Back

Vansh Khandelwal

Full Stack Web Devel... • 7m

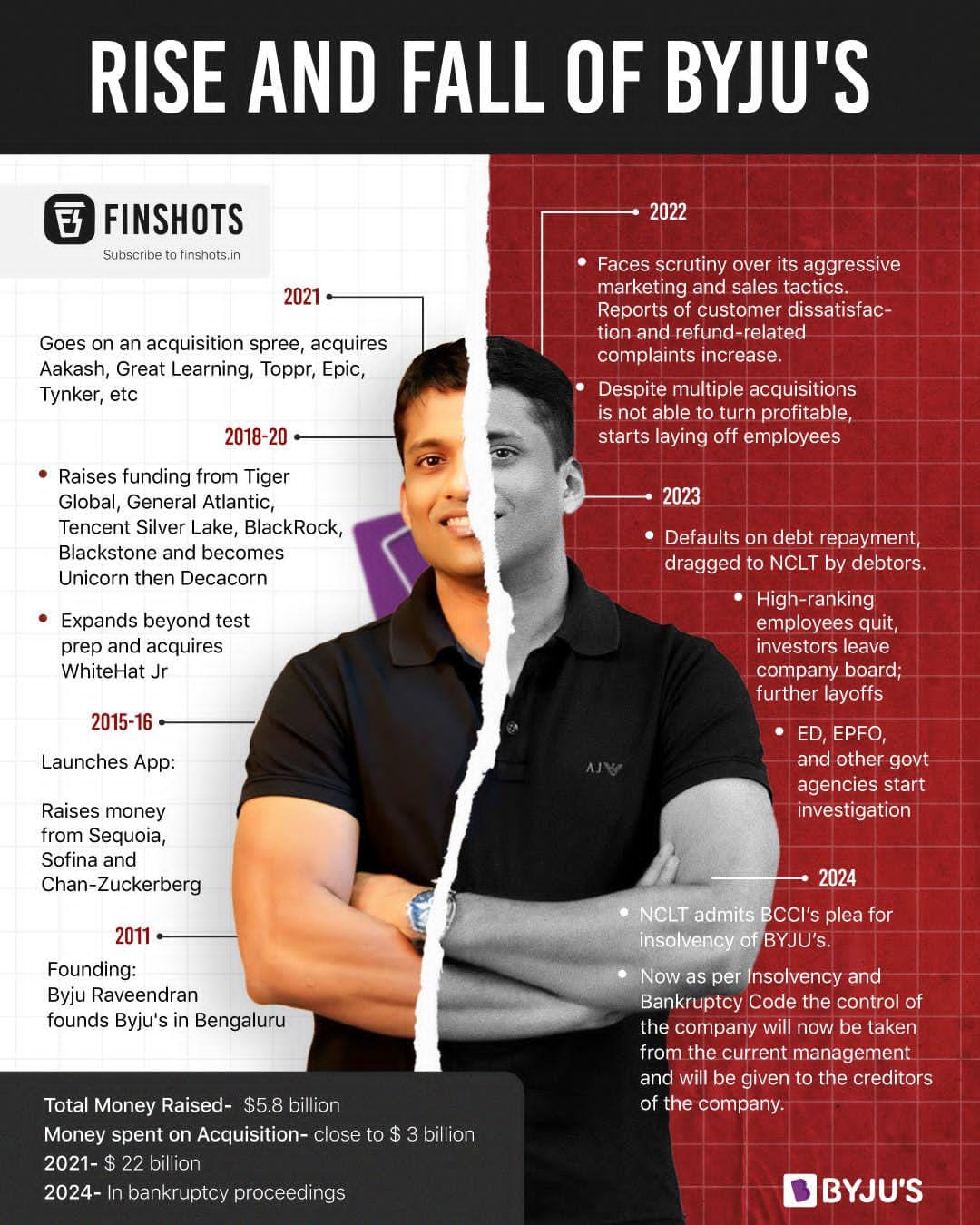

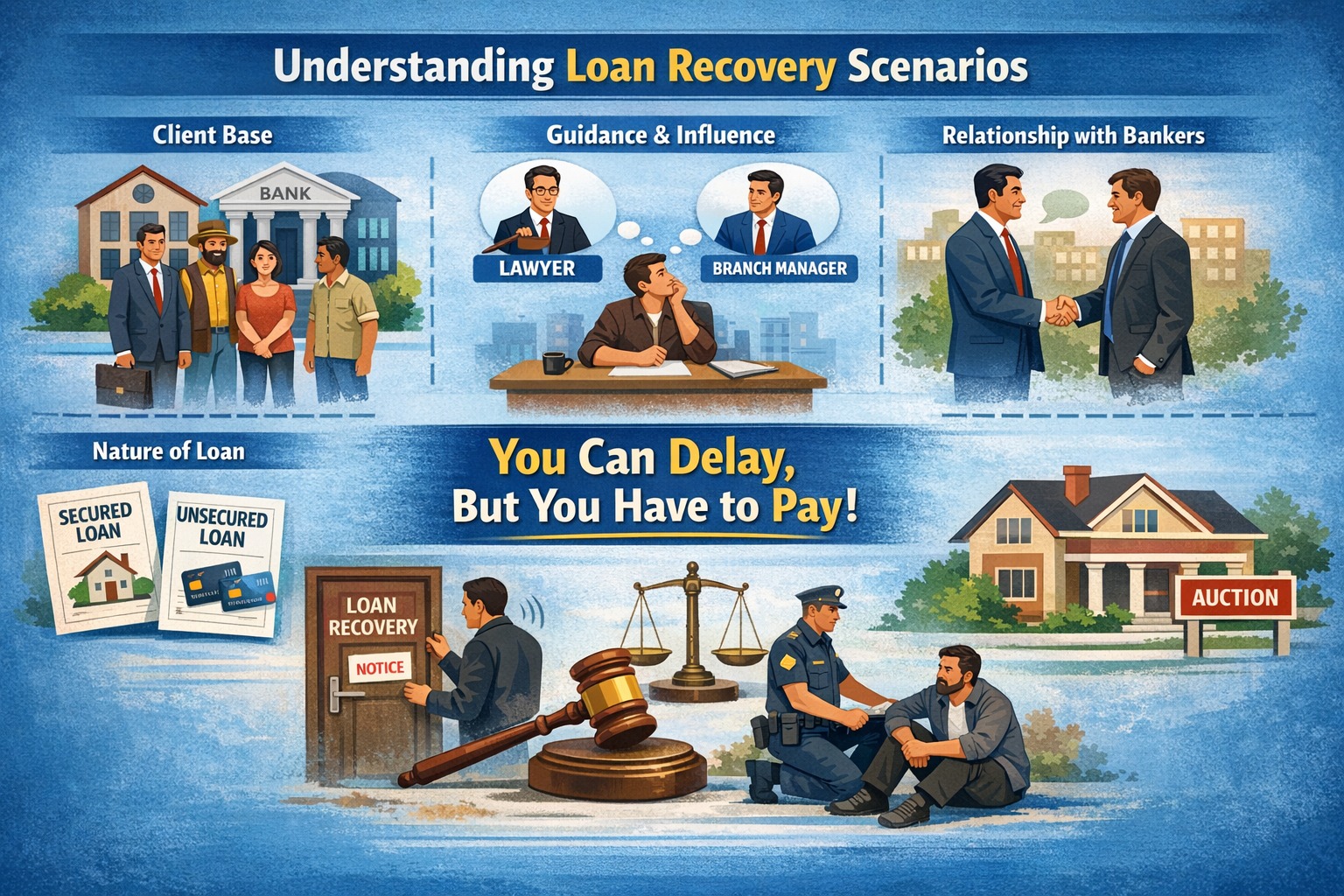

In the blog titled "Bankruptcy: Understanding the Approaches," I explore essential strategies for businesses facing bankruptcy. The three primary approaches discussed are debt restructuring, deferment of payments, and emergency relief operations. Debt restructuring involves negotiating with creditors to modify loan terms, aiming to reduce the principal amount, lower interest rates, and extend loan tenures, thereby alleviating financial burdens. The deferment of payments allows businesses to temporarily suspend obligations, providing critical relief and protection from legal actions. Emergency relief operations emphasize the importance of maintaining normal business functions during bankruptcy, including paying employee wages, fulfilling tax obligations, managing vendor relationships, and ensuring insurance coverage. By understanding these approaches, businesses can better navigate bankruptcy and potentially emerge stronger from the experience.

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreTarun Suthar

•

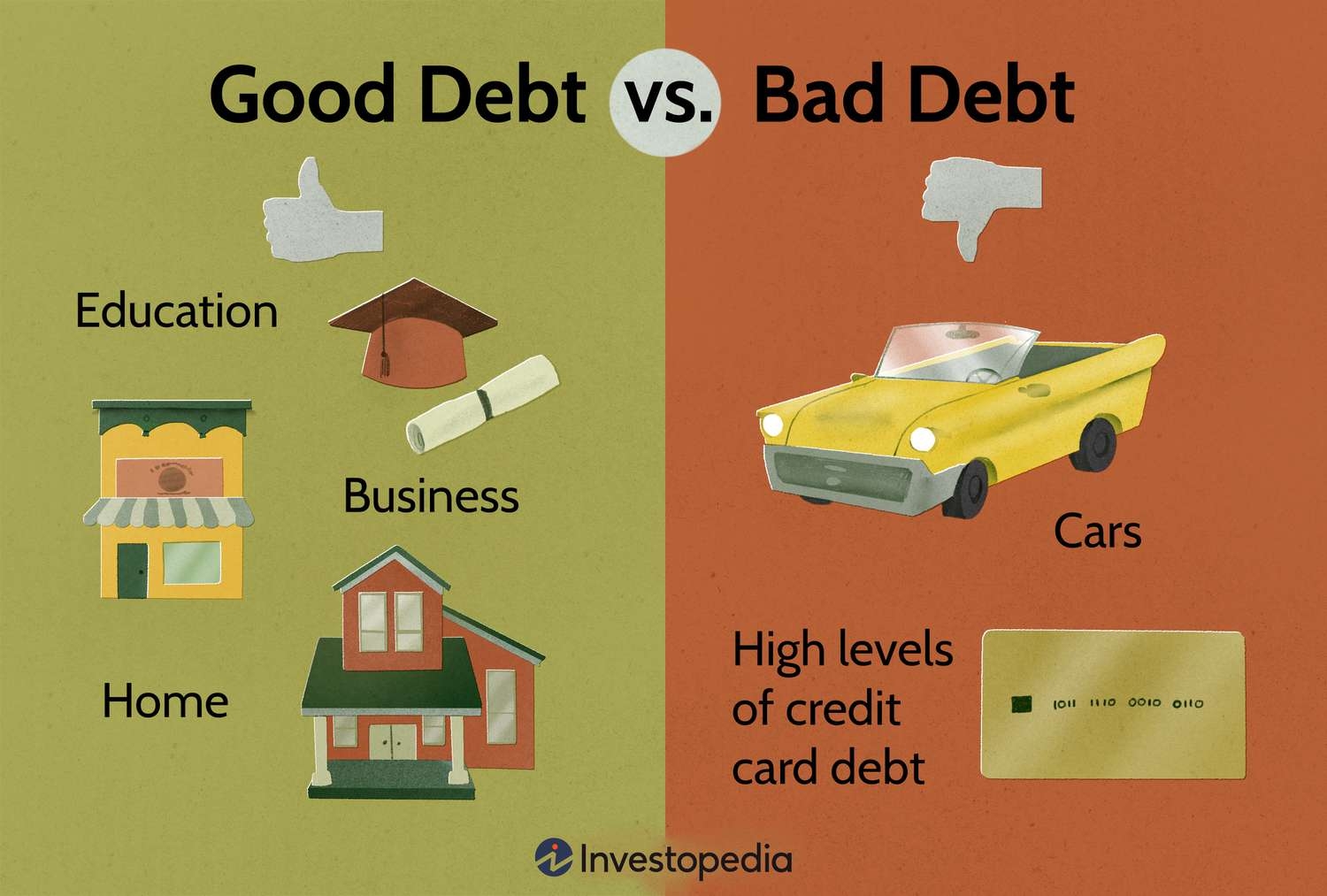

The Institute of Chartered Accountants of India • 1y

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Sairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreMahendra Mishra

Founder & CEO of Gom... • 1y

Allopathic vs. Ayurvedic Medicine Allopathic and Ayurvedic medicines offer different approaches to health and healing. Allopathy: It primarily focuses on symptom management and uses drugs or surgery to provide quick relief. This approach often targ

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)