Back

RV Dhameliya

Student • 8m

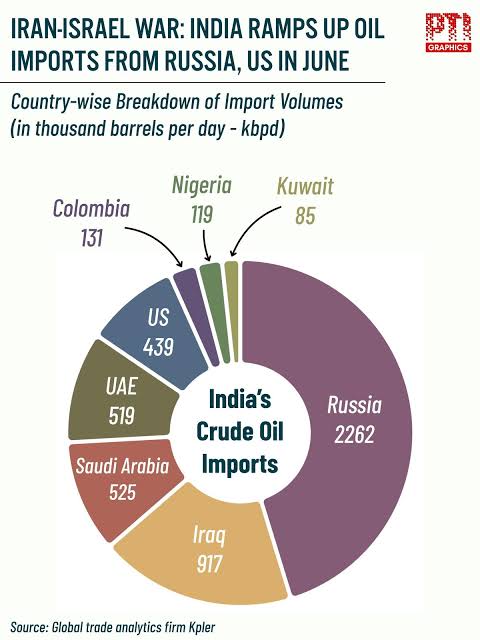

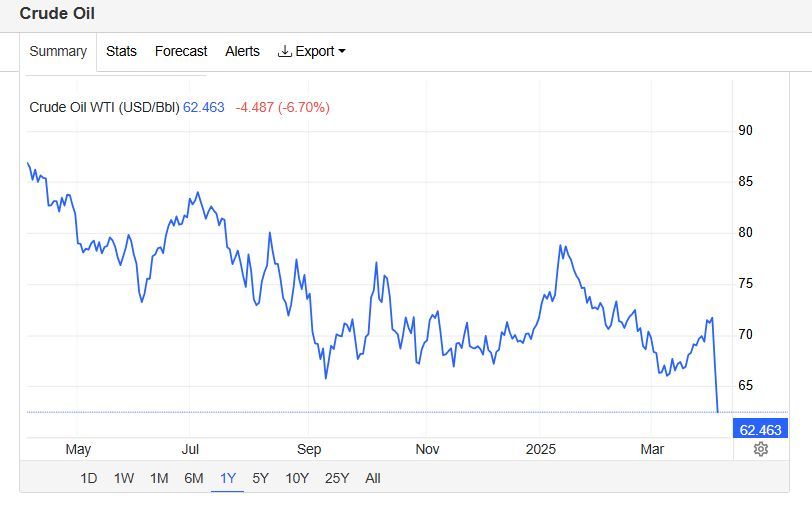

🛢️ Global Oil Shock Ahead? Strait of Hormuz in Danger Amid Iran-Israel Tensions Key Points: 1. Shell's Big Warning: Shell Plc fears massive oil supply disruptions if the Strait of Hormuz shuts down. 2. Why It Matters: This chokepoint handles 25% of global oil trade—closure could hit the global economy hard. 3. Tension Rising: Escalating conflict between Iran and Israel may trigger the shutdown. 4. Impact on India: As a major oil importer, India faces energy supply risks and rising fuel prices. 5. More Than Just Oil: Threats of signal jamming and possible U.S. involvement add to global uncertainty. 6. Oil Prices on Edge: Potential for surging global oil prices due to restricted flow in the Gulf region. #OilCrisis #StraitOfHormuz #MiddleEastTensions #IranIsraelConflict #EnergySecurity #OilPrices #GlobalTrade #Geopolitics #CrudeOil #IndiaEnergy #ShellWarning #OilDisruption #FuelPrices #EconomicImpact #SupplyChainCrisis

Replies (3)

More like this

Recommendations from Medial

Pulakit Bararia

Founder Snippetz Lab... • 8m

Why Israel is attacking Iran? It’s not about nukes. That’s just the excuse. The real reason? Oil and the U.S. dollar. Iran sells oil cheap — up to 30% below market — and doesn’t use dollars. This threatens the petrodollar system, where global oil mu

See MoreArdnim Raghuvanshi

Hey I am on Medial • 1y

The recent escalation of hostilities between Israel and Iran, highlighted by Israel's airstrike in Tehran involving 140 aircraft, is creating ripples across international markets. The potential economic implications are noteworthy: 1. Market Instabi

See MorePulakit Bararia

Founder Snippetz Lab... • 11m

We fuckedd How This Could Lead to a Global Conflict: 1. U.S.-Iran Tensions Escalate The Houthis, are backed by Iran, which means U.S. military action against them is indirectly a strike against Iran’s regional influence. If Iran retaliates—whether

See More

Pulakit Bararia

Founder Snippetz Lab... • 6m

India currently imports 40% of its crude oil from Russia — around 2 million barrels a day — and it comes at a discounted price, $2–$5 cheaper than global rates. But what if that stops? The economic cost alone would be massive. India would end up s

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)