Back

Varun Bhambhani

•

Medial • 1m

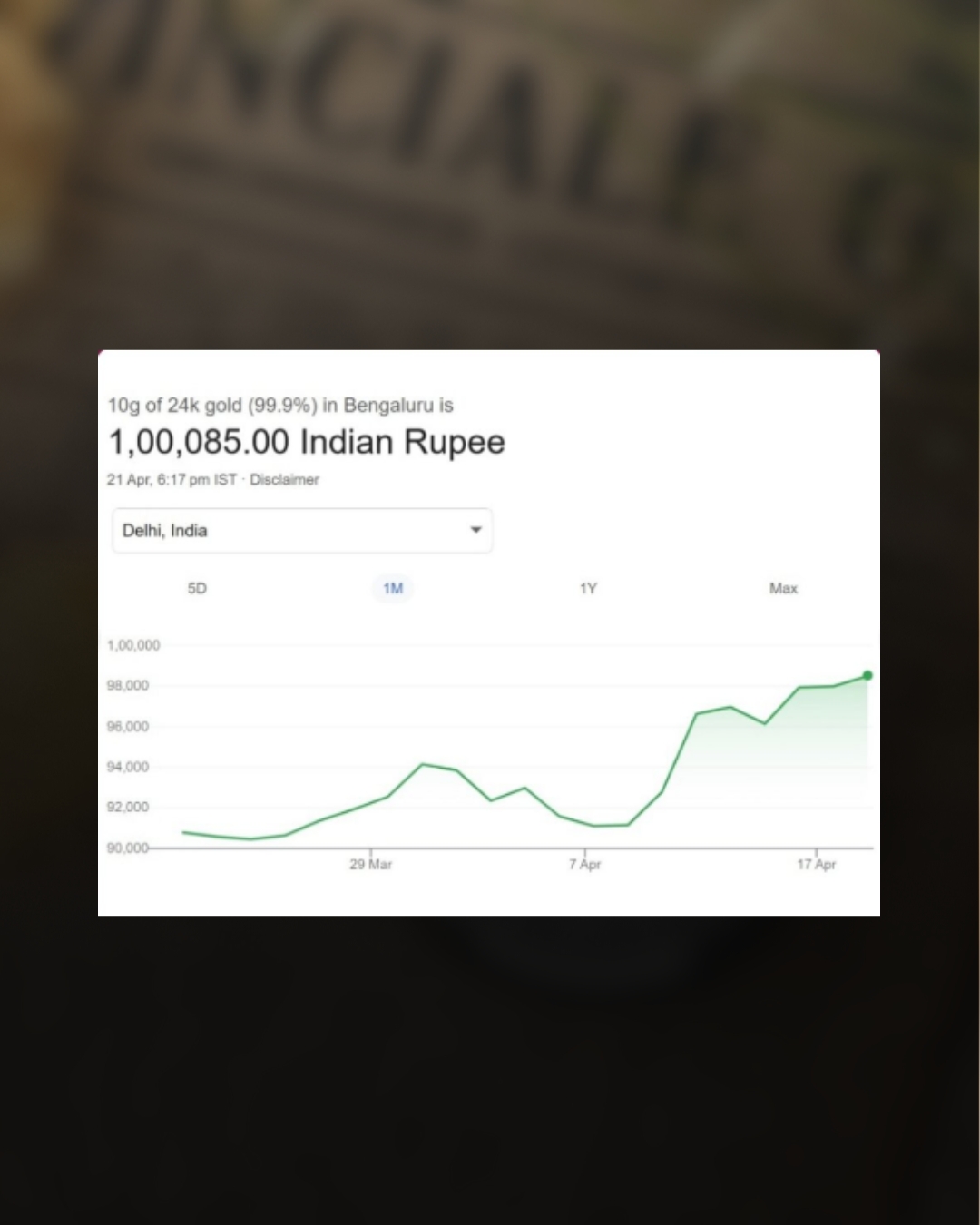

Gold has reached a historic milestone in India, touching ₹1,44,600 per 10 grams. This surge reflects more than jewelry demand. It signals a global pivot toward safe-haven assets as investors hedge against inflation, currency volatility, and uncertain monetary policies. As central banks slow their easing pace, tangible assets like gold are back in focus. For India, this rally is a mixed blessing. It boosts household wealth held in gold but adds pressure on imports and could soften jewelry demand. The question now is whether this is a long-term structural shift toward gold as a global hedge or a short-term reaction to macroeconomic uncertainty.

More like this

Recommendations from Medial

Siddharth K Nair

Thatmoonemojiguy 🌝 • 10m

Why Jewelry Shops Make Money Even Without Selling Unlike clothing or gadget stores, jewelry shops win even if they don’t sell. Their secret? Gold itself. While gold prices rise over time, their unsold jewelry quietly gains value. A ₹7 crore stock ca

See More

Startopia news

Your daily dose of s... • 10m

Goldflation Gold Hits All-Time High: ₹1 Lakh per 10g in Delhi! A Global uncertainty, Trump's remarks, and a falling dollar push investors toward the ultimate safe haven. Is this just the beginning of gold's golden run? For more follow Startopia n

See More

Madhavsingh Rajput

Founder & CEO at Fin... • 1y

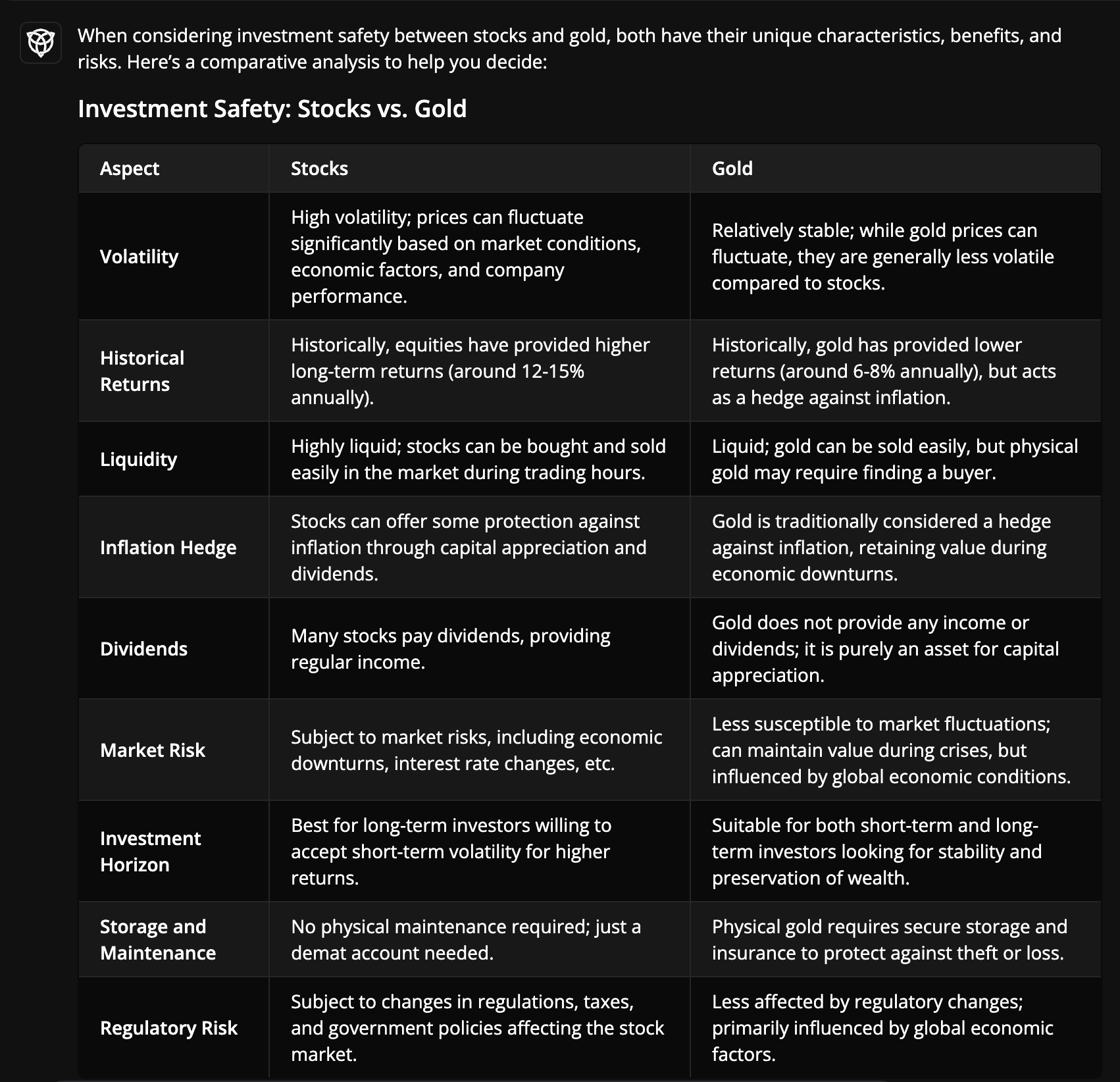

Gold or Stocks: Which is the better investment? 🤔 To make it simple, Finstreets' AI has prepared an easy to understand comparison table highlighting key aspects like: 1️⃣ Volatility: Stocks have high fluctuation, while gold is more stable. 2️⃣ Retur

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

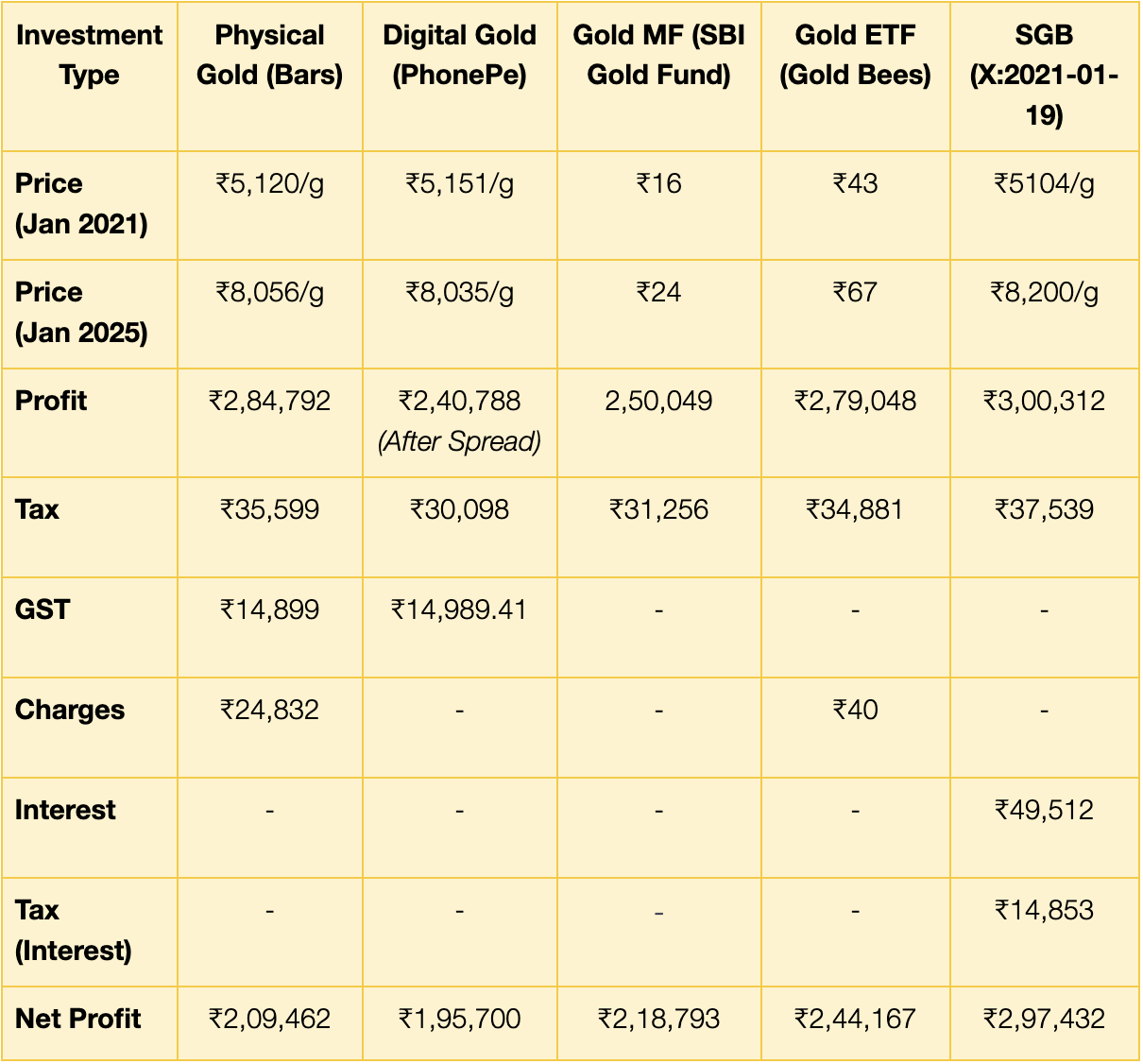

Different Ways to Invest in Gold 🪙 If you invest ₹5 Lakhs for a period of 5 years, what could your ROI look like across different gold investment options? There are commonly 5ways to invest in gold. 🪙 Physical Gold (Jewelry, Coins, Bars) 🪙 Digi

See More

Emily Kristina

Avid Blogger and Con... • 10m

Why Luxury Jewelry is an Everlasting Market? The luxury jewelry industry isn’t just about aesthetics—it’s a $300B+ market driven by legacy, craftsmanship, and investment value. Unlike fast-moving consumer goods, high-end pieces appreciate over time,

See MoreGangesh Rameshkumar

Figure it out • 8m

Fellas, I'm doing a self-post challenge where I'm going to explain a business term briefly every day Today's term: Assets Assets are resources that are owned by a company that provide economic value and future benefits such as generating income, im

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)