Back

Akash Koli

Experienced Financia... • 1y

Understanding Return Ratios: Measuring Your Business Performance 📊💡 Hello VittArena Network! Return ratios are key to assessing how well your business is performing. Here’s a quick guide: # ROI (Return on Investment): Measures the gain or loss from an investment. It answers, "How much profit am I making per dollar invested?" # ROA (Return on Assets): Shows how efficiently assets are used to generate profit. It asks, "How well are my assets converting to earnings?" # ROE (Return on Equity): Indicates how well shareholder equity is used to generate profits. It evaluates, "How effectively am I using investors’ money?" At VittArena, we use these ratios to optimize your financial strategy. Discover more with our FP&A services.

Replies (1)

More like this

Recommendations from Medial

Akash Koli

Experienced Financia... • 1y

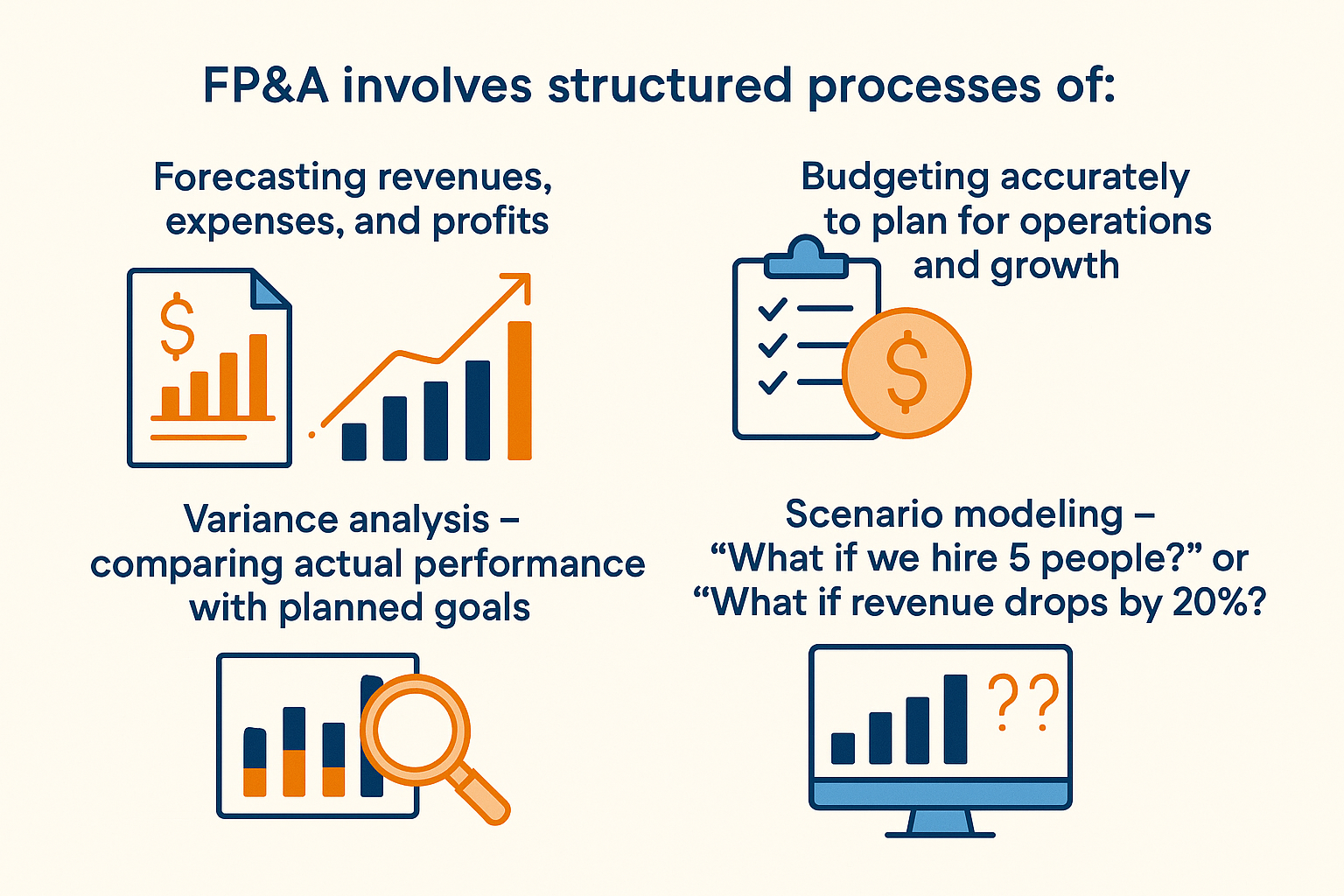

How FP&A Can Turn Your Business Data into Strategic Gold 📊💡 Transform your business data from numbers into insights with Financial Planning & Analysis (FP&A). Think of FP&A as your treasure map, guiding you to turn data into strategic gold! 🗺️✨

See MoreAnirudh Gupta

CA Aspirant|Content ... • 8m

Daily(irregular 😅) dose of financial ratios by Anirudh Gupta Lets learn these two ratios 1.Capital turnover ratio: =Sales or Cost of goods sold/Capital employed Capital employed=Shareholders funds+ Non-current liabilities Purpose: -To understa

See MoreGangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Equity Equity, in simple terms, is the money that is returned to all the shareholders of a company, if all the company's assets are liquidated and liablities are paid off. It is also a measure of the financial health of a c

See MoreShivam Singh

"Igniting My Startup... • 1y

Fundamental Challenges of Finance #Valuation . How are financial assets valued? How should financial assets be valued? How do financial markets determine asset values? How well do financial markets work? #Management . How much should I save

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)