VCs fail to even beat the basic stock market returns. -> So, in a market like India where the ecosystem is yet to mature, and has seen a 25x jump in the number of VCs, who are now sitting on a crazy amount of dry powder, will fate be any different? -> Plus, the influx of inexperienced investors is a major concern for any asset class. Reckless investments distort the market first, but lead to big losses eventually I hope I am wrong here, but even though I am happy about the maturing Indian VC ecosystem, I hold my fears. What do you think?

Replies (5)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC- DAY-14 🎯What is Hurdle Rate? 🎯What is Carry Fees? 🎯The preferred returns are also called as “Hurdle Rate” in VC & P.E Funds. It is the threshold return that LP’S should receive prior GP’S receive. In developed markets, The hurdle

See MoreManik Gruver

•

Macwise Capital • 8m

You spend months understanding your customer's pain, but VCs skip your problem slide in 30 seconds for XYZ reasons. Since VCs rush through problem statements, how can founders ensure that VCs understand the depth of problem? #39 # Started #VC #Fundr

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

The VC landscape is shifting. Funders are grappling with critical challenges impacting the entire startup ecosystem. Key VC Hurdles: * Exit Uncertainty: IPOs are slow, M&As are down. VCs are holding investments longer, impacting liquidity for new de

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-15 What are Additional Returns? What is the Catch-Up Clause? In Developed Markets, The structure is in 2-20% where 2 is Management Fees & 20 is Additional Returns.Additional Returns & 2-20 structure is not ideal in Indian AIF Market

See MoreAdithya Pappala

250Tn Global Impact Ventures • 3m

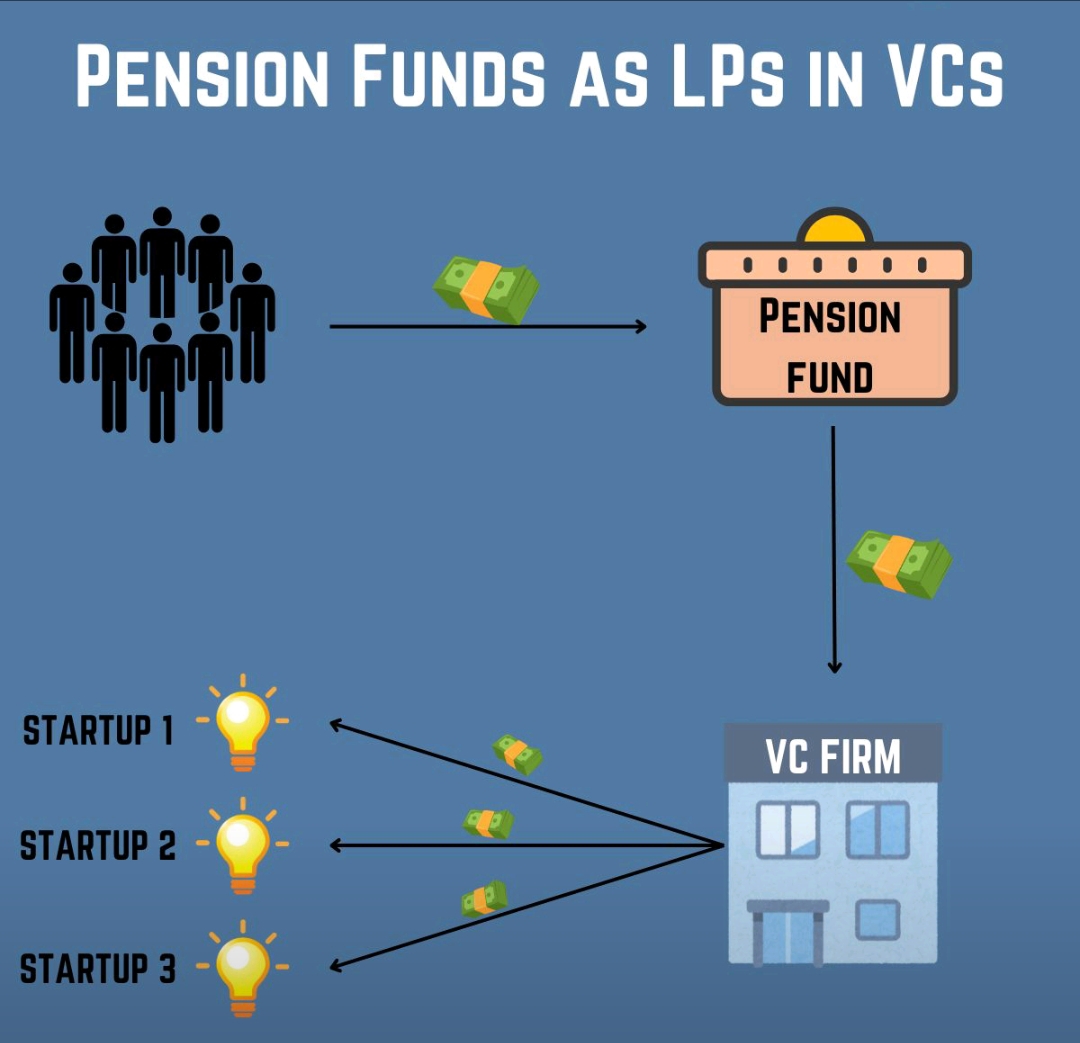

Insaneeeee! 99% of Indian-founders think VCs are cash-rich In reality, It's not. For those who aren't well aware about- Startups raise from VC VC raises from L.P'S & L.P's do the business 🔁Repeat VCs are not cash-rich. I had a line that struck

See MoreMayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)