Back

Cards Wala

One stop shop for ev... • 4m

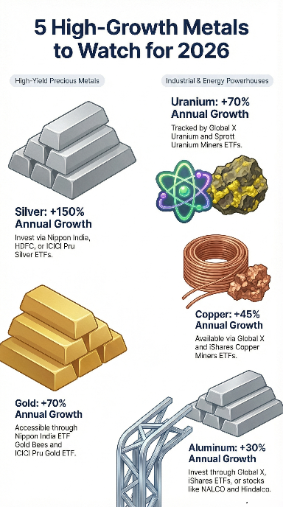

#RBI has now allowed to keep #silver as collateral for loans. Good for overall economy as the metals which are lying idle can create new credit. But should you pledge your #gold and #silver to take a loan? I wouldn't do so.

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 8d

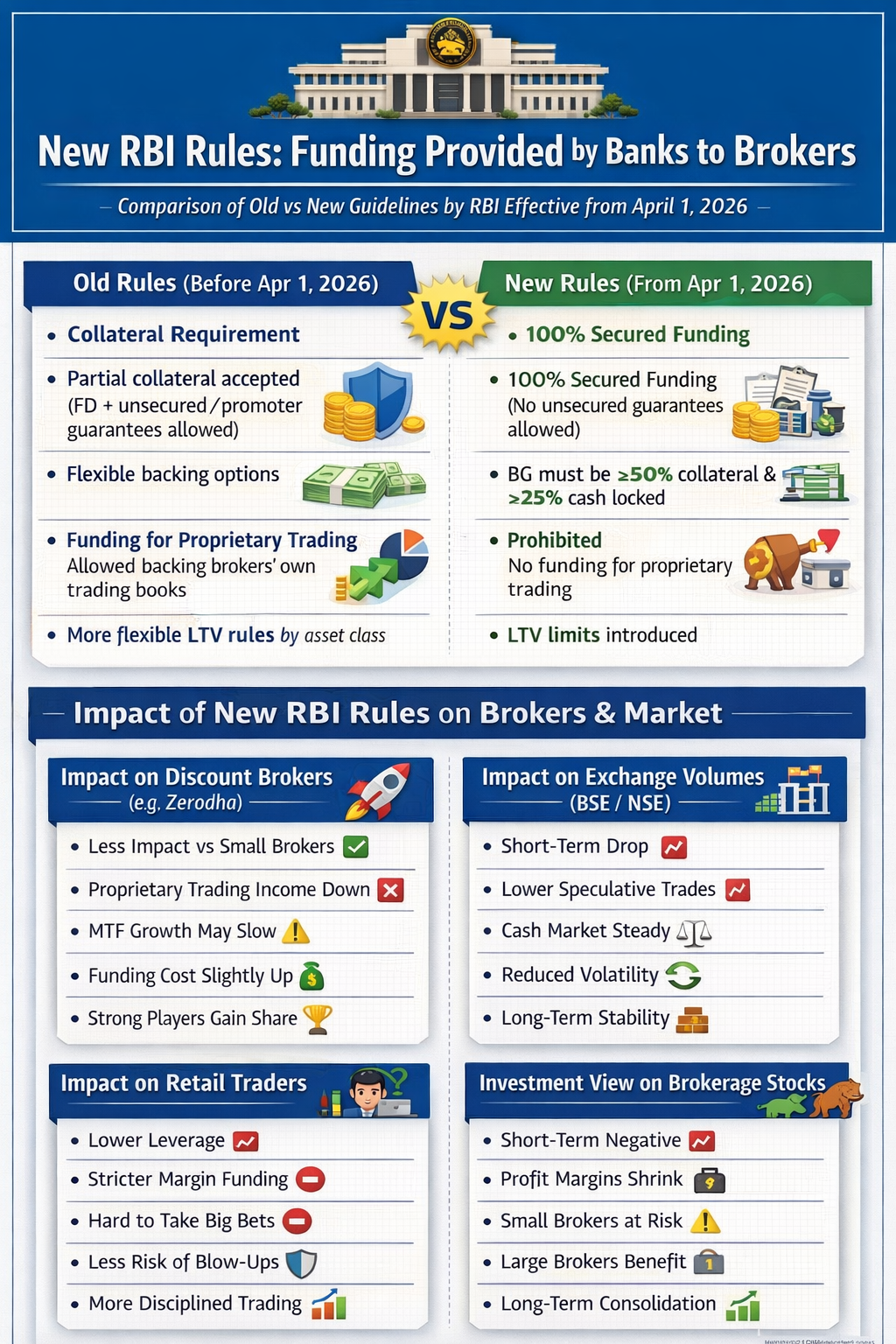

New RBI Rules for Brokers – Big Change for Markets! The Reserve Bank of India (RBI) has tightened rules on bank funding to brokers (effective April 1, 2026). 🔹 Old Rules: • Partial collateral allowed (FD + promoter guarantee) • Proprietary trading

See More

BigLoot IN

BigLoot.in - Where S... • 1y

Navi has built a personal loan book size exceeding ₹10,439 crore and has an Asset Under Management (AUM) of ₹11,725 crore. The company charges interest rates as high as 45% on loans. For home loans, it's reported that they require full access to pers

See MoreAnsh Kadam

Founder & CEO at Bui... • 1y

How does RBI earn money ? & why the RBI is more of a banker than a regulator. Last year, the RBI transferred over ₹87,000 Crore to the government, and it's expected to surpass ₹1,00,000 Crore in FY 2025. But how does the RBI generate this enormous

See More

Priyant Dhrangdhariya

Head of Finance @ Th... • 1y

India’s Gold Loan Market: A Glittering Opportunity The Sparkling Growth: Bajaj Finserv Ltd., a diversified NBFC, predicts India’s gold loan market—valued at $55.52 billion in 2022—will soar to $124.45 billion by 2029. A 12.22% annual growth fuels t

See Moregray man

I'm just a normal gu... • 10m

BharatPe announced today that its subsidiary, Resilient Payments Private Limited, has received final approval from the Reserve Bank of India (RBI) to operate as an online payment aggregator (PA). With this approval, the company stated that it is now

See More

Poosarla Sai Karthik

Tech guy with a busi... • 3m

RBI Hints at a Rate Cut: RBI Governor Sanjay Malhotra says there’s room to cut the repo rate as inflation cools and the data lines up. Many expect a 25 bps cut in December. Let’s break down what this actually means on the ground. Lending and Banki

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)