Back

Anonymous

Hey I am on Medial • 1y

What restrictions has RBI imposed? on new india coopetative bank The RBI has prohibited the bank from: Granting or renewing loans and advances Making fresh investments Borrowing funds or accepting new deposits Disbursing payments except for essential expenses such as salaries, rent, and utility bills Selling, transferring, or disposing of its assets without prior RBI approval In addition, the bank has been directed not to allow any withdrawals from savings or current accounts. However, depositors will be entitled to claim up to Rs 5,00,000 under the Deposit Insurance and Credit Guarantee Corporation (DICGC) scheme.

More like this

Recommendations from Medial

Atharva Deshmukh

Daily Learnings... • 1y

Brief History of RBI The Reserve Bank of India (RBI) was established on April 1, 1935, based on the Hilton Young Commission's recommendations and the Reserve Bank of India Act, 1934. Initially, the RBI took over the functions of the Controller of

See MoreVikram Kumar

Founder at Stockware • 1y

Navi Finserv Ordered to Cease Loan Disbursement by RBI 🚨 In a recent development, Navi Finserv, the NBFC arm of Sachin Bansal’s Navi Technologies, has been ordered by the Reserve Bank of India to cease and desist from sanctioning and disbursing loa

See MoreVIJAY PANJWANI

Learning is a key to... • 3d

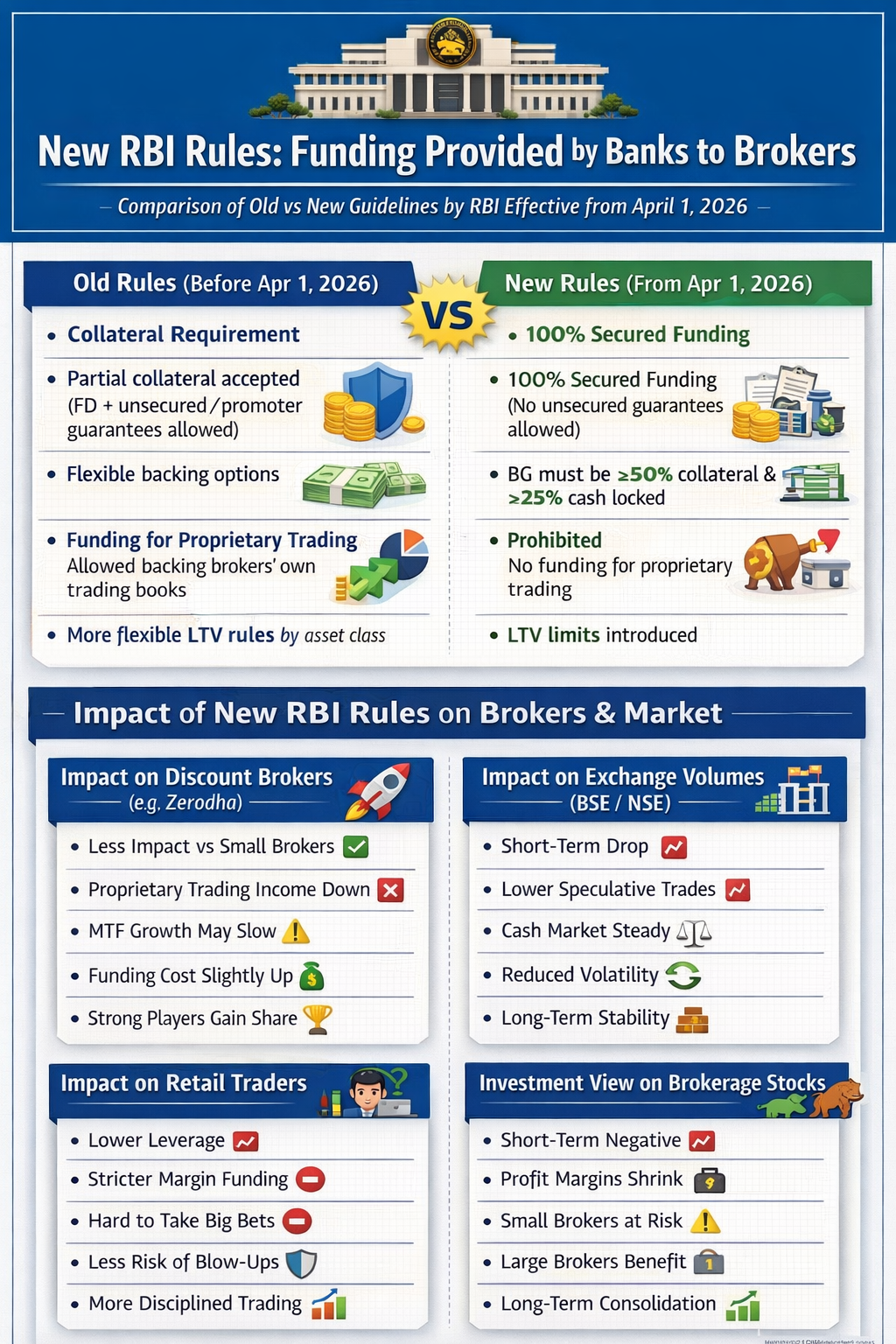

New RBI Rules for Brokers – Big Change for Markets! The Reserve Bank of India (RBI) has tightened rules on bank funding to brokers (effective April 1, 2026). 🔹 Old Rules: • Partial collateral allowed (FD + promoter guarantee) • Proprietary trading

See More

gray man

I'm just a normal gu... • 10m

BharatPe announced today that its subsidiary, Resilient Payments Private Limited, has received final approval from the Reserve Bank of India (RBI) to operate as an online payment aggregator (PA). With this approval, the company stated that it is now

See More

gray man

I'm just a normal gu... • 10m

The Reserve Bank of India (RBI) has announced that it will soon revise the transaction limits for Unified Payments Interface (UPI) payments made to merchants, also known as person-to-merchant (P2M) transactions. This move is aimed at enhancing the ef

See More

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

RBI Increases Gold Purchases The Reserve Bank of India has significantly increased its gold purchases, buying 50 tonnes so far in FY25. This move aims to diversify its foreign exchange reserves and mitigate revaluation risks, as part of efforts to m

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)