Back

VIJAY PANJWANI

Learning is a key to... • 2h

Major Risks in Gold & Silver – What Investors Must Watch Gold and Silver have rallied strongly, but key risks are building: 🔶 Gold Risks • Profit-booking pressure after sharp rallies • Momentum slowdown if prices stagnate • Impact of AI-driven productivity shifts • Strong dollar & rate hike concerns • Geopolitical shifts ⚪ Silver Risks • Tariff & trade policy uncertainty • Supply chain dislocations (London–COMEX movement) • Volatile demand from solar & EV sectors • Physical premium distortions • Heavy speculative positioning 💡 Both metals remain highly sensitive to macro events, liquidity flows, and sentiment shifts. Volatility can increase quickly. ⚠️ Disclaimer: This post is for educational purposes only and not investment advice. Please consult your financial advisor before making any trading or investment decisions.

More like this

Recommendations from Medial

Krishna Varma

Founder of Memoria -... • 1m

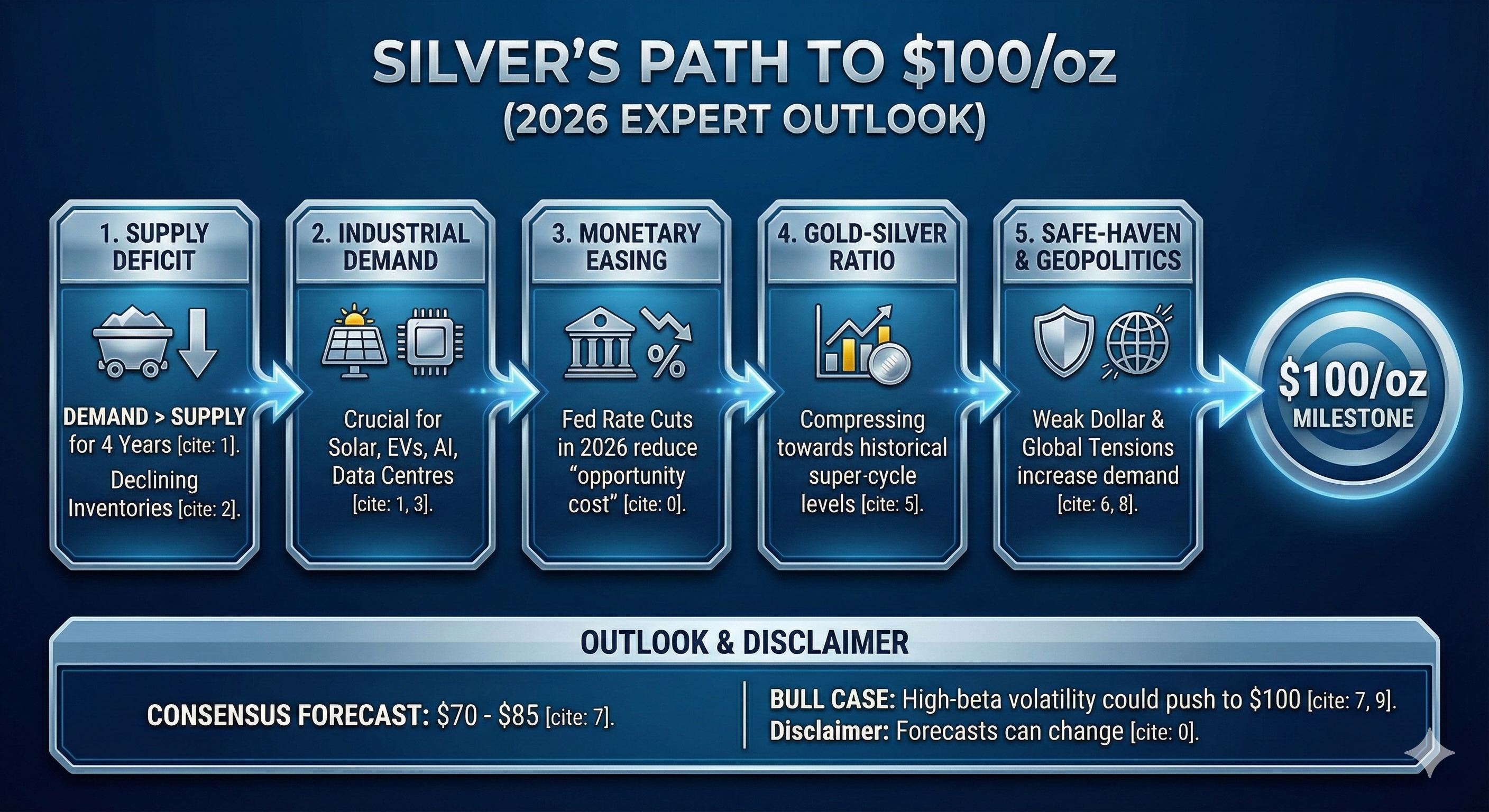

Is Silver the new Gold? 🤔 While Gold hits record highs, Silver is quietly preparing for a breakout. With inventories drying up in London and COMEX, and industrial demand from EVs and Solar skyrocketing, the floor price is rising. Experts predict

See More

financialnews

Founder And CEO Of F... • 10m

Gold rate jumps 25% in YTD. Is it the right time to buy gold in current rally? According to experts, the outlook for gold remains constructive. Persistent trade tensions, inflationary pressures, and central bank gold purchases are expected to contin

See Morefinancialnews

Founder And CEO Of F... • 1y

Equities Projected to Deliver 8%-12% Returns in 2025 The year 2025 brings a mixed bag of challenges and opportunities, marked by macroeconomic turbulence, global trade uncertainties, and policy changes. Investors can benefit from well-planned asset

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)