Back

ADITYA

Aditya Kumar Jha | P... • 5m

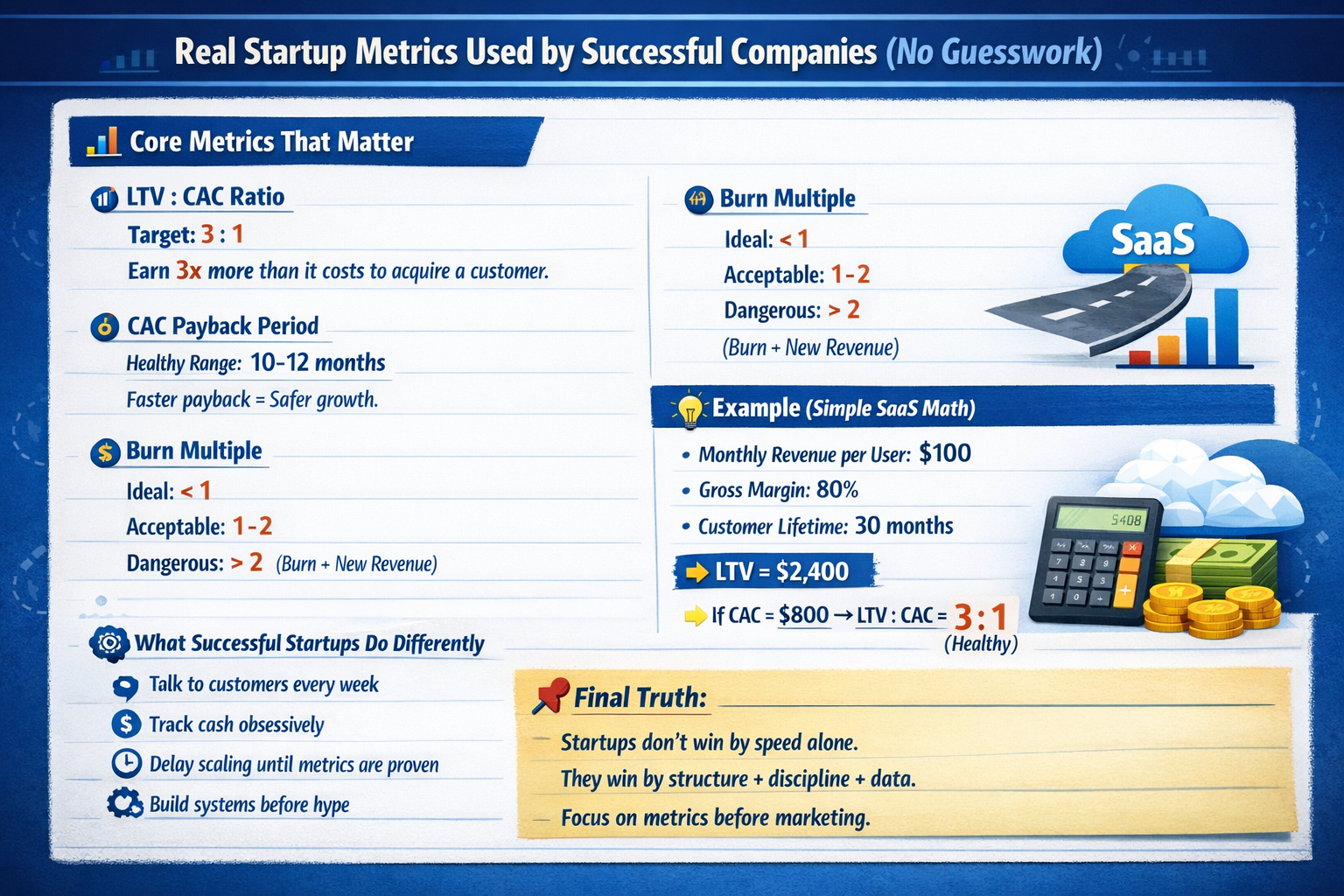

Day 13 of my 30-day Business & Entrepreneurship series . Building and testing your product is one thing — but knowing if your business is healthy is another. That’s where metrics like CAC, LTV, Churn, and Retention come in. 📊 Here’s the breakdown 👇 CAC (Customer Acquisition Cost): How much does it cost you to get one new customer? Marketing, ads, sales — it all counts. LTV (Lifetime Value): How much revenue will a customer generate for you over their entire journey? High retention = high LTV. The Golden Ratio (LTV:CAC): A healthy business often aims for 3:1 — customers bring in 3x more value than they cost to acquire. Churn: The % of customers who leave over time. Even a small churn can kill growth if not fixed. Retention: The opposite of churn — keeping customers engaged and loyal is where real growth happens. AARRR Funnel (Pirate Metrics): Acquisition → Activation → Retention → Referral → Revenue. Master this flow, and you’ll see exactly where your growth leaks are. 👉 The big takeaway? Revenue tells the story today, but CAC, LTV, and churn predict the story tomorrow. Read here - https://www.linkedin.com/pulse/day-13-cac-ltv-churn-aditya-kumar-jha-er55c See you on Day 14 — where we’ll dive into unit economics and how to make numbers your superpower. hashtag#Entrepreneurship hashtag#Startups hashtag#CAC hashtag#LTV hashtag#Churn hashtag#Retention hashtag#30DayChallenge hashtag#LearnAndBuild

More like this

Recommendations from Medial

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreSwapnil gupta

Founder startupsunio... • 9m

🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Value (LTV) 8. Churn Rate 9. Unit

See MoreManu

Building altragnan • 10m

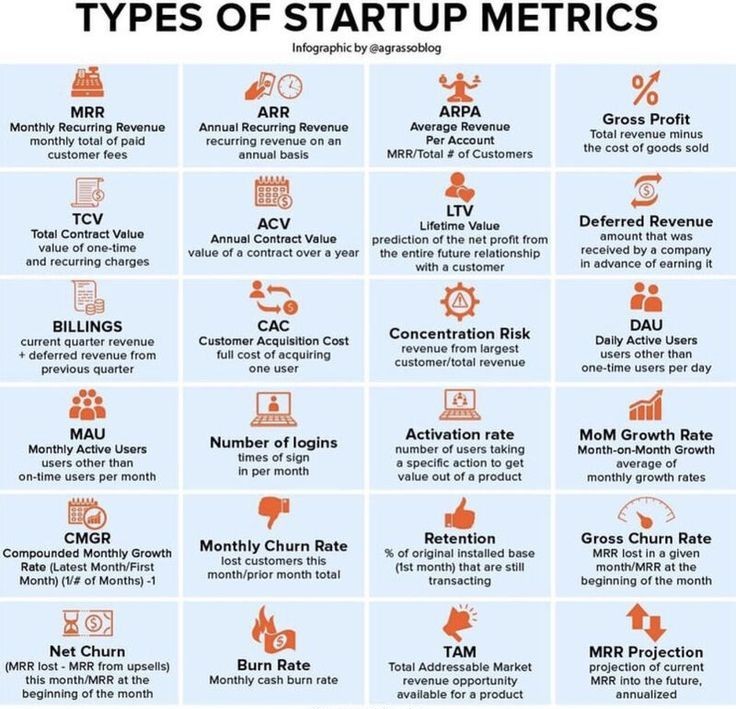

This infographic shows key startup metrics. MRR is monthly recurring revenue, while ARR is annual recurring revenue. ARPA shows average revenue per customer. Gross Profit is revenue minus costs. TCV and ACV measure contract values. LTV predicts total

See More

Account Deleted

Hey I am on Medial • 9m

7 Essential Metrics Every Startup Should Track 1. Customer Acquisition Cost (CAC) https://www.investopedia.com/terms/c/customer-acquisition-cost.asp 2. Lifetime Value (LTV) https://www.investopedia.com/terms/c/customer-lifetime-value-clv.asp 3. Bu

See More

Centriagal performance marketing agency

24 karat pure meta a... • 2m

The Real Metrics That Grow a Business Most businesses fail because they run ads without tracking three critical metrics: 1️⃣ ROAS (Return on Ad Spend) ROAS tells you how much revenue you generated from every ₹1 spent on ads. For example, if you sp

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)