Back

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Quick ratio: =Quick assets/Current liabilities Where quick assets means, (current assets-inventory) Purpose: -Unlike the current ratio (as we have discussed in the previous post), the quick ratio shows : whether a company can meet its short-term obligations even if it makes no sales. -Quick Ratio considers only liquid assets those that can be quickly converted into cash, such as cash, bank balances, and receivables. -Helps to check instant liquidity, considering the fact that inventories has been excluded while calculating quick ratio. -useful for cash tight businesses. (ex-for early stage startups) Why are inventories excluded? -cannot be easily convertible into cash in times of financial difficulties, hence not included as a part of current assets. Ideal ratio: 1:1 or higher, -shows that the company is able to meet its short term obligations without selling inventory. On a final note, “Where there is a will,there is finance to learn so you can pay your bill” Follow for more. Will be Coming back with more ratios from tomorrow which will be interesting than what I have shared till now.Stay tuned!

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Current ratio: =Current assets/current liabilities Purpose: -To evaluate the company's short-term financial health and liquidity. -This ratio tells us whether the company can meet its short term ob

See MoreAnirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreTushar Aher Patil

Trying to do better • 1y

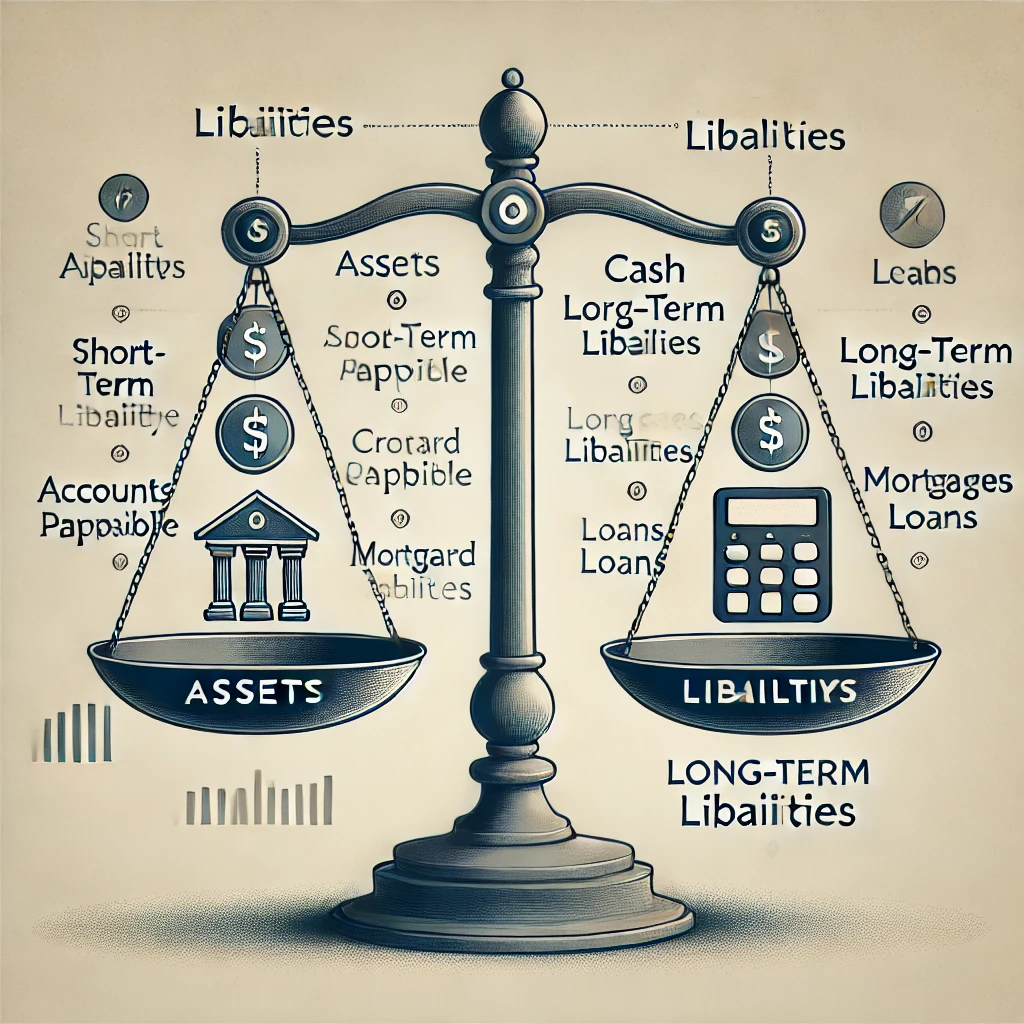

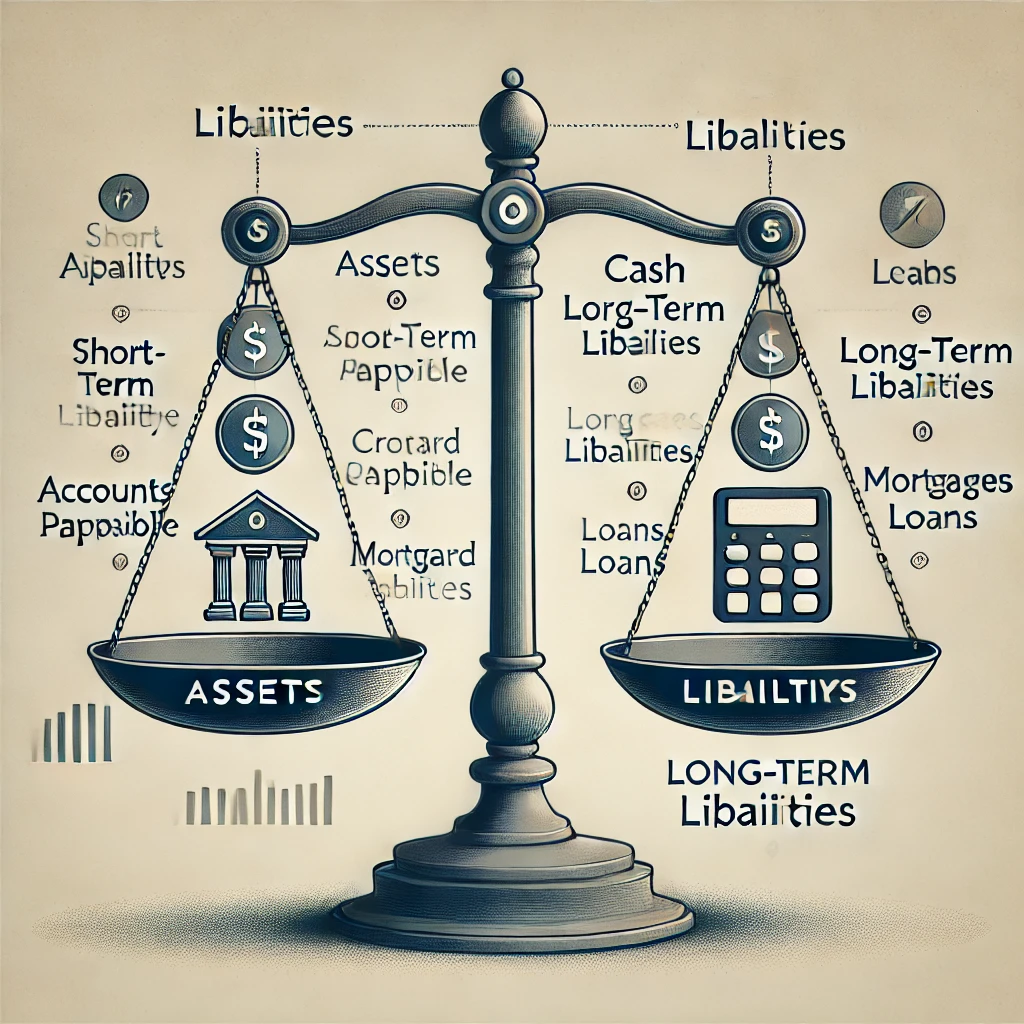

Day 8 About Basic Finance and Accounting Concepts Here's Some New Concepts In finance, Liabilities represent obligations or debts that an individual or organization owes to others. They indicate an outflow of resources, either cash or services, that

See More

Akash Koli

Experienced Financia... • 1y

Understanding Return Ratios: Measuring Your Business Performance 📊💡 Hello VittArena Network! Return ratios are key to assessing how well your business is performing. Here’s a quick guide: # ROI (Return on Investment): Measures the gain or loss f

See MoreTushar Aher Patil

Trying to do better • 1y

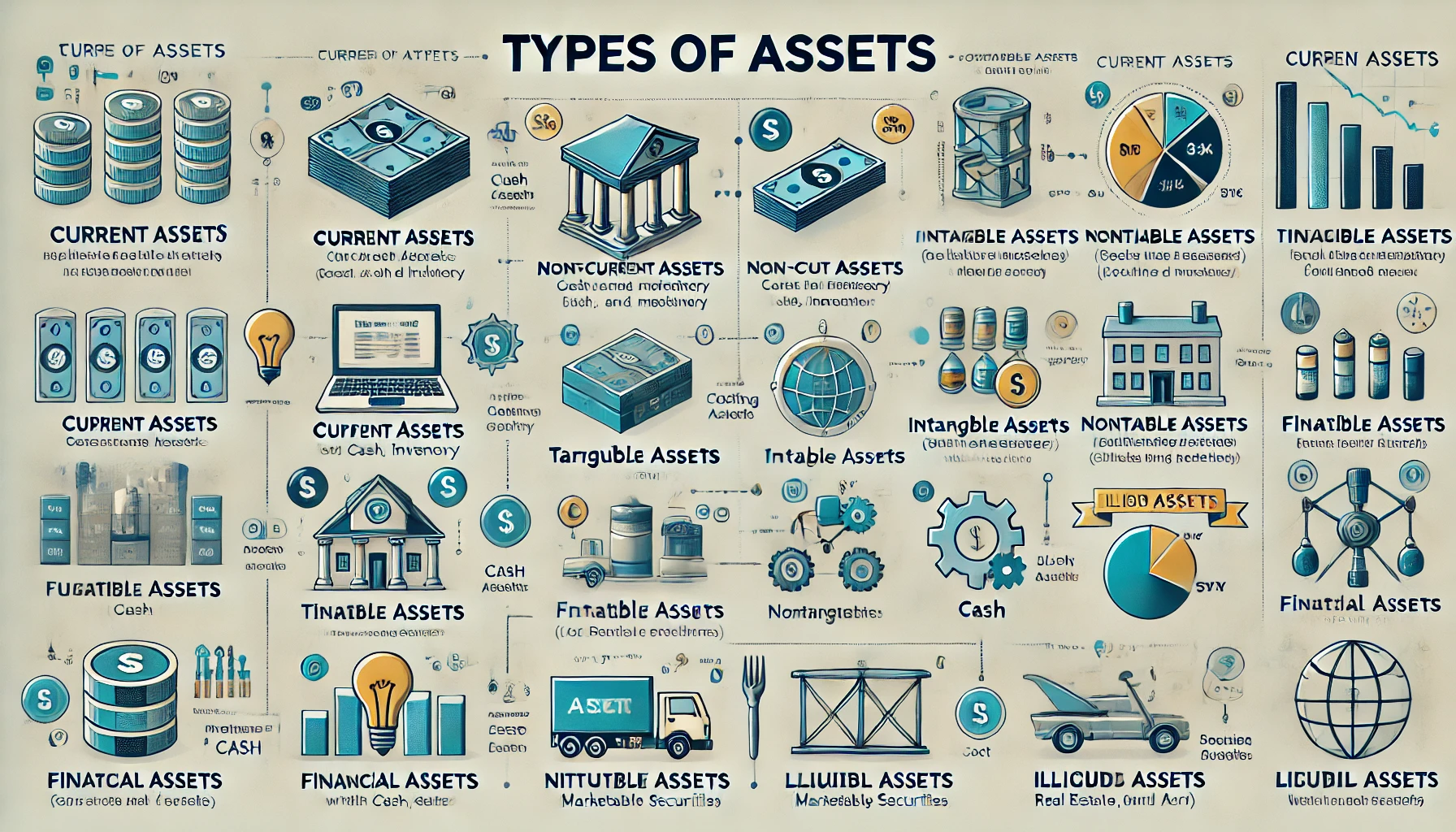

Day 5 About Basic Finance and Accounting Concepts Here's Some New Concepts An asset is anything that an individual, company, or government owns that holds value and can generate future benefits. Assets are essential components in financial accounti

See More

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily(irregular 😅) dose of financial ratios by Anirudh Gupta Lets learn these two ratios 1.Capital turnover ratio: =Sales or Cost of goods sold/Capital employed Capital employed=Shareholders funds+ Non-current liabilities Purpose: -To understa

See MoreTushar Aher Patil

Trying to do better • 1y

Day 9 About Basic Finance and Accounting Concepts Here's Some New Concepts 2. Non-Current (Long-Term) Liabilities Non-current liabilities are long-term debts that are due beyond one year. These are generally used to fund large purchases or investme

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)