Back

Nikhil Raj Singh

Entrepreneur | Build... • 11m

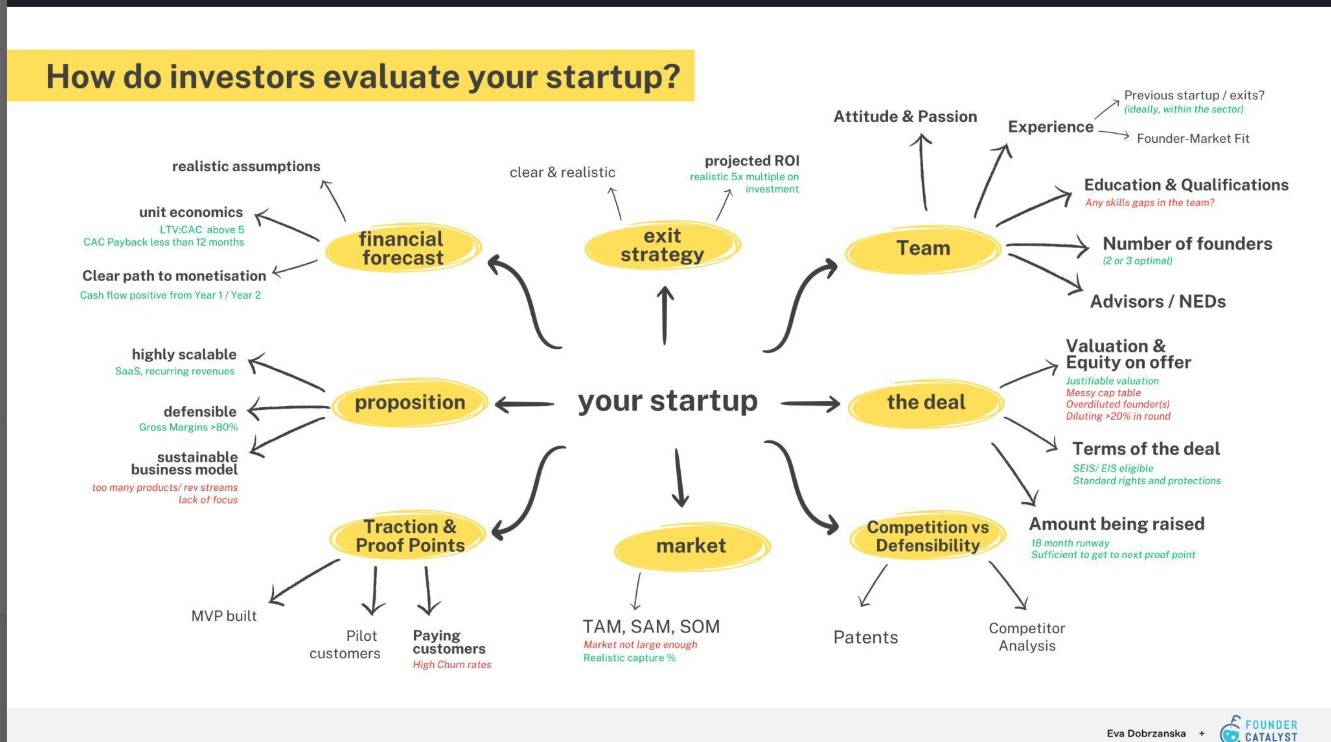

Whenever any Investor evaluates a startup then they focus on these criteria.. 1. A team with relevant experience is super important- their past working experience, educational qualifications, etc. 2. Next is the market opportunity- how big is your market? How did you determine this market size? TAM, SAM, SOM analysis 3. Competitor Analysis- SWOT analysis, PESTLE analysis. 4. Traction- information on product stage, pilot customers, paying customers 5. USP- business highly scalable or not, sustainability of the business model, etc. 6. Financial Forecast: assumptions considered are realistic or not- this is a challenging part, clear path to monetization, Unit Economics data- CAC, LTV, LTV: CAC ratio, CAC payback time, Gross Margin, growth rate, etc. 7. Deal Information- how much are you raising? SAFE note/ convertible note/ Priced Round, Current Captable status, etc. 8. Exit Strategy: at least 3X Return on Investment, Merger & Acquisition Plan if any, etc. Image Credit: Eva Dobrzanska and FounderCatalyst

Replies (1)

More like this

Recommendations from Medial

Anup Thatal

IT enthusiastic | Fu... • 7m

Some glimpse of business full form ? GTM:- go to market LTV:- lifetime value MVP :- Minimum viable product GT:- General Trade SP:- selling price ROI:- return on investment ROAS:- Return on advertising spend DAU:- Daily Active user MAU:- Monthly A

See MoreVivek Joshi

Director & CEO @ Exc... • 6m

In today’s fast-paced market, environmental scanning is not just crucial for survival—it's the key to unlocking hidden opportunities for startups. In this video, we delve into the PESTLE framework—Political, Economic, Social, Technological, Legal, an

See MoreAtharva Deshmukh

Daily Learnings... • 1y

MARKET ANALYSIS Market Analysis is the process of determining the attractiveness of a market, i.e., whether it is worth investing in the current market scenario both now and in the future. Organizations analyze the market before launching a product

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Vivek Joshi

Director & CEO @ Exc... • 1m

Learn how to shave months off time-to-revenue by tightly integrating Lean Product Development with an aggressive, focused Go-To-Market sprint. This 1-minute LinkedIn-ready video breaks down the Rudder MVP, Jobs-to-be-Done lProduct-Led Growth and high

See MoreVivek Joshi

Director & CEO @ Exc... • 28d

Learn how to shave months off time-to-revenue by tightly integrating Lean Product Development with an aggressive, focused Go-To-Market sprint. This 1-minute LinkedIn-ready video breaks down the Rudder MVP, Jobs-to-be-Done lProduct-Led Growth and high

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)