Back

CA Rahul Nahata

•

Upwork • 9m

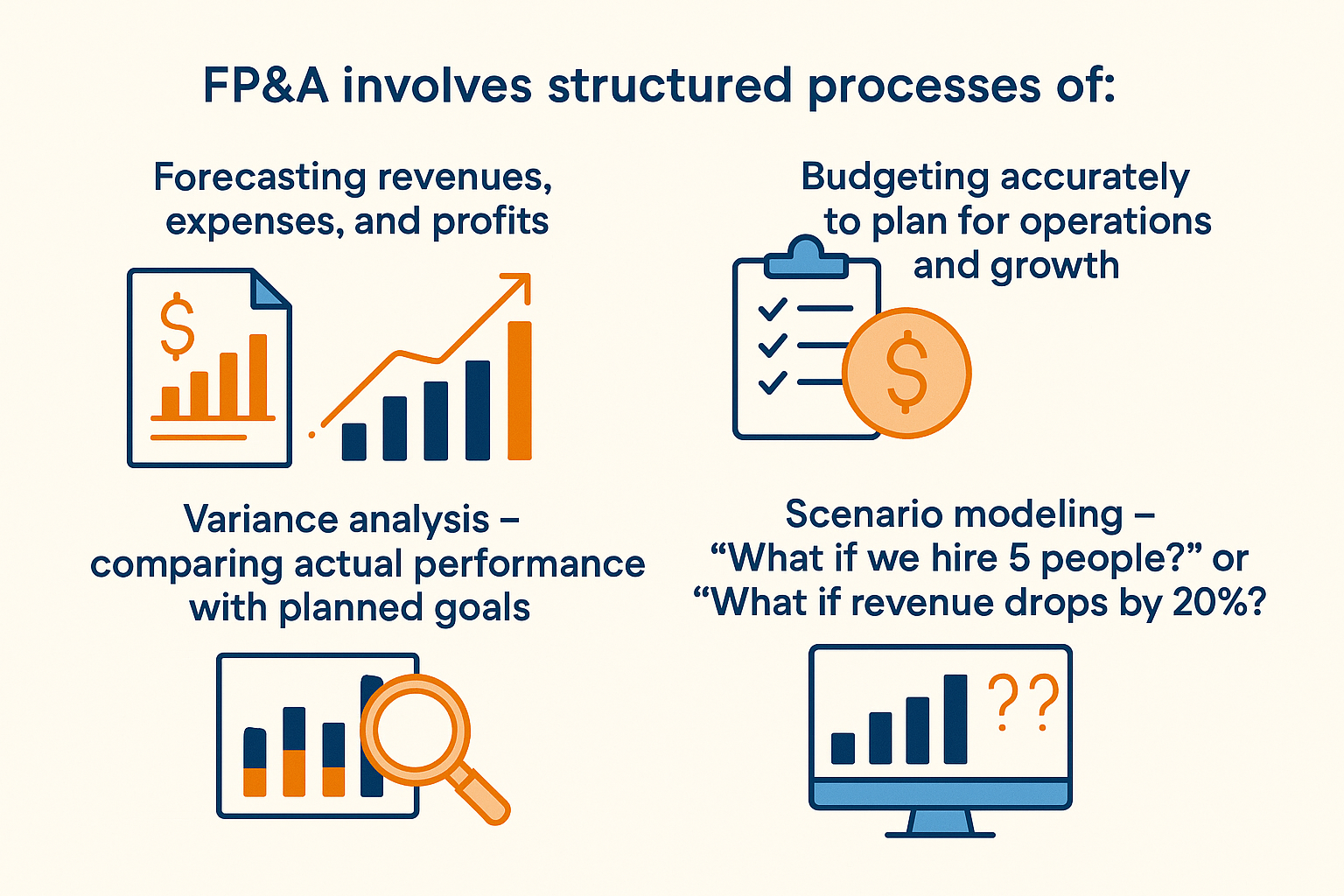

🔴 90% of startups fail. But do you know why? Not because of bad products. Not because of lack of demand. But because they run out of cash and make poor financial decisions. 💡 That’s where Financial Planning & Analysis (FP&A) steps in — and becomes your startup’s secret weapon. 🚀 What is FP&A? FP&A is the process of using financial data to plan, analyze, and support better decision-making. It includes: 📊 Budgeting & Forecasting 📊 Cash Flow Planning 📊 Scenario Analysis 📊 Performance Tracking 📊 Strategic Financial Modeling In simple words: It helps you know where your money is going, and where it should go. 📌 Why FP&A is Critical in Early-Stage Startups 💸 1. Control Your Burn Rate Most startups burn $10K–$100K/month. Without FP&A, you won’t know: How long your runway is What costs can be optimized When you’ll need the next funding round With FP&A: You can forecast runway down to the week, and plan 6–12 months ahead. 🔁 2. Track ROI on Every Spend Whether it’s hiring, ads, or tools — FP&A helps you calculate: Cost vs. return of each action Break-even timelines Profit margins by product or service 💰 Know if spending ₹1 lakh on ads is actually giving you ₹1.5 lakh in return — or burning cash. 📉 3. Make Data-Driven Decisions, Not Gut Calls Imagine choosing between hiring a new sales lead or launching a new feature. FP&A helps you simulate both cases: What happens to revenue in 3 months? What’s the cash impact? Which one improves margin? 📅 4. Plan Fundraising Smartly Investors want numbers, not just vision. FP&A provides: 12–18 month financial projections Unit economics like CAC, LTV, Payback Period Clean dashboards that increase investor trust 🧠 5. Keep Your Team Aligned Everyone on your team knows the targets: Revenue = ₹5 Cr this year Monthly cost = < ₹3 lakh Growth = 10% MoM No more guessing. Just goals.

More like this

Recommendations from Medial

Akash Koli

Experienced Financia... • 1y

Financial Analysis: The Espresso Shot for Your Business! ☕📊 Just like a strong cup of coffee, financial analysis gives your business the boost it needs! It helps you spot where profits are brewing ☕, where costs are too bitter, and keeps your cash

See MoreAkash Koli

Experienced Financia... • 1y

How FP&A Can Turn Your Business Data into Strategic Gold 📊💡 Transform your business data from numbers into insights with Financial Planning & Analysis (FP&A). Think of FP&A as your treasure map, guiding you to turn data into strategic gold! 🗺️✨

See MoreAccount Deleted

Hey I am on Medial • 5m

💡Why Every Startup Needs a Financial Advisor Many founders believe financial planning is something to worry about later. But the truth? Your financial foundation decides how far your startup can go. Here’s why startups work with advisors early: ✅ P

See MoreAarihant Aaryan

Prev- Founder & CEO ... • 1y

I watched fewer episodes of Shark Tank, most founders optimised for equity, sharks but not cash If someone wants to do a combined deal or wants more equity ask for a little bit more cash-only "cash" increases your runway and chances of succeeding.

Kshitiz Trigunayat

Aspiring Entrepreneu... • 1y

Hi, I was wondering how much you will be willing to pay for an event plan for your wedding or how much did you pay at the time of your wedding? Considering the average wedding cost in India is 20 Lakh and the average cost of a good plan ranges from 2

See MoreVikas Acharya

Building Reviv | Ent... • 1y

WTF is RUNRATE ? Run Rate A financial projection of your yearly revenue or expenses based on current performance. Example: If your startup earns ₹100,000 in one quarter, your annual run rate would be ₹400,000. Why it matters: Helps forecast growth

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)