Back

Ravi Ranjan

Noob Entrepreneur 🤓 • 1y

Does Gold is the only best investment option from long term perspective in current economic scenario, as the big nation like India and China really bullish on Gold?

Replies (1)

More like this

Recommendations from Medial

Sanskar Agarwal

| Building - kidzkap... • 1y

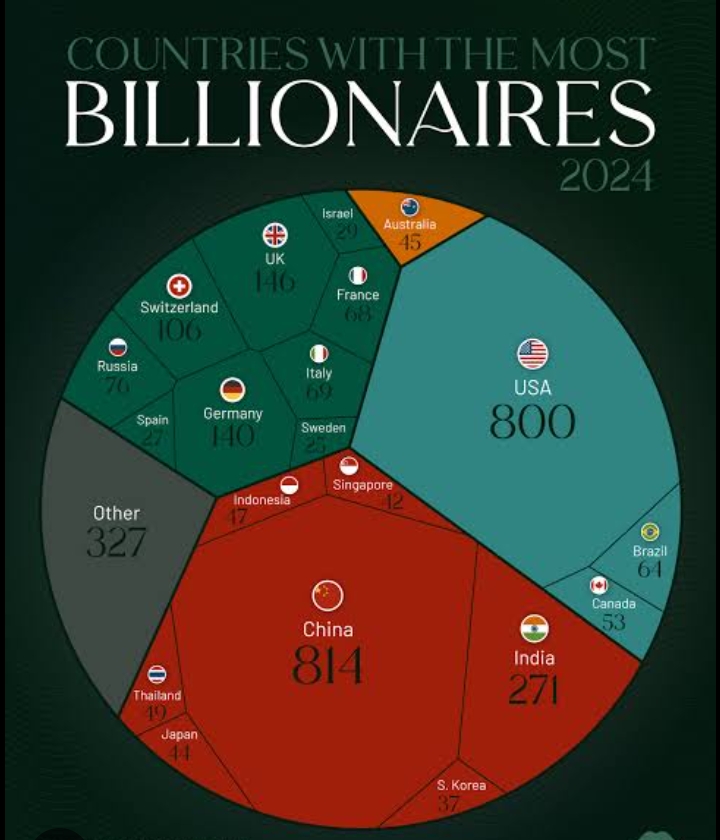

🌍 India and China: The Middle-Income Trap Challenge The recent World Development Report 2024 by the World Bank sheds light on a crucial issue: the "middle-income trap." This is a scenario where countries, after reaching a certain level of economic

See More

Madhavsingh Rajput

Founder & CEO at Fin... • 1y

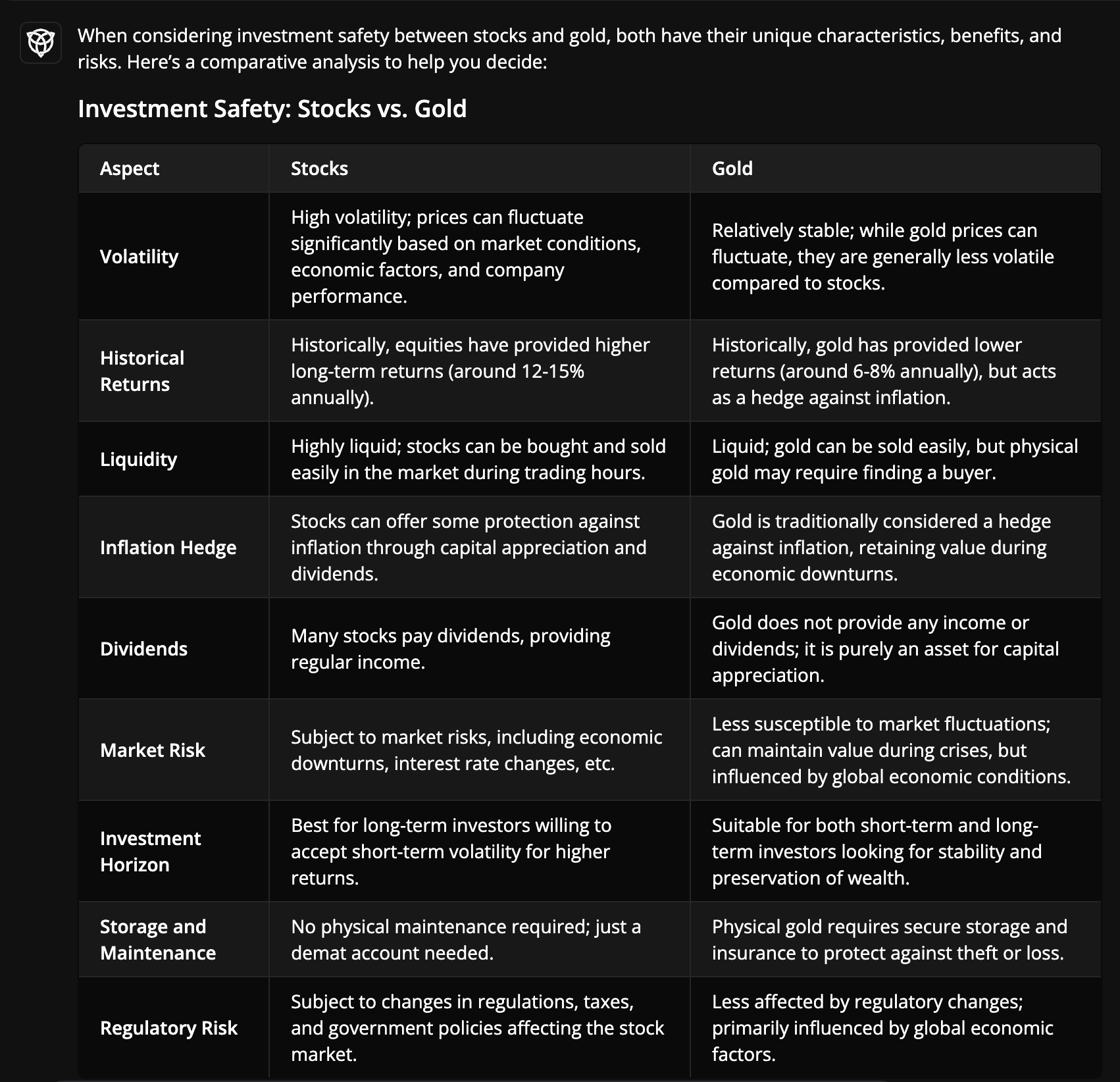

Gold or Stocks: Which is the better investment? 🤔 To make it simple, Finstreets' AI has prepared an easy to understand comparison table highlighting key aspects like: 1️⃣ Volatility: Stocks have high fluctuation, while gold is more stable. 2️⃣ Retur

See More

Bhavya jha

Just on the way of r... • 1y

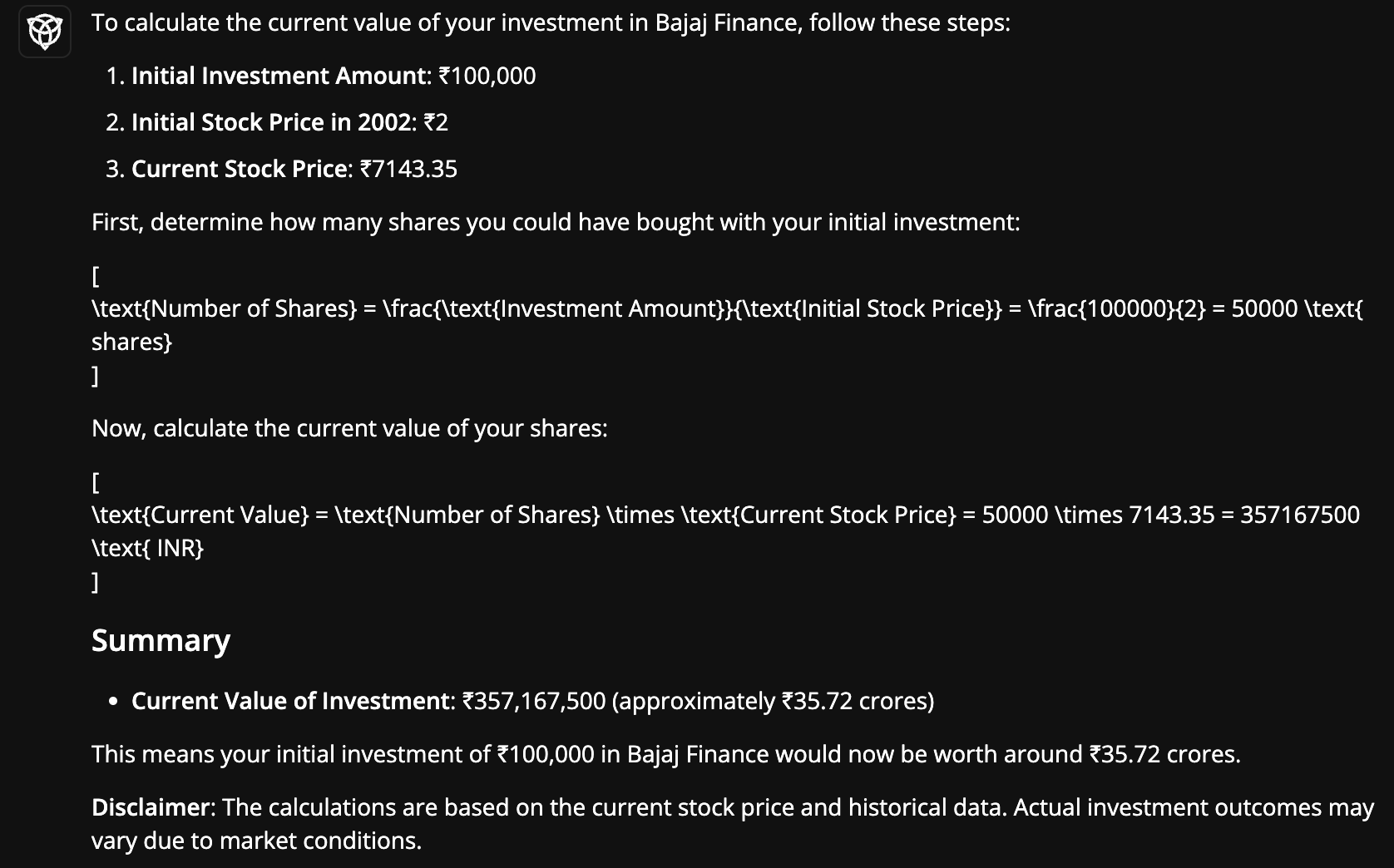

According to the Hurun Global Rich List 2024, China housed the highest number of billionaires worldwide in 2024. In detail, there were 814 billionaires living in China as of January that year. Now , all of u are wondering , how china come this far, o

See More

financialnews

Founder And CEO Of F... • 10m

Gold rate jumps 25% in YTD. Is it the right time to buy gold in current rally? According to experts, the outlook for gold remains constructive. Persistent trade tensions, inflationary pressures, and central bank gold purchases are expected to contin

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)