Back

spectar

the best closer • 10m

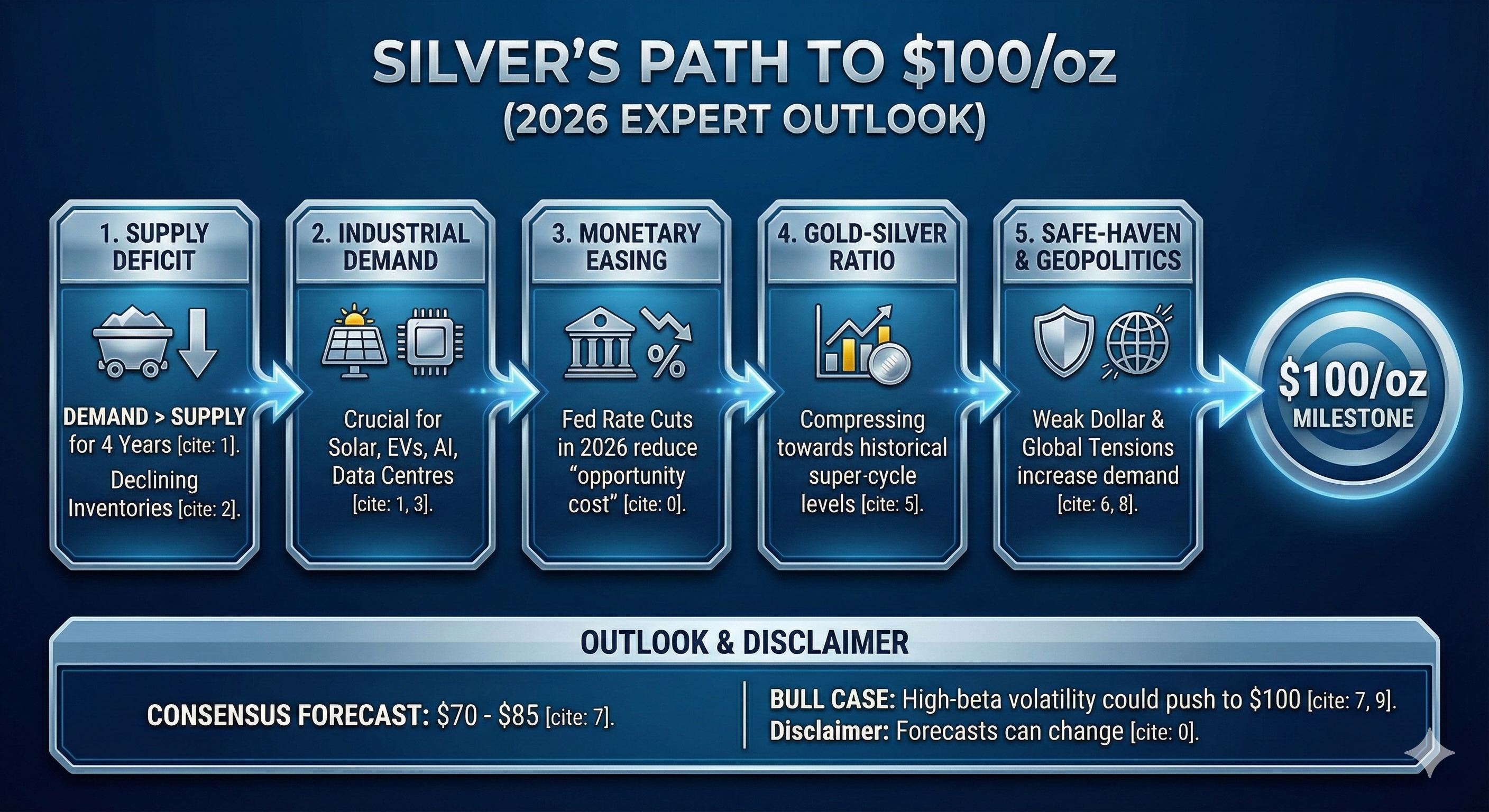

Gold-Silver Ratio Hits 5-Year High: What Investors Should Know The gold-silver ratio has climbed above 100 for the first time since the COVID-19 pandemic, meaning it now takes over 100 ounces of silver to buy just one ounce of gold. This unusual divergence has occurred as gold prices surge while silver lags behind. Why the split? Gold is thriving as a safe haven during uncertain times, boosted by central bank buying and expected interest rate cuts. Meanwhile, silver—which serves both as a precious metal AND an industrial metal—has been held back by global economic concerns and trade tensions affecting industrial demand. Many analysts see this extreme ratio as unsustainable and suggest silver could be poised for a strong performance if industrial demand recovers in the coming months.

Replies (1)

More like this

Recommendations from Medial

Krishna Varma

Founder of Memoria -... • 2m

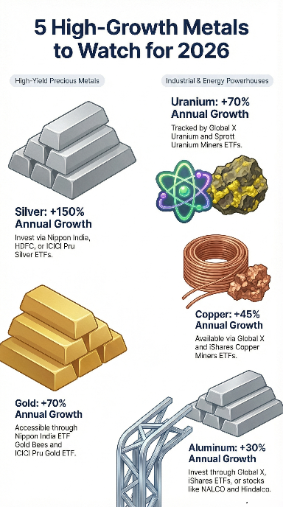

Is Silver the new Gold? 🤔 While Gold hits record highs, Silver is quietly preparing for a breakout. With inventories drying up in London and COMEX, and industrial demand from EVs and Solar skyrocketing, the floor price is rising. Experts predict

See More

Ansh Kadam

Founder & CEO at Bui... • 1y

Why Silver suddenly becoming so expensive, and should you be investing in Silver right now ? But here is the catch. The reason for the increase in prices is because of industrial uses such as in EVs, 5g, hydro power, limited recycling, and inflat

See More

Dhruvang Pd

setting new benchmar... • 8m

Revolutionising and Redefining Silver Jewellery Let’s rethink the default. Gold offers 24K (investment), 22K (tradition), 18K (style + durability). Silver? Only 925 Sterling Silver. Problem: 925 tarnishes fast (copper), scratches, bends, needs high m

See Morefinancialnews

Founder And CEO Of F... • 1y

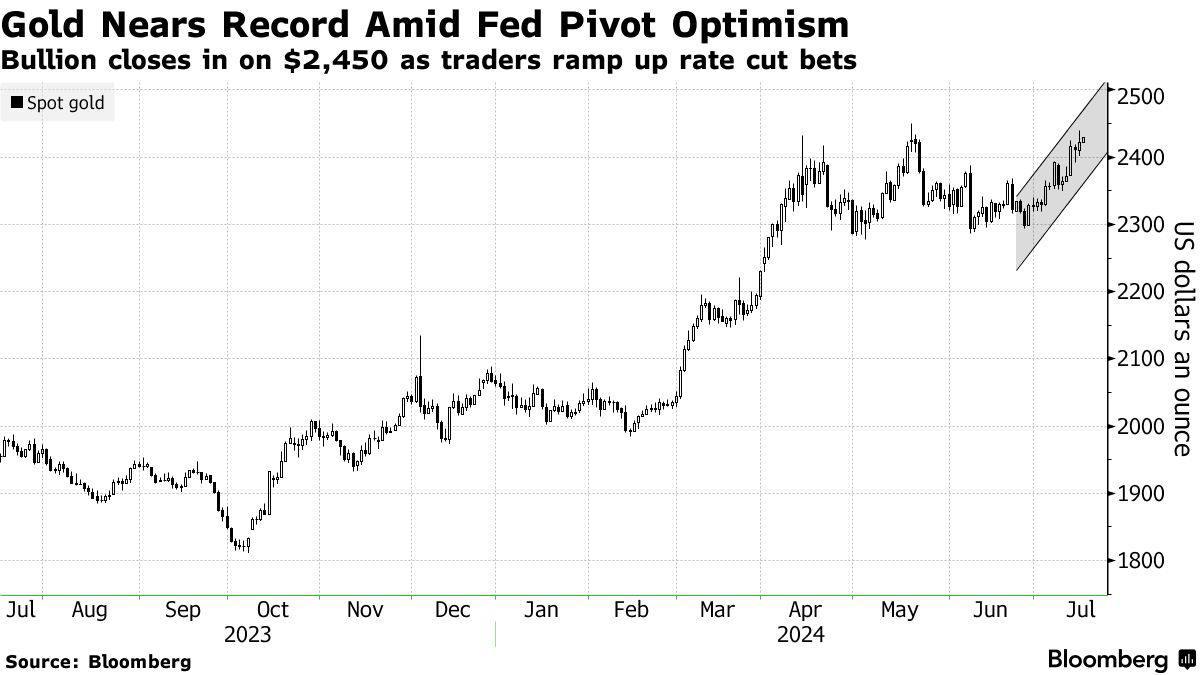

New Record High! Gold hits fresh peak to ₹89,450 per 10 gm, silver above ₹1 lakh New Record High! Gold hits fresh peak to ₹89,450 per 10 gm, silver above ₹1 lakh Gold prices reached a new peak of ₹89,450 per 10 grams in the national capital on Thur

See MoreVIJAY PANJWANI

Learning is a key to... • 23d

Major Risks in Gold & Silver – What Investors Must Watch Gold and Silver have rallied strongly, but key risks are building: 🔶 Gold Risks • Profit-booking pressure after sharp rallies • Momentum slowdown if prices stagnate • Impact of AI-driven produ

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)