Back

financialnews

Founder And CEO Of F... • 10m

Gold rate jumps 25% in YTD. Is it the right time to buy gold in current rally? According to experts, the outlook for gold remains constructive. Persistent trade tensions, inflationary pressures, and central bank gold purchases are expected to continue supporting prices. Gold has shown exceptional performance in the first four months of 2025, surging nearly 25 per cent year-to-date (YTD) and reaching record highs on both the MCX and COMEX exchanges. This sharp rally is attributed to a combination of heightened geopolitical risks, trade tensions—particularly between the U.S. and China—and a surge in safe-haven demand from both institutional and retail investors. According to experts, the outlook for gold remains constructive. Persistent trade tensions, inflationary pressures, and central bank gold purchases are expected to continue supporting prices Gold has shown exceptional performance in the first four months of 2025, surging .. if you want to know more click below 👇 the link

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 6m

As we see geopolitical tensions gradually easing there might be some selling pressure in gold because the main reason behind the rise in gold prices has been trade and war tensions what discussions take place between USA and Russia will be important

See More

Anonymous

Hey I am on Medial • 1y

🎇 HAPPY DHANTERAS GUY'S 🎇 Do you know dhanteras is one of the most unique Hindu festival and according to hindusiam if you buy something in this festival then that thing gives you lots of growth in income. That's why Alone Dhanteras generates 50 T

See More

Ardnim Raghuvanshi

Hey I am on Medial • 1y

The recent escalation of hostilities between Israel and Iran, highlighted by Israel's airstrike in Tehran involving 140 aircraft, is creating ripples across international markets. The potential economic implications are noteworthy: 1. Market Instabi

See MoreDr Sarun George Sunny

The Way I See It • 2m

📌Rupee is Asia's worst performing currency' Asia’s worst‑performing currency” is not a headline any country wants but that is where the rupee finds itself in 2025. With a 4.3% depreciation versus the dollar, record trade deficits fuelled by US tar

See More

Tushar Aher Patil

Trying to do better • 9m

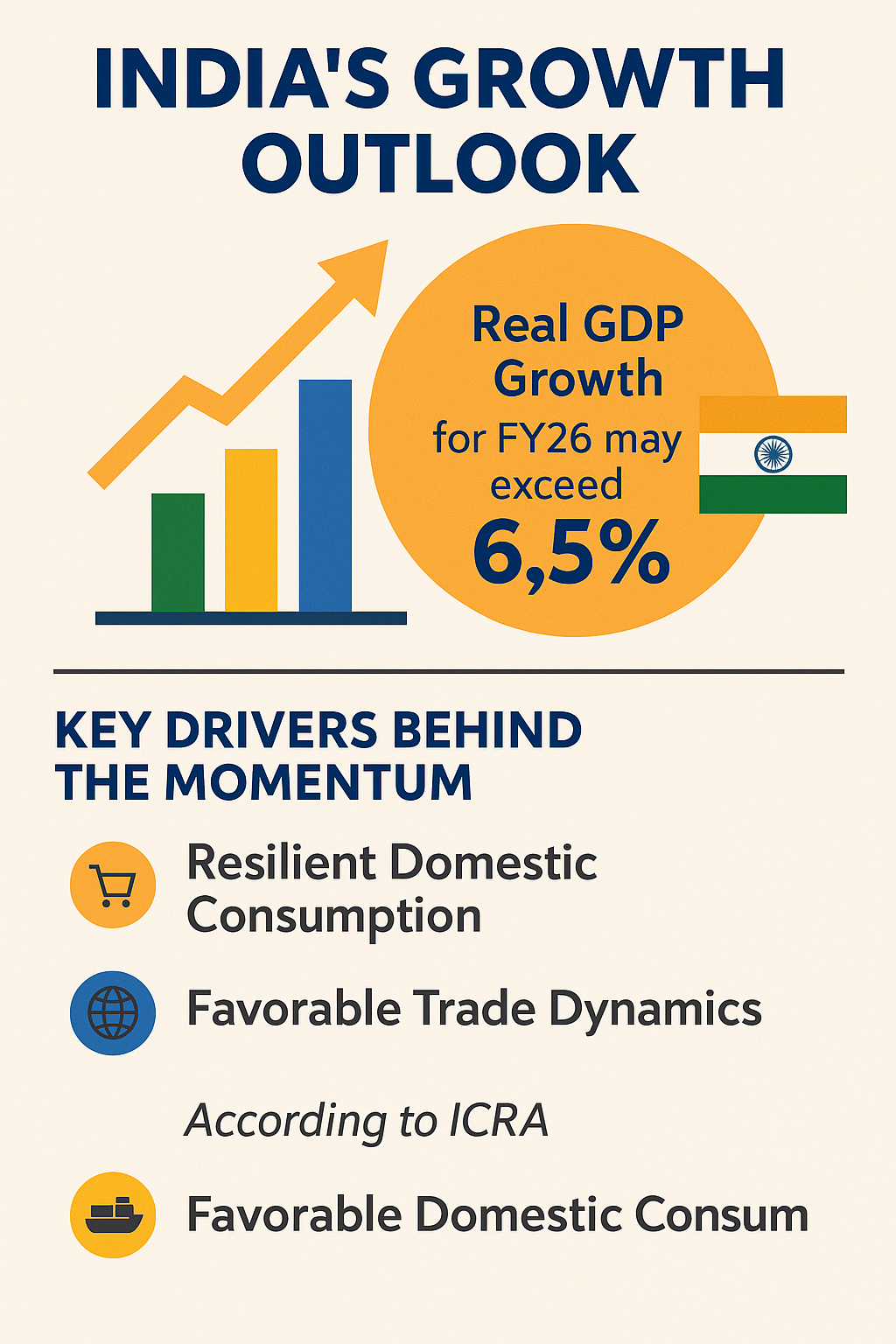

India's Economic Outlook Remains Robust Amid Global Challenges Tracking the Indian economy? The latest projections from the Confederation of Indian Industry (CII) offer a positive picture! India's GDP is projected to grow at 6.5% this fiscal year, de

See More

financialnews

Founder And CEO Of F... • 1y

Wall Street Update: US Stock Indices Trade Mixed Amid Fresh PCE Inflation Data Wall Street Update: Dow Rises, S&P 500 and Nasdaq Slip Amid PCE Inflation Data **US Stocks Mixed as Investors Digest PCE Inflation Data** US stock indices were mixed on

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)