Back

Vivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets of startup success with our comprehensive guide on Decoding Unit Economics! In this video, we break down the critical components that can determine the fate of your early-stage venture. Learn how to define your unit, calculate Customer Acquisition Cost (CAC), and determine Customer Lifetime Value (LTV). We’ll also explore the importance of Contribution Margin, Payback Period, and benchmarking your ratios for optimal growth. Understanding these metrics can mean the difference between thriving and diving into cash burn. Don’t miss out on these essential insights! Like and share this video to help other entrepreneurs grasp the importance of unit economics. #StartupSuccess #UnitEconomics #Entrepreneurship #CAC #LTV #BusinessGrowth #entrepreneurship #startupcompany #excessedgeexperts #smallbusiness #excessedgeexpertsconsulting #business #followmychannel #entrepreneur #likeandsubscribe

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreKarnivesh

Simplifying finance.... • 1m

I’ve noticed that many startups celebrate users, orders, and revenue before asking the hardest question: does each unit actually make money? That’s what unit economics reveals. Strip away the hype, and it comes down to whether a business earns more

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Unlock the secrets to sustainable growth in our latest video, "Unlocking Scale: The Science of Smart Growth." Discover how startups and corporates can expand without sacrificing unit economics. We delve into five key strategies: System Dynamics Model

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

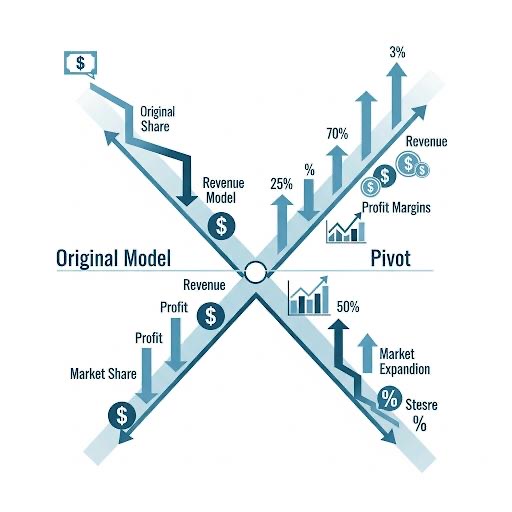

Pivoting -When do the numbers tell you it's time to drastically re-evaluate your startup's core business model?" Financial Red Flags: Consistently Negative Unit Economics: Losing money on every sale with no clear path to profit? Your Customer Acquis

See More

Nikhil Raj Singh

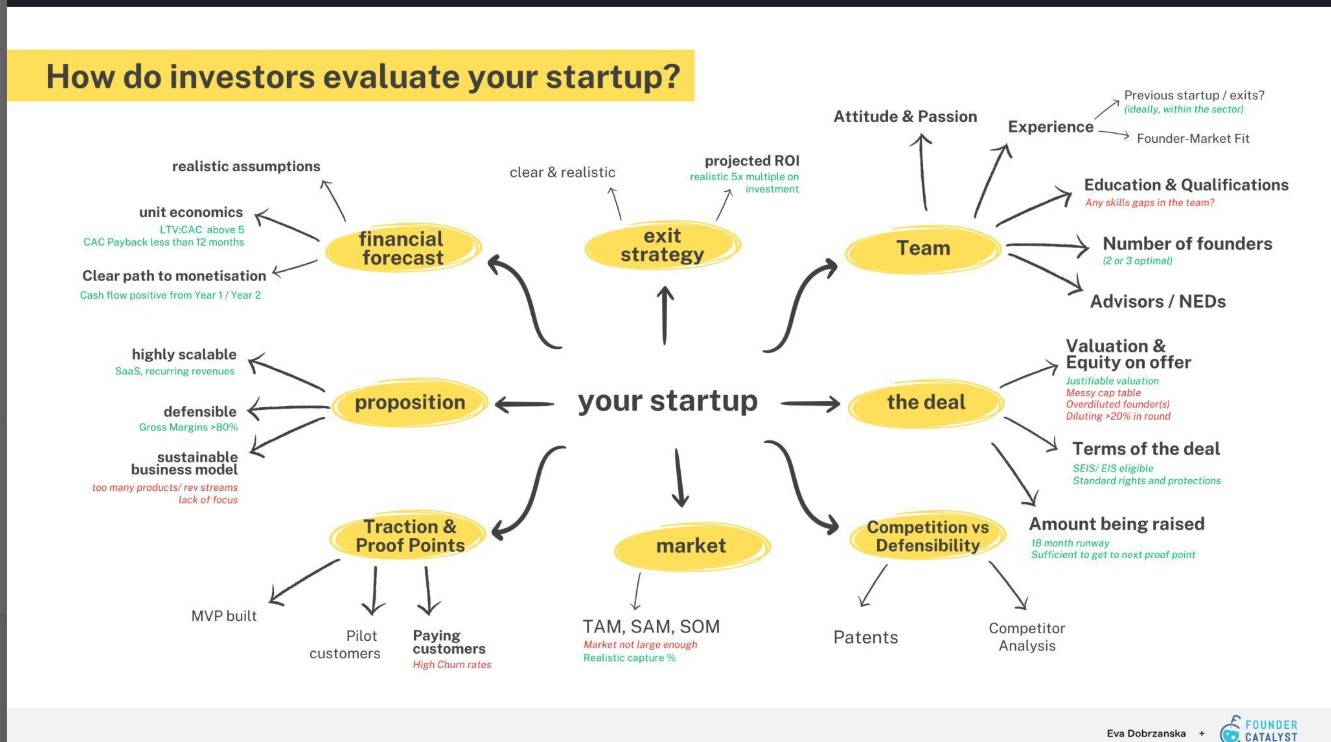

Entrepreneur | Build... • 11m

Whenever any Investor evaluates a startup then they focus on these criteria.. 1. A team with relevant experience is super important- their past working experience, educational qualifications, etc. 2. Next is the market opportunity- how big is your

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)