Back

Rohan Saha

Founder - Burn Inves... • 10m

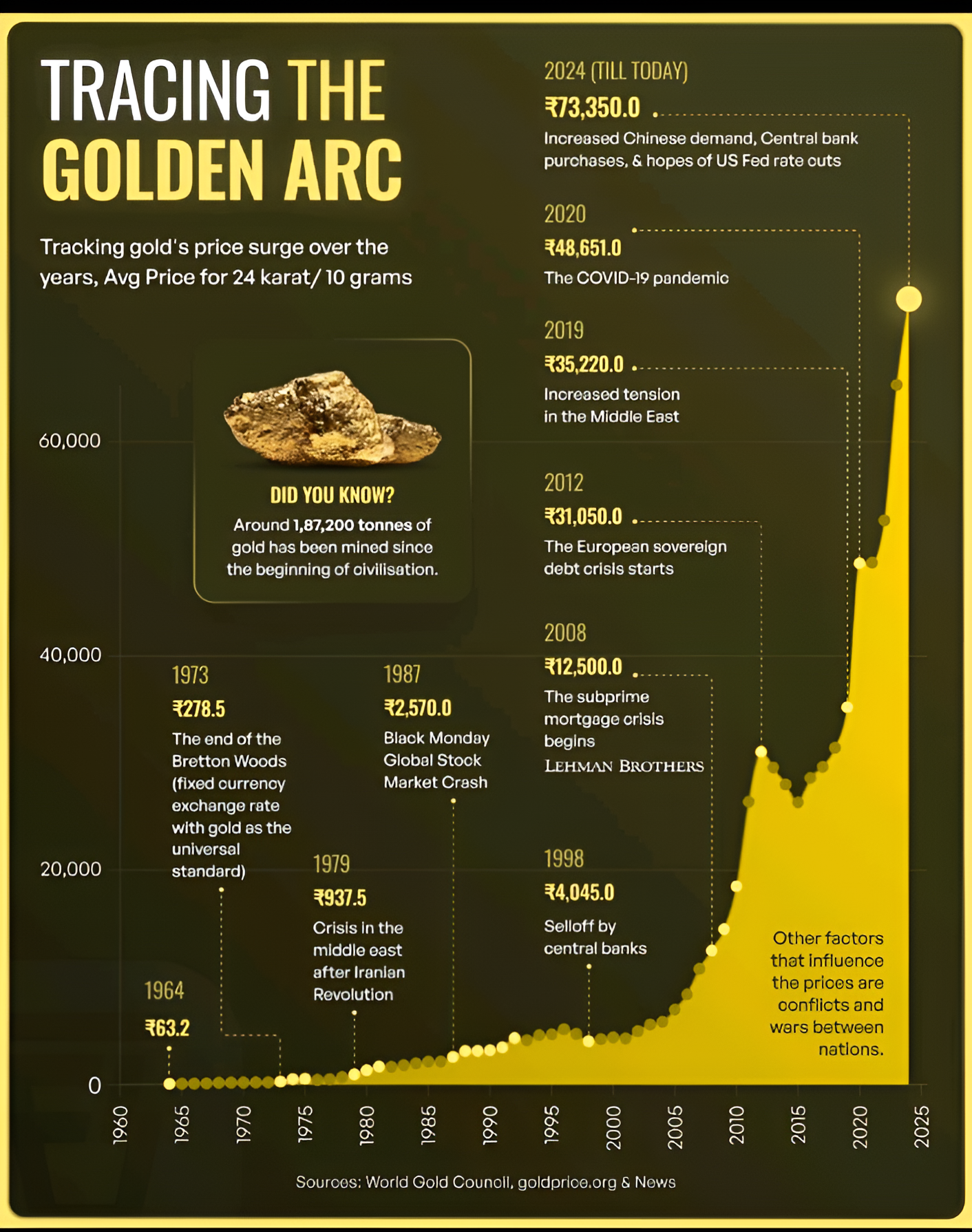

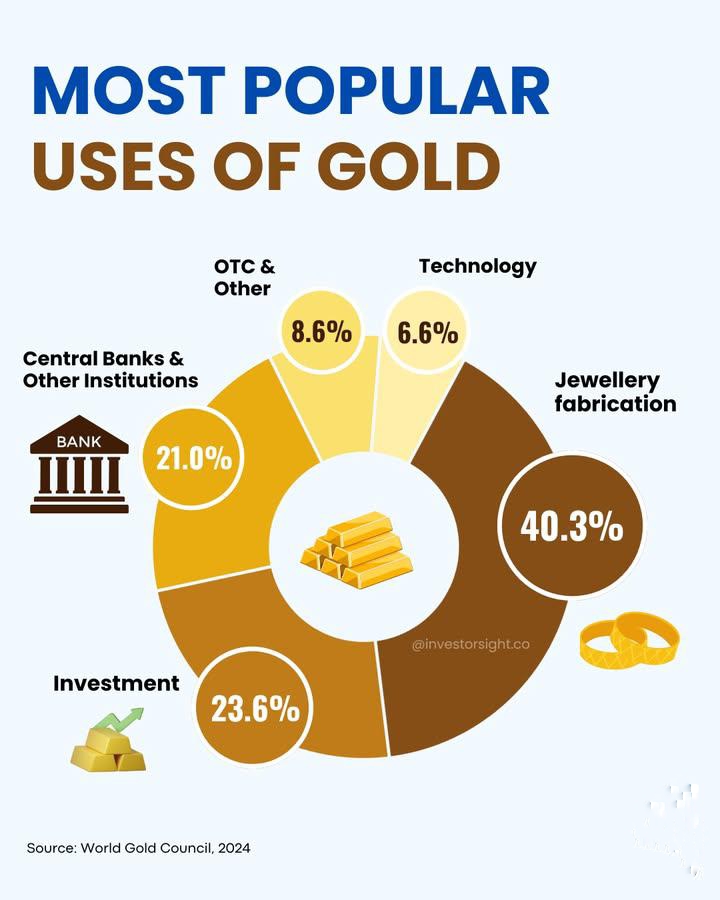

Many people might think that the fall in gold prices is due to that research report, but let me clarify, that's not the case. Look, the reason behind gold's decline is something else. The biggest reason is profit booking, and the second reason is margin shortfall. When we traders hold any leveraged trade, we have to maintain a margin with the broker. When the market falls, we need to add more margin to keep our positions active. Now, since global markets are falling significantly, around 3%-5%, many traders or trading companies must have received margin shortfall notices. To maintain those margins, they likely converted their gold positions into cash. Additionally, there isn't enough demand for gold from Central Banks at the moment, which has also caused a slight correction in gold prices. But this doesn't mean that gold will drop to 56K. Personally, I don't believe in such predictions.

Replies (7)

More like this

Recommendations from Medial

Startopia news

Your daily dose of s... • 10m

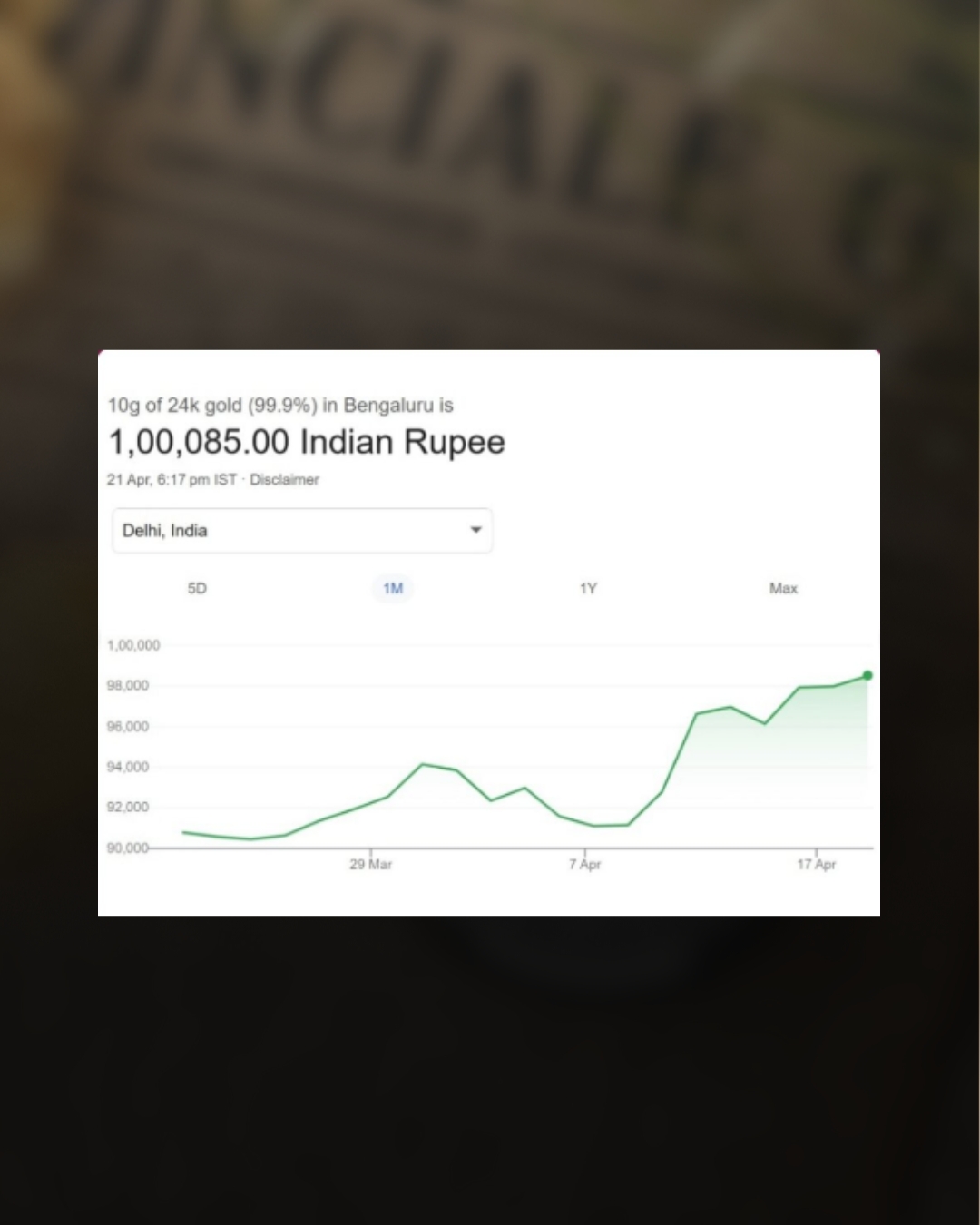

Goldflation Gold Hits All-Time High: ₹1 Lakh per 10g in Delhi! A Global uncertainty, Trump's remarks, and a falling dollar push investors toward the ultimate safe haven. Is this just the beginning of gold's golden run? For more follow Startopia n

See More

Rohan Saha

Founder - Burn Inves... • 6m

As we see geopolitical tensions gradually easing there might be some selling pressure in gold because the main reason behind the rise in gold prices has been trade and war tensions what discussions take place between USA and Russia will be important

See Morefinancialnews

Founder And CEO Of F... • 10m

Gold rate jumps 25% in YTD. Is it the right time to buy gold in current rally? According to experts, the outlook for gold remains constructive. Persistent trade tensions, inflationary pressures, and central bank gold purchases are expected to contin

See Morefinancialnews

Founder And CEO Of F... • 1y

New Record High! Gold hits fresh peak to ₹89,450 per 10 gm, silver above ₹1 lakh New Record High! Gold hits fresh peak to ₹89,450 per 10 gm, silver above ₹1 lakh Gold prices reached a new peak of ₹89,450 per 10 grams in the national capital on Thur

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)