Back

VIJAY PANJWANI

Learning is a key to... • 1d

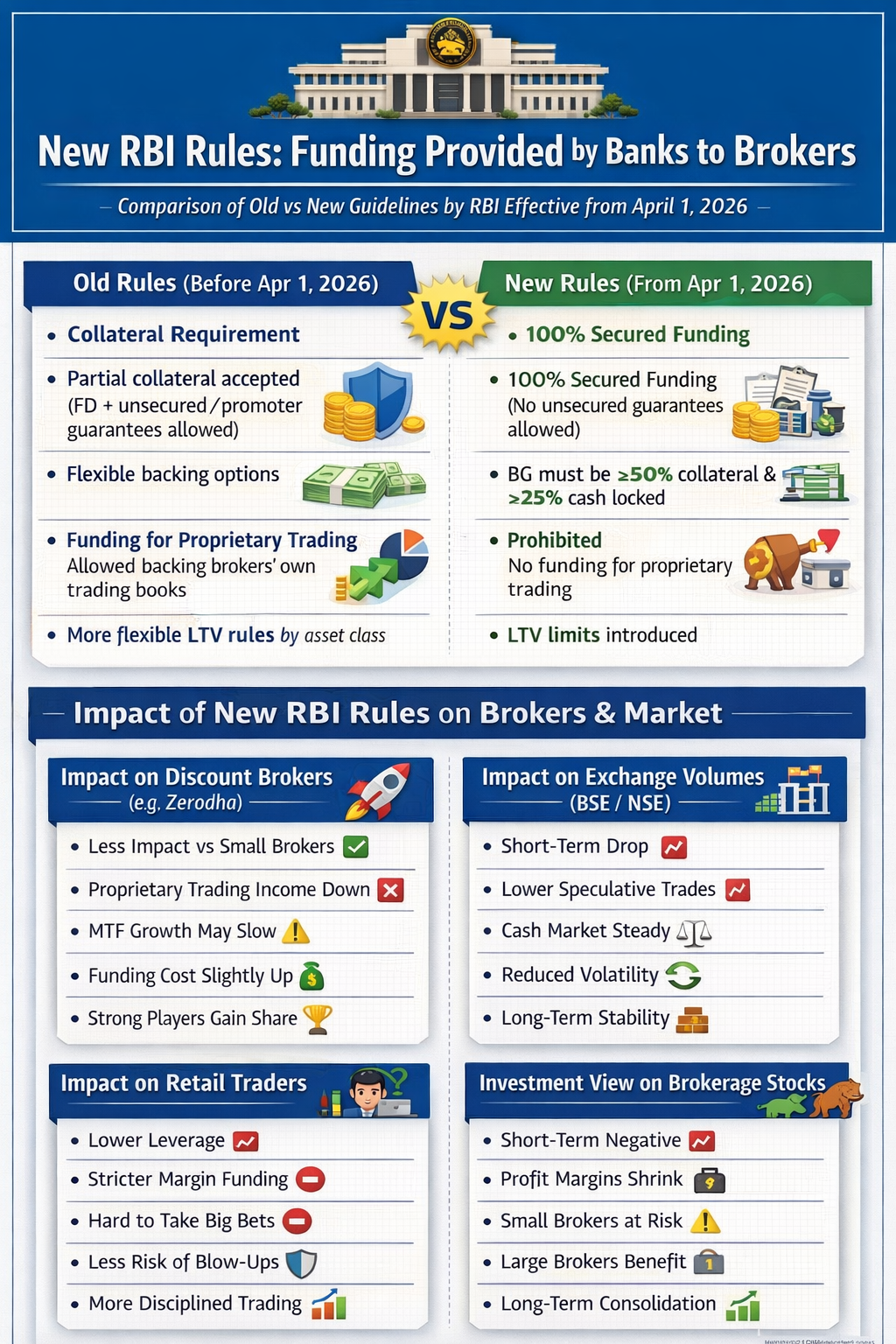

New RBI Rules for Brokers – Big Change for Markets! The Reserve Bank of India (RBI) has tightened rules on bank funding to brokers (effective April 1, 2026). 🔹 Old Rules: • Partial collateral allowed (FD + promoter guarantee) • Proprietary trading funding allowed • Flexible LTV norms 🔹 New Rules: • ✅ 100% secured funding mandatory • ❌ No bank funding for proprietary trading • 📉 40% haircut on equity collateral • 📊 Clear LTV limits introduced 💥 Impact: • Lower leverage in market • Short-term drop in speculative volumes • Strong brokers benefit • More stable financial system long term 👉 Less leverage = Less risk = Stronger market foundation.

More like this

Recommendations from Medial

VENTURE NAVIGATOR

INVESTOR | Start up ... • 1y

Scaling a Traditional Business with Debt Funding 💰🍦 Recently, I had the opportunity to consult the founder of an ice cream brand looking to raise funds—not for an exit, but for scaling up! 🚀 With an annual turnover of ₹2 Cr, he needed ₹30 Lakhs

See More

Sahin Aktar

https://t.me/+dXN5At... • 1y

Funding Proposal for Crypto Trading and Investment I am seeking funding to establish a robust crypto trading and investment portfolio. With the rapidly growing digital asset market, this proposal aims to leverage opportunities in cryptocurrencies t

See More

Rohan Saha

Founder - Burn Inves... • 7m

How Indian Stock Brokers Turn Your Data Into Profits When we open a trading account we give a lot of our personal info name, phone number, email, income details and even bank account info we usually think it’s only for account setup or KYC but in ma

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)