Back

VENTURE NAVIGATOR

INVESTOR | Start up ... • 1y

Scaling a Traditional Business with Debt Funding 💰🍦 Recently, I had the opportunity to consult the founder of an ice cream brand looking to raise funds—not for an exit, but for scaling up! 🚀 With an annual turnover of ₹2 Cr, he needed ₹30 Lakhs for operating expenses—and he needed it instantly. Given the urgency and the nature of the business, I recommended debt funding over equity. 💼 ✅ The criteria for securing the debt funding: 🔹 3+ years of market activity 🔹 ₹1Cr+ turnover 🔹 No existing loans or debts 🔹 No need to be in profit stage I connected him with aggregators specializing in debt financing, ensuring a smooth funding process. Traditional businesses can scale without dilution—if they leverage the right funding sources! 💡 Would love to hear your thoughts—what funding strategy do you think works best for traditional businesses? 🤔💬 Connect me on :- www.vivekmv.com Whats app :- +91 9778777922

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 10m

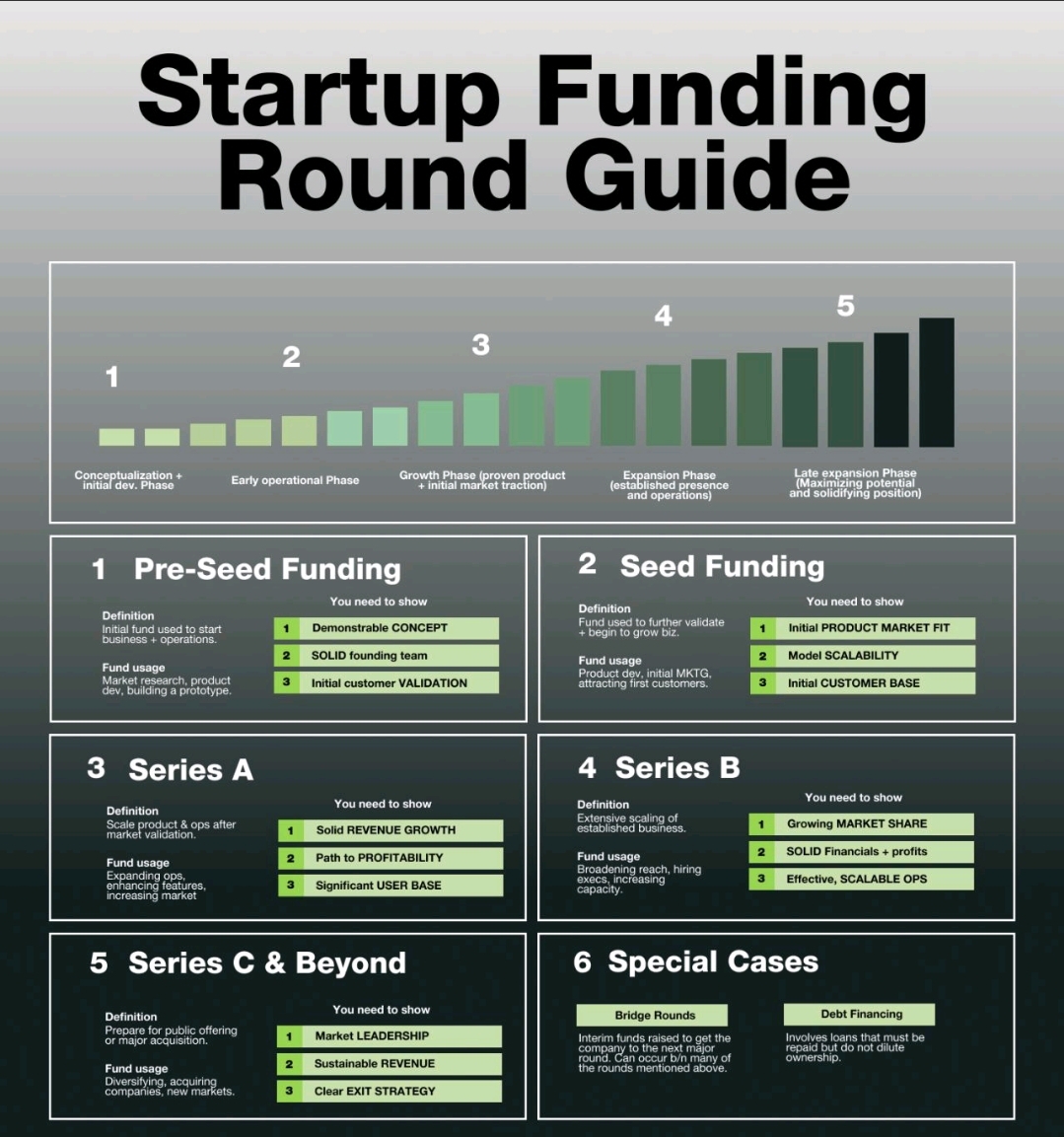

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Sandeep Namasudra

Change is the only c... • 11m

Why Are People So Obsessed with "Unique Ideas"? 🤯💡 Execution > Idea. You don't need a revolutionary idea to create a business worth billions. Selling ice cream can also get you rich, and I'm not being sarcastic here—ask Gopal's 56 (₹1200 Cr valuat

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)