Back

VIJAY PANJWANI

Learning is a key to... • 3m

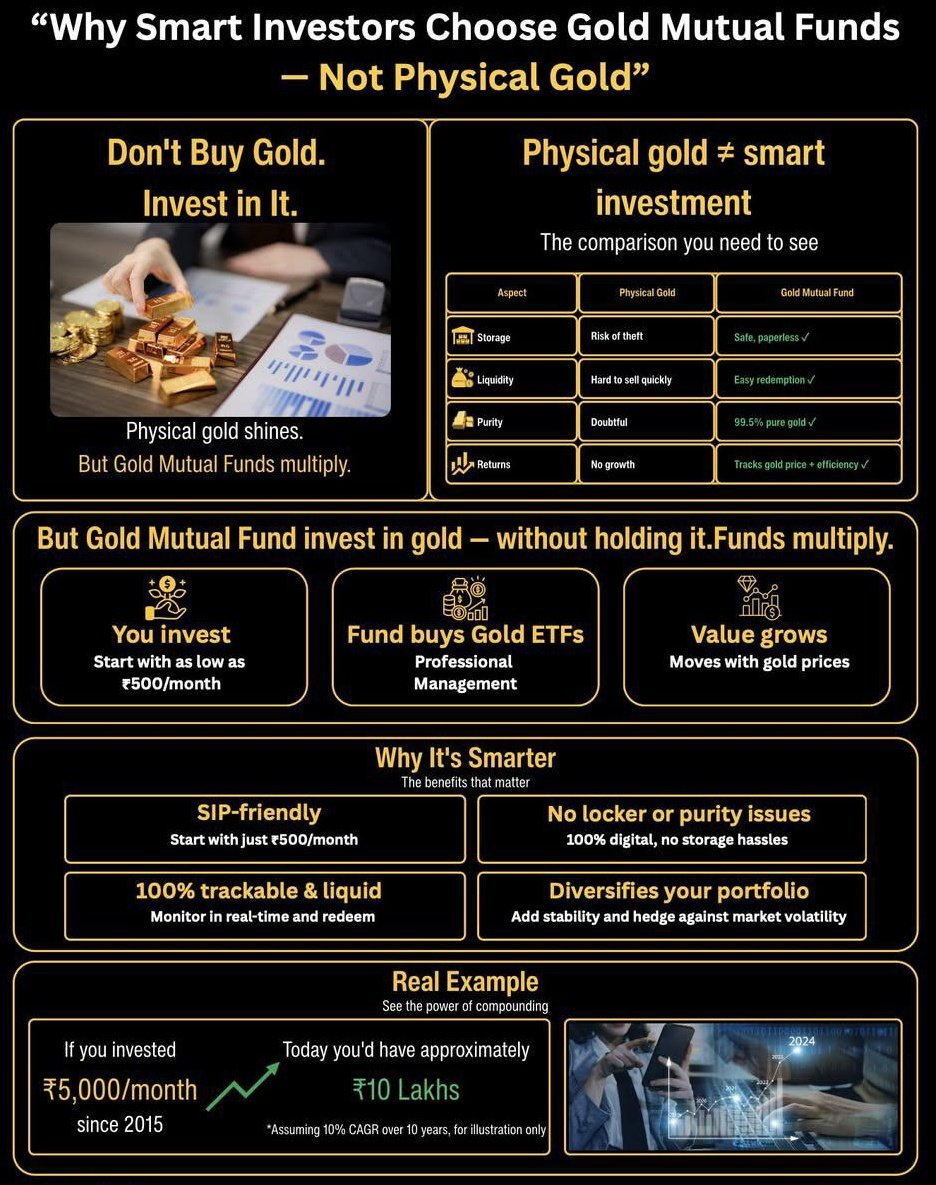

Why Smart Investors Choose Gold Mutual Funds Not Physical Gold ✨ Physical gold shines… but Gold Mutual Funds GROW your wealth! No locker issues, no purity doubts, no selling struggle — just simple, smart, paperless investing. 💰 Start with just ₹500/month 📊 Professionally managed Gold ETFs 🔒 100% digital, safe & trackable ⚡ Easy redemption anytime 🌟 Ideal for SIP & long-term growth Example: If you invested ₹5,000/month since 2015, today it could be approx ₹10 Lakhs!* (*Assuming 10% CAGR for illustration) 👉 Make your money work smarter. 👉 Choose Gold Mutual Funds over physical gold.

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 11m

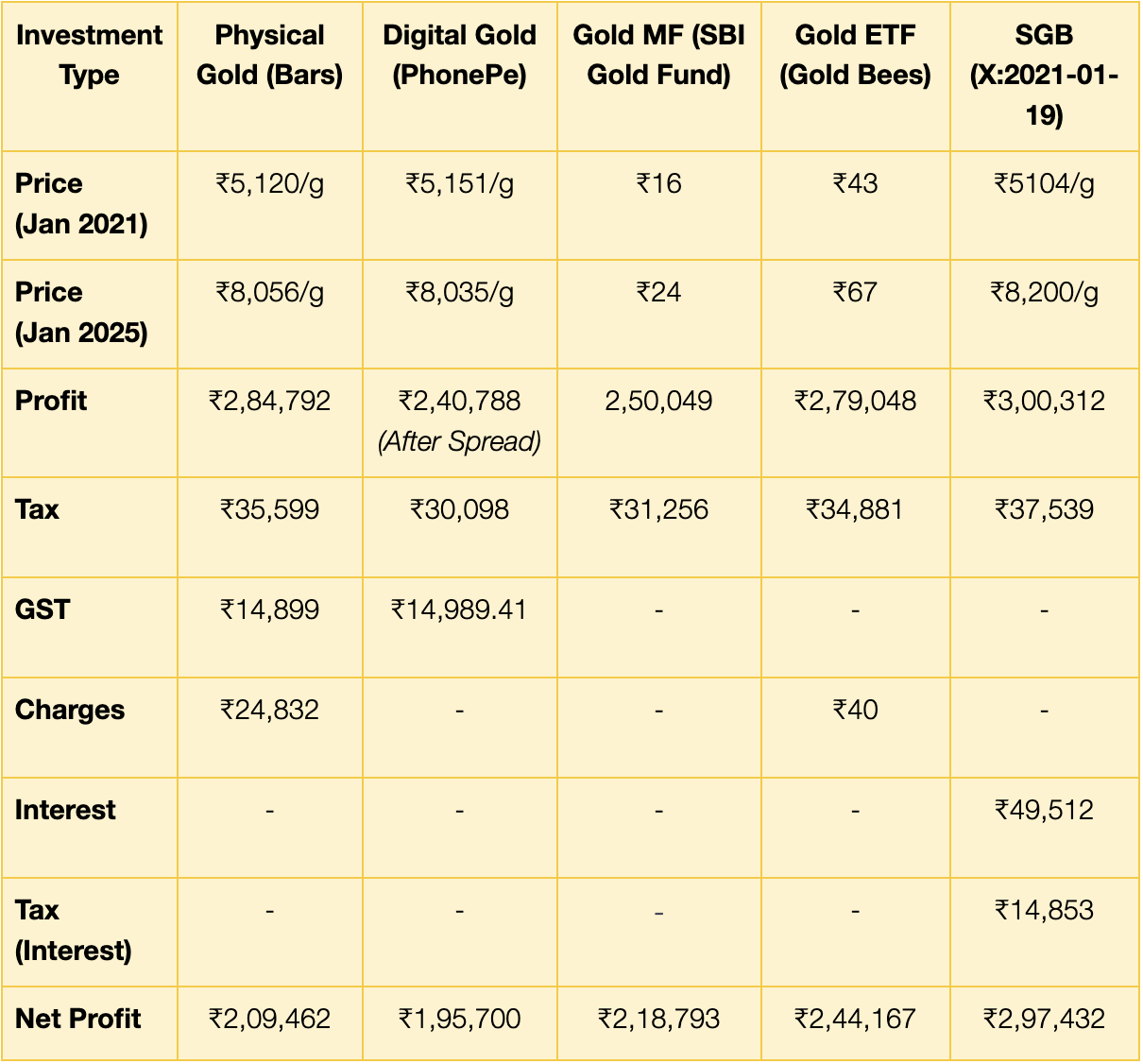

Different Ways to Invest in Gold 🪙 If you invest ₹5 Lakhs for a period of 5 years, what could your ROI look like across different gold investment options? There are commonly 5ways to invest in gold. 🪙 Physical Gold (Jewelry, Coins, Bars) 🪙 Digi

See More

Account Deleted

Hey I am on Medial • 5m

A lot of people in their 20s–30s focus only on savings accounts, but inflation silently eats into that money. Even small SIPs in mutual funds (starting from ₹1000) can grow wealth over time. The best part—opening an account now takes just a few minut

See MoreShubham Jain

Partner @ Finshark A... • 1y

Financial Planning for One Client Age :- 34 Salary In Hand :- 1.8L Expenses :- 85-95K ( Including EMI ) Advised him to invest in 60K in Mutual Funds and 20K in Gold Funds . Going to increase SIP by 10% Every Year Amount after 15 Year in MF :-

See MoreKrunali Jain

Actively looking for... • 1y

As a beginner with NO knowledge in stocks/mutual funds, what should my first step be to get into investing? How can I start? Should I - 1) Study Stocks (also, please suggestbest resources to get strted with) OR 2)Practically start with mutual funds

See MoreDr Sarun George Sunny

The Way I See It • 4m

SEBI’s New Rule: Mutual Funds Must Say Goodbye to Pre-IPO Deals The Securities and Exchange Board of India (SEBI) has recently stepped in to bring a meaningful change in the way mutual funds invest in the IPO space. From now on, mutual funds can no

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)