Back

VIJAY PANJWANI

Learning is a key to... • 24d

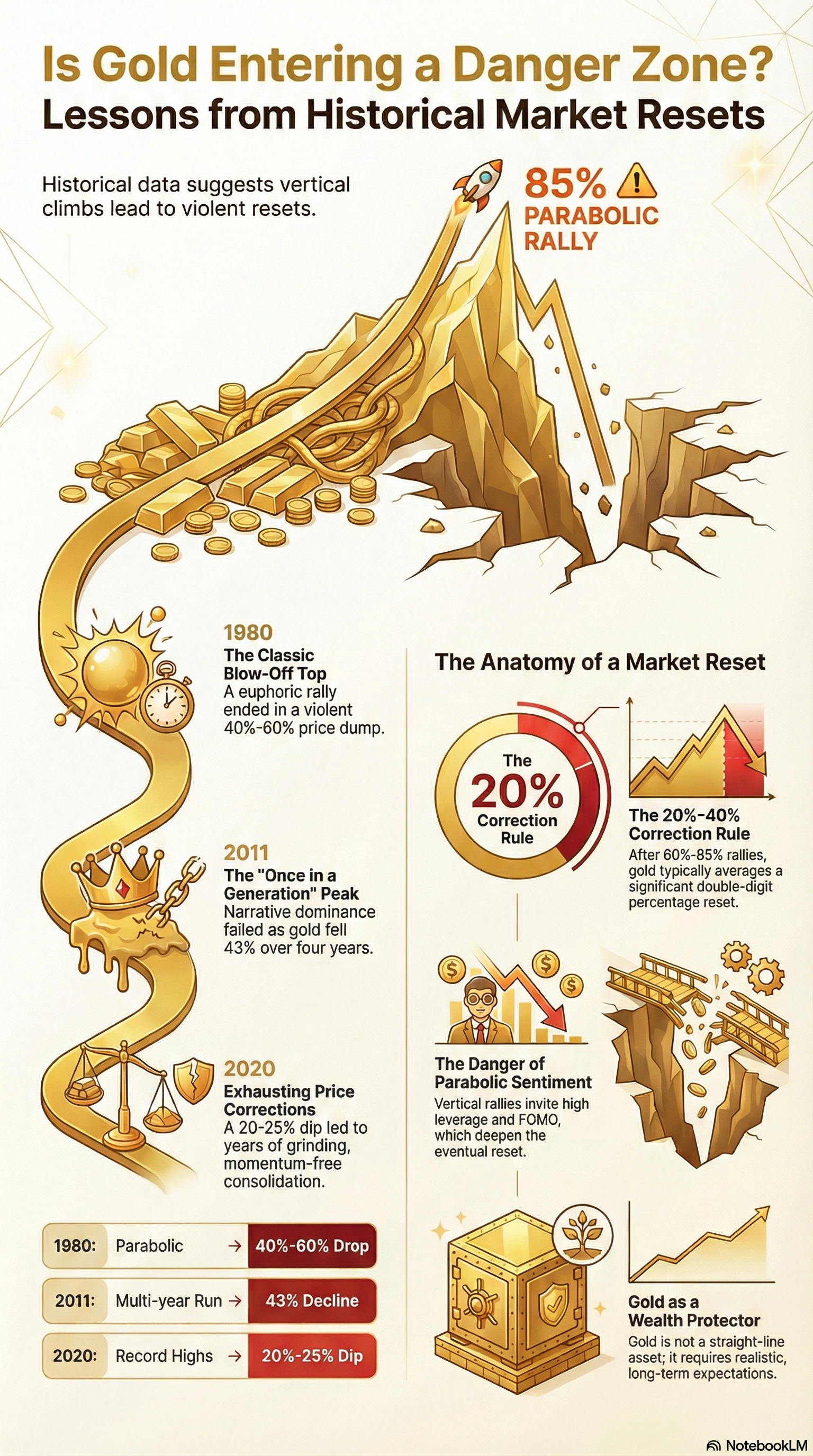

Gold has always played an important role as a long-term store of value. But history shows that after strong, fast rallies, the market often goes through a period of correction or consolidation. This visual looks at past major gold cycles — 1980, 2011, and 2020 — to highlight how markets tend to move in phases: expansion, peak optimism, correction, and stabilization. The purpose isn’t to predict a crash, but to remind investors that no asset moves in a straight line. Understanding historical patterns can help set realistic expectations, manage risk, and make more balanced decisions. Gold can be a wealth protector but patience and perspective matter just as much as price.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 7m

Looks like gold is finally entering a correction phase for the past few months, demand wasn’t really strong it’s just that because of certain situations, investors were holding onto it and not selling. But now, as things start to look better no one w

See Morefinancialnews

Founder And CEO Of F... • 1y

Stock Market Correction: Jefferies Highlights Significant Earnings Downgrades, Largest Since Early 2020 Jefferies Highlights Healthy Stock Market Correction and Earnings Downgrades Since 2020 Chris Wood from Jefferies recently emphasized that the c

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)