Back

Karnivesh

Simplifying finance.... • 2m

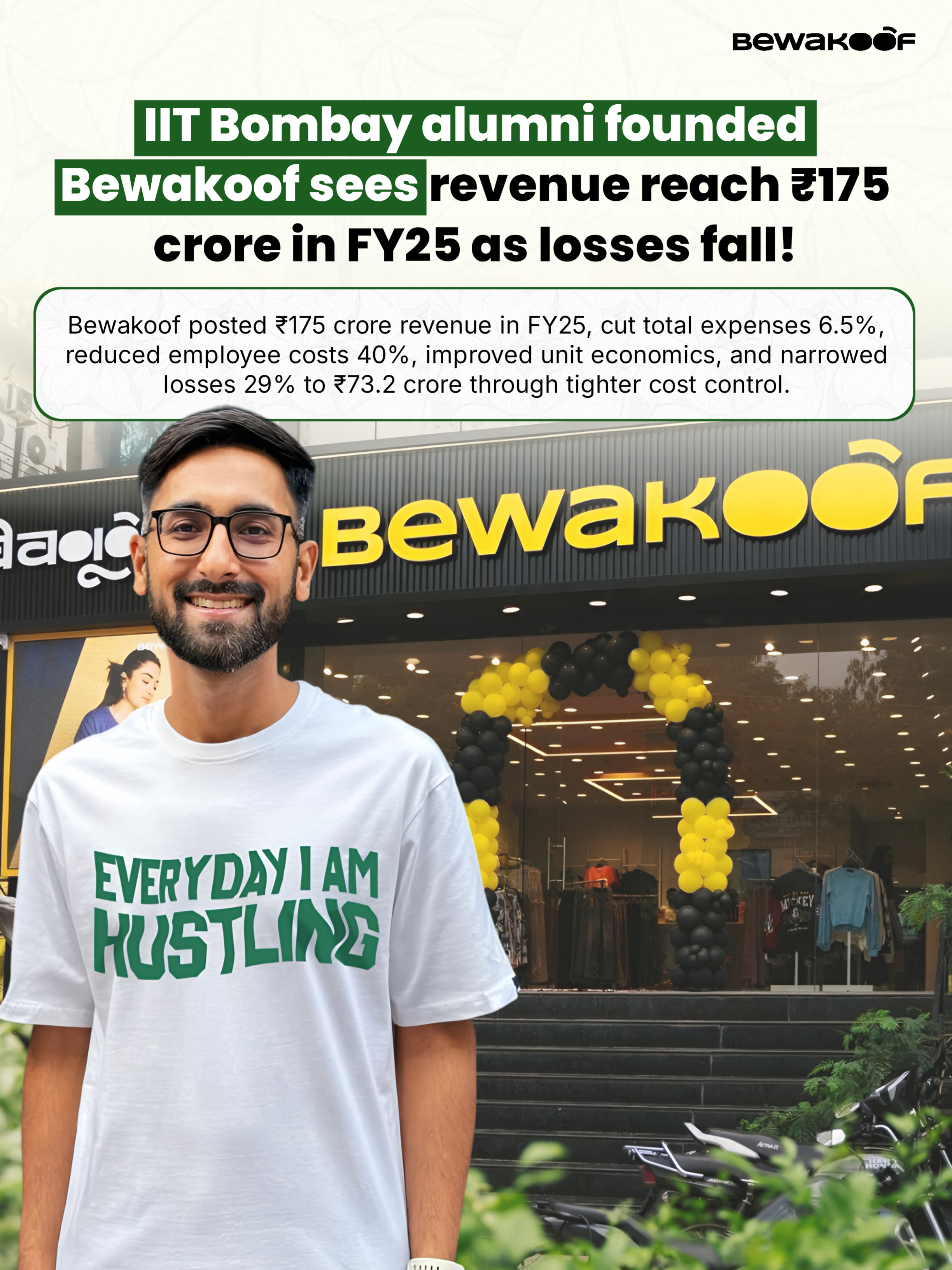

I’ve noticed that many startups celebrate users, orders, and revenue before asking the hardest question: does each unit actually make money? That’s what unit economics reveals. Strip away the hype, and it comes down to whether a business earns more from a customer than it spends to acquire and serve them. A quick mental checklist I always come back to: • 📊 Is LTV at least 3× CAC? • ⏱️ Is the payback period reasonable? • 💸 Are margins improving as scale grows? • 🔁 Is growth driven by retention or discounts? Strong unit economics quietly compound. Weak ones hide behind growth until cash runs out. 📌 Takeaway: Scale amplifies truth. If the unit works, growth helps. If it doesn’t, growth hurts. 👉 For a deeper breakdown with real startup examples, refer to the attached link.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets of startup success with our comprehensive guide on Decoding Unit Economics! In this video, we break down the critical components that can determine the fate of your early-stage venture. Learn how to define your unit, calculate Cust

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Swapnil gupta

Founder startupsunio... • 9m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

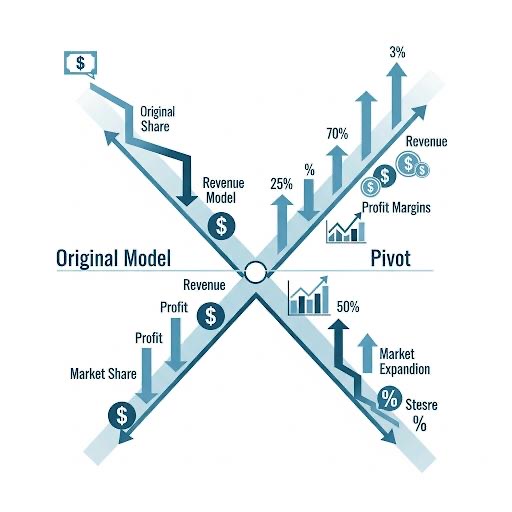

Pivoting -When do the numbers tell you it's time to drastically re-evaluate your startup's core business model?" Financial Red Flags: Consistently Negative Unit Economics: Losing money on every sale with no clear path to profit? Your Customer Acquis

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)