Back

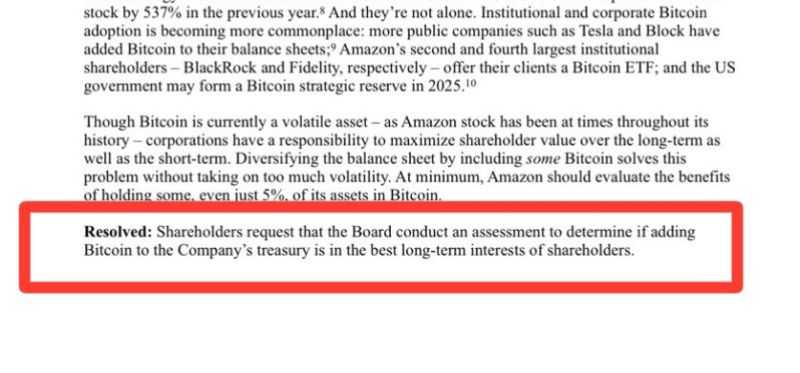

SARWAN NANDH

•

Sarwagyna Pvt Ltd. • 1m

Most people assume startup profits must come only from core operations. But here’s a reality many founders overlook. I recently learned about a startup that was barely profitable from its main business—but still showed strong overall profits. The reason? Treasury income. A significant portion came from fixed deposits and low-risk instruments on idle cash. This is an underrated lesson for early-stage founders: capital management is as important as product and growth. As your company scales, parked funds can generate meaningful, stable returns through FDs, T-bills, or liquid funds. These “non-operating” returns won’t replace your business model—but they can act as a financial cushion during downturns, burn phases, or slow growth cycles. Building a startup isn’t just about revenue. It’s also about how intelligently you manage the cash you already have.

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 11m

You always hear about startups failing, but no one talks about VC funds going under. It happens more often than you think. Most fail because they chase hype instead of solid businesses, burn through capital without a follow-on strategy, or simply get

See MoreSandip Kaur

Hey I am on Medial • 1y

Mastering Cash Flow: Simple Strategies for Indian Startups Cash flow can either make or break your startup, and managing it well is critical. Here are some practical tips to help your startup thrive financially: 1.Separate Business and Personal Fina

See MoreAlok Patle

Invest for your fina... • 1y

📢 New Service Alert! Confused about when to exit? 🤔 We analyze your holdings using AI + Quantitative Analysis to help you decide: ✅ Hold for more gains ✅ Exit with full profits ✅ Book partial profits 💡 Make informed decisions, maximize your return

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)